Page 120 - Profile's Unit Trusts & Collective Investments - September 2025

P. 120

Chapter 6 Investment risk

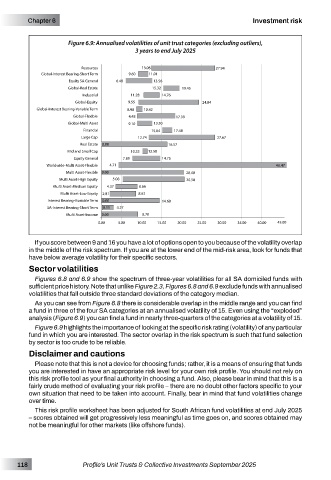

Figure 6.9: Annualised volatilities of unit trust categories (excluding outliers),

3 years to end July 2025

If you score between 9 and 16 you have a lot of options open to you because of the volatility overlap

in the middle of the risk spectrum. If you are at the lower end of the mid-risk area, look for funds that

have below average volatility for their specific sectors.

Sector volatilities

Figures 6.8 and 6.9 show the spectrum of three-year volatilities for all SA domiciled funds with

sufficient price history. Note that unlike Figure 2.3, Figures 6.8 and 6.9 exclude funds with annualised

volatilities that fall outside three standard deviations of the category median.

As you can see from Figure 6.8 there is considerable overlap in the middle range and you can find

a fund in three of the four SA categories at an annualised volatility of 15. Even using the “exploded”

analysis (Figure 6.9) you can find a fund in nearly three-quarters of the categories at a volatility of 15.

Figure 6.9 highlights the importance of looking at the specific risk rating (volatility) of any particular

fund in which you are interested. The sector overlap in the risk spectrum is such that fund selection

by sector is too crude to be reliable.

Disclaimer and cautions

Please note that this is not a device for choosing funds; rather, it is a means of ensuring that funds

you are interested in have an appropriate risk level for your own risk profile. You should not rely on

this risk profile tool as your final authority in choosing a fund. Also, please bear in mind that this is a

fairly crude method of evaluating your risk profile – there are no doubt other factors specific to your

own situation that need to be taken into account. Finally, bear in mind that fund volatilities change

over time.

This risk profile worksheet has been adjusted for South African fund volatilities at end July 2025

– scores obtained will get progressively less meaningful as time goes on, and scores obtained may

not be meaningful for other markets (like offshore funds).

118 Profile’s Unit Trusts & Collective Investments September 2025