Page 164 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 164

CHAPTER 9

generation and increased maintenance by Eskom. The inflation outlook has also improved,

benefiting from lower oil prices, and easing food inflation. The SARB now anticipates that inflation

will reach the midpoint of 4.5% earlier than previously expected.

We believe the year ahead will be characterised by central bank actions both locally and

globally. Central banks are expected to ease monetary policies by cutting rates. The European

Central Bank and the Bank of Canada are among the central banks that have already begun their

rate-cutting cycles. In the absence of shocks, we anticipate that the SARB will begin cutting rates

before the end of 2024, and it is more likely to be a gradual process.

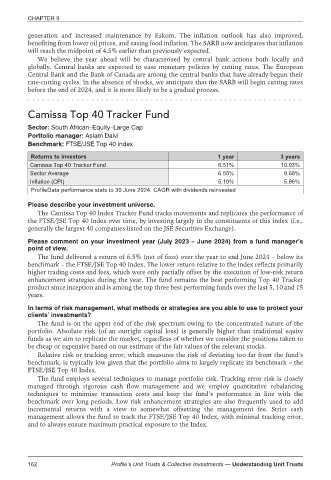

Camissa Top 40 Tracker Fund

Sector: South African–Equity–Large Cap

Portfolio manager: Aslam Dalvi

Benchmark: FTSE/JSE Top 40 index

Returns to investors 1 year 3 years

Camissa Top 40 Tracker Fund 6.51% 10.03%

Sector Average 6.55% 9.68%

Inflation (CPI) 5.10% 5.96%

ProfileData performance stats to 30 June 2024: CAGR with dividends reinvested

Please describe your investment universe.

The Camissa Top 40 Index Tracker Fund tracks movements and replicates the performance of

the FTSE/JSE Top 40 Index over time, by investing largely in the constituents of this index (i.e.,

generally the largest 40 companies listed on the JSE Securities Exchange).

Please comment on your investment year (July 2023 – June 2024) from a fund manager’s

point of view.

The fund delivered a return of 6.5% (net of fees) over the year to end June 2024 – below its

benchmark – the FTSE/JSE Top 40 Index. The lower return relative to the index reflects primarily

higher trading costs and fees, which were only partially offset by the execution of low-risk return

enhancement strategies during the year. The fund remains the best performing Top 40 Tracker

product since inception and is among the top three best performing funds over the last 5, 10 and 15

years.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

The fund is on the upper end of the risk spectrum owing to the concentrated nature of the

portfolio. Absolute risk (of an outright capital loss) is generally higher than traditional equity

funds as we aim to replicate the market, regardless of whether we consider the positions taken to

be cheap or expensive based on our estimate of the fair values of the relevant stocks.

Relative risk or tracking error, which measures the risk of deviating too far from the fund’s

benchmark, is typically low given that the portfolio aims to largely replicate its benchmark – the

FTSE/JSE Top 40 Index.

The fund employs several techniques to manage portfolio risk. Tracking error risk is closely

managed through rigorous cash flow management and we employ quantitative rebalancing

techniques to minimise transaction costs and keep the fund’s performance in line with the

benchmark over long periods. Low risk enhancement strategies are also frequently used to add

incremental returns with a view to somewhat offsetting the management fee. Strict cash

management allows the fund to track the FTSE/JSE Top 40 Index, with minimal tracking error,

and to always ensure maximum practical exposure to the Index.

162 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts