Page 162 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 162

CHAPTER 9

Please give your views regarding interest rate trends and the yield curve over the next 1 to 2

years. What interest rates can investors expect? Do you anticipate further repo rate cuts?

Most global central banks have already begun their rate cutting cycle with the US expected to

deliver their first Fed funds rate cut in September this year. The Fed is then expected to cut rates

again in November and December, which means the dollar will weaken further. Dollar weakness

loosens global financial conditions, and this paves the way for the SARB to cut the repo rate as

well. We expect the SARB to cut rates twice this year by 0.25% each and with a follow up of

another two rate cuts in 2025, thus bringing the repo rate to 7.25% from 8.25% currently. With

rate cuts coming, we expect the SA yield curve to steepen as short rates fall faster than long-dated

rates. The Argon BCI Flexible Income Fund is well positioned to take advantage of these rate cuts.

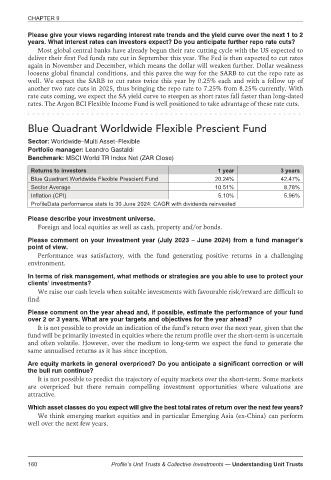

Blue Quadrant Worldwide Flexible Prescient Fund

Sector: Worldwide–Multi Asset–Flexible

Portfolio manager: Leandro Gastaldi

Benchmark: MSCI World TR Index Net (ZAR Close)

Returns to investors 1 year 3 years

Blue Quadrant Worldwide Flexible Prescient Fund 20.24% 42.47%

Sector Average 10.51% 8.78%

Inflation (CPI) 5.10% 5.96%

ProfileData performance stats to 30 June 2024: CAGR with dividends reinvested

Please describe your investment universe.

Foreign and local equities as well as cash, property and/or bonds.

Please comment on your investment year (July 2023 – June 2024) from a fund manager’s

point of view.

Performance was satisfactory, with the fund generating positive returns in a challenging

environment.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

We raise our cash levels when suitable investments with favourable risk/reward are difficult to

find.

Please comment on the year ahead and, if possible, estimate the performance of your fund

over 2 or 3 years. What are your targets and objectives for the year ahead?

It is not possible to provide an indication of the fund’s return over the next year, given that the

fund will be primarily invested in equities where the return profile over the short-term is uncertain

and often volatile. However, over the medium to long-term we expect the fund to generate the

same annualised returns as it has since inception.

Are equity markets in general overpriced? Do you anticipate a significant correction or will

the bull run continue?

It is not possible to predict the trajectory of equity markets over the short-term. Some markets

are overpriced but there remain compelling investment opportunities where valuations are

attractive.

Which asset classes do you expect will give the best total rates of return over the next few years?

We think emerging market equities and in particular Emerging Asia (ex-China) can perform

well over the next few years.

160 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts