Page 126 - Profile's Unit Trusts & Collective Investments - September 2025

P. 126

Chapter 7 Understanding asset allocation

In addition, there are provisions of subordinate regulations relating specifically to Money Market

funds. Regulations stipulate:

R That only instruments with a maturity of less than a year may be included in a money

market portfolio

R That the portfolio should have an average duration of no more than 90 days (this helps to

ensure that money market portfolios are not exposed to capital risk)

R That instruments held in the portfolio should have an average weighted legal maturity of no

more than 120 days

R That instruments with no fixed maturity date and/or an unknown interest rate may not be held

R That the manager must, at all times, be able to calculate the return on the portfolio

Constant unit price vs accumulating unit price

Unlike other unit trusts, Money Market funds do not have a variable price. The value of each unit

remains constant at R1, whether investors are buying or selling, on the assumption that the capital

value of the fund’s investment remains constant. With Money Market funds it is the interest rate,

not the capital value, that increases and decreases. Each investor’s proportional income earned is

accumulated and reinvested monthly in the form of further units or cash.

The quoted yield on Money Market funds usually fluctuates every working day. Unlike money

invested with banks there is no “fixed” yield. Instead, the yield moves up and down in accordance

with the interest earned on the investments in the Money Market fund. The investment conditions of

some Money Market funds stipulate that investors can withdraw funds at any point, but they will be

penalised if the balance falls below the minimum investment level. The objective of this is to prevent

clients using the money market account as a current account, and creating high administration

expenses for the management company.

Investment and withdrawal costs

Minimum initial investments for Money Market funds range between R5 000 and R50 000 (only

three of the 26 funds available have lump sum minimums below R5 000, two have minimums of

R100 000). Debit order minimums mostly range from R500 to R2 000 a month (two funds are below

R500 at R100 and R200 respectively).

None of the Money Market funds charge initial fees.

Typically, withdrawals from Money Market funds are free of transaction costs. Most managers pay

out cash in at most two or three business days, but in some cases instructions submitted in the

morning are processed the same day and the investor will receive the money the following day.

Annual fees charged by Money Market funds range from 0.25% to 0.50% per annum of the

money invested. Some Money Market funds charge a commission on the reinvestment of income,

others don’t.

Performance measurement of Money Market funds

Performance measurement of equity funds is generally focused on the issue of capital growth.

Money Market funds are designed to pay high interest over the short term, and therefore require

different performance measurement techniques.

The CIS industry has agreed on indicative short term yield figures (eg, for publication in the media)

calculated in a specific way.

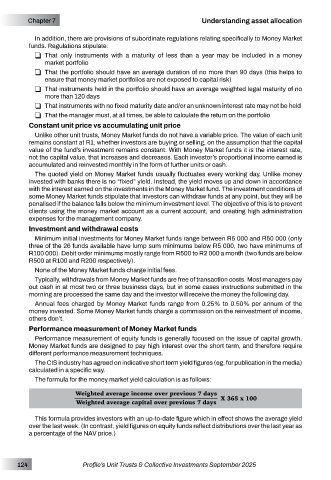

The formula for the money market yield calculation is as follows:

This formula provides investors with an up-to-date figure which in effect shows the average yield

over the last week. (In contrast, yield figures on equity funds reflect distributions over the last year as

a percentage of the NAV price.)

124 Profile’s Unit Trusts & Collective Investments September 2025