Page 163 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 163

Fund Manager Interviews

Offshore investments are heavily influenced by the rand. Please give your view on the rand

over the next 1, 3 and 5 years.

We have no view over 1 year, but in general we expect the rand to depreciate over the

longer-term relative to most developed market currencies.

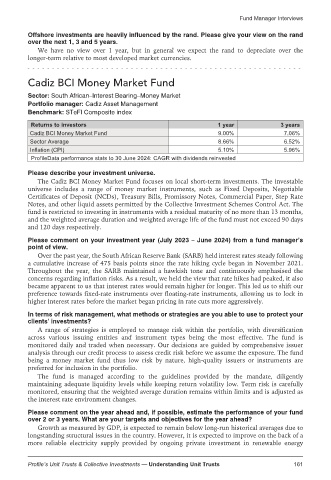

Cadiz BCI Money Market Fund

Sector: South African–Interest Bearing–Money Market

Portfolio manager: Cadiz Asset Management

Benchmark: STeFI Composite index

Returns to investors 1 year 3 years

Cadiz BCI Money Market Fund 9.00% 7.06%

Sector Average 8.66% 6.52%

Inflation (CPI) 5.10% 5.96%

ProfileData performance stats to 30 June 2024: CAGR with dividends reinvested

Please describe your investment universe.

The Cadiz BCI Money Market Fund focuses on local short-term investments. The investable

universe includes a range of money market instruments, such as Fixed Deposits, Negotiable

Certificates of Deposit (NCDs), Treasury Bills, Promissory Notes, Commercial Paper, Step Rate

Notes, and other liquid assets permitted by the Collective Investment Schemes Control Act. The

fund is restricted to investing in instruments with a residual maturity of no more than 13 months,

and the weighted average duration and weighted average life of the fund must not exceed 90 days

and 120 days respectively.

Please comment on your investment year (July 2023 – June 2024) from a fund manager’s

point of view.

Over the past year, the South African Reserve Bank (SARB) held interest rates steady following

a cumulative increase of 475 basis points since the rate hiking cycle began in November 2021.

Throughout the year, the SARB maintained a hawkish tone and continuously emphasised the

concerns regarding inflation risks. As a result, we held the view that rate hikes had peaked, it also

became apparent to us that interest rates would remain higher for longer. This led us to shift our

preference towards fixed-rate instruments over floating-rate instruments, allowing us to lock in

higher interest rates before the market began pricing in rate cuts more aggressively.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

A range of strategies is employed to manage risk within the portfolio, with diversification

across various issuing entities and instrument types being the most effective. The fund is

monitored daily and traded when necessary. Our decisions are guided by comprehensive issuer

analysis through our credit process to assess credit risk before we assume the exposure. The fund

being a money market fund thus low risk by nature, high-quality issuers or instruments are

preferred for inclusion in the portfolio.

The fund is managed according to the guidelines provided by the mandate, diligently

maintaining adequate liquidity levels while keeping return volatility low. Term risk is carefully

monitored, ensuring that the weighted average duration remains within limits and is adjusted as

the interest rate environment changes.

Please comment on the year ahead and, if possible, estimate the performance of your fund

over 2 or 3 years. What are your targets and objectives for the year ahead?

Growth as measured by GDP, is expected to remain below long-run historical averages due to

longstanding structural issues in the country. However, it is expected to improve on the back of a

more reliable electricity supply provided by ongoing private investment in renewable energy

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 161