Page 127 - Profile's Unit Trusts & Collective Investments - September 2025

P. 127

Understanding asset allocation Chapter 7

Note that for the fund fact sheets in Profile’s Unit Trusts & Collective Investments handbook a

different method is used in order to give an historical perspective on monthly yields (see page 190).

Each month’s distribution is annualised to give its annual equivalent – as if that rate of return had

been earned for the full year. The yield for any month can therefore be compared to the rate that was

offered by a one-year fixed deposit which paid interest monthly in arrears. (Note that both historic

yields and indicative short term yields are available on www.fundsdata.co.za, updated daily. The

latter can be found by clicking on the home menu button and selecting money market yields.)

The performance of money market instruments and fixed interest products is obviously dependent

on the level and trend of interest rates in the economy.

Under normal economic conditions, long term interest rates are higher than short term interest

rates (eg, a one-year fixed deposit pays higher interest than a savings account to compensate

investors for tying up their money for extended periods).

In a weakening economy with falling short term interest rates (resulting from attempts by monetary

authorities to stimulate the economy), long term rates may drop below those of short term rates as

investors compete to lock in favourable long-dated rates (known as an inverted yield curve).

Underlying investments

The money market features a number of different types of instruments. The two main types are

interest bearing investments and discount instruments.

An interest-bearing investment pays a periodic rate of interest to the holder. An example is a fixed

deposit, which pays a pre-defined rate of interest on an amount of money which must be invested for

a fixed period (30 or 60 days, for example). A call deposit, by contrast, can be withdrawn at any time

(ie, depositors can “call” for their money on short notice), but pays a variable rate of interest. At any

point in time, call deposits will usually offer a slightly lower rate than fixed deposits.

Call deposits are favoured by investors who may need their money in a hurry. They are also

favoured by asset managers who think that interest rates are about to rise, because the variable rate

of the call deposit will go up as interest rates in the market go up. An asset manager who believes

that interest rates are about to decline might opt instead for a fixed deposit, “locking in” a higher rate

in the expectation that call rates will fall.

A discount instrument works a little differently to an interest bearing instrument. The latter involves

a fixed capital amount on which interest is paid. A discount instrument, by contrast, is sold at a

“discount” to its face value; the larger the discount, the greater the effective interest rate. By way of

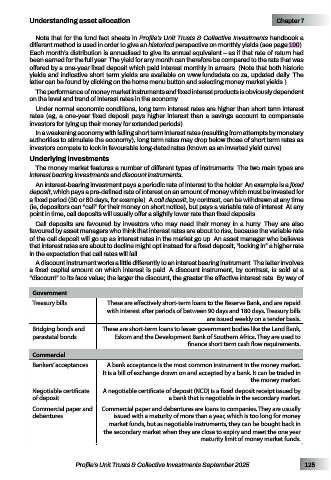

Government

Treasury bills These are effectively short-term loans to the Reserve Bank, and are repaid

with interest after periods of between 90 days and 180 days. Treasury bills

are issued weekly on a tender basis.

Bridging bonds and These are short-term loans to lesser government bodies like the Land Bank,

parastatal bonds Eskom and the Development Bank of Southern Africa. They are used to

finance short term cash flow requirements.

Commercial

Bankers’ acceptances A bank acceptance is the most common instrument in the money market.

It is a bill of exchange drawn on and accepted by a bank. It can be traded in

the money market.

Negotiable certificate A negotiable certificate of deposit (NCD) is a fixed deposit receipt issued by

of deposit a bank that is negotiable in the secondary market.

Commercial paper and Commercial paper and debentures are loans to companies. They are usually

debentures issued with a maturity of more than a year, which is too long for money

market funds, but as negotiable instruments, they can be bought back in

the secondary market when they are close to expiry and meet the one year

maturity limit of money market funds.

Profile’s Unit Trusts & Collective Investments September 2025 125