Page 125 - Profile's Unit Trusts & Collective Investments - September 2025

P. 125

Understanding asset allocation Chapter 7

Money Market fund managers specialise in placing clients’ Figure 7.1

funds on the best terms possible with institutions that wish

to borrow money for short periods. Because of this access

to the wholesale market, Money Market funds usually offer

a yield (a percentage return on investment) higher than that

offered by the retail banks.

Money Market funds are restricted to investing in interest

bearing investments with an average maturity of 90 days or

less (and a legal maturity of 120 days or less). Depending

on the investment policies of a particular fund, the portfolio

manager may invest in either short term debt instruments

of government, or short term loans to companies (known

as “commercial paper”) and negotiable certificates of

deposit (NCDs).

After many years of resistance from the banking sector,

which had a monopoly on the investment of short term

funds, Money Market unit trusts were introduced to SA in

1997. In most countries Money Market funds are used as a

“parking place” for funds waiting to be invested elsewhere,

or as a refuge against equity market weakness. In SA the

demand for money market investments is driven by a third

consideration: non-resident South Africans require a high-

interest investment paid as quickly as possible, and, to reduce risk, spread across a range of

financial institutions.

Other interest bearing funds and bank

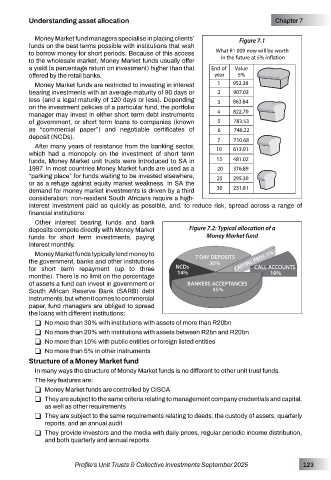

deposits compete directly with Money Market Figure 7.2: Typical allocation of a

funds for short term investments, paying Money Market fund

interest monthly.

Money Market funds typically lend money to

the government, banks and other institutions

for short term repayment (up to three

months). There is no limit on the percentage

of assets a fund can invest in government or

South African Reserve Bank (SARB) debt

instruments, but when it comes to commercial

paper, fund managers are obliged to spread

the loans with different institutions:

R No more than 30% with institutions with assets of more than R20bn

R No more than 20% with institutions with assets between R2bn and R20bn

R No more than 10% with public entities or foreign listed entities

R No more than 5% in other instruments

Structure of a Money Market fund

In many ways the structure of Money Market funds is no different to other unit trust funds.

The key features are:

R Money Market funds are controlled by CISCA

R They are subject to the same criteria relating to management company credentials and capital,

as well as other requirements

R They are subject to the same requirements relating to deeds, the custody of assets, quarterly

reports, and an annual audit

R They provide investors and the media with daily prices, regular periodic income distribution,

and both quarterly and annual reports

Profile’s Unit Trusts & Collective Investments September 2025 123