Page 306 - Profile's Unit Trusts & Collective Investments - September 2025

P. 306

Mazi Asset Management Prime Africa Equity Fund Domestic funds

Mazi Asset Management Prime Africa Equity Fund

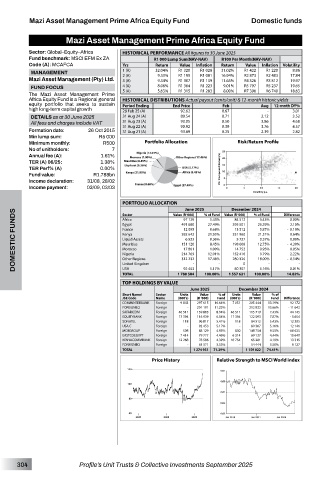

Sector: Global–Equity–Africa HISTORICAL PERFORMANCE All figures to 30 June 2025

Fund benchmark: MSCI EFM Ex ZA R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Code (A): MCAFCA Yrs Return Value Inflation Return Value Inflation Volatility

1 (A) 32.04% R1 320 R1 028 31.02% R1 422 R1 220 8.86

MANAGEMENT 2 (A) 9.33% R1 195 R1 081 16.94% R2 873 R2 483 17.84

Mazi Asset Management (Pty) Ltd. 3 (A) 9.34% R1 307 R1 139 11.65% R4 326 R3 812 19.97

FUND FOCUS 4 (A) 8.06% R1 364 R1 223 9.01% R5 797 R5 237 19.65

The Mazi Asset Management Prime 5 (A) 5.63% R1 315 R1 283 8.00% R7 396 R6 740 18.63

Africa Equity Fund is a Regional general HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

equity portfolio that seeks to sustain Period Ending End Price Feb Aug 12-mnth DY%

high long-term capital growth 28 Feb 25 (A) 92.62 0.67 - 3.01

DETAILS as at 30 June 2025 31 Aug 24 (A) 80.54 0.71 2.12 3.52

All fees and charges include VAT 31 Aug 23 (A) 93.05 0.50 3.86 4.68

Formation date: 26 Oct 2015 31 Aug 22 (A) 90.92 0.39 3.76 4.57

0.25

2.82

2.39

31 Aug 21 (A)

93.69

Min lump sum: R5 000

Minimum monthly: R500 Portfolio Allocation Risk/Return Profile

No of unitholders: 7

Annual fee (A): 1.61%

TER (A) 06/25: 1.38%

TER Perf% (A) 0.00% 3Yr Compound Return(%)

Fund value: R1.788bn

Income declaration: 31/08, 28/02

Income payment: 03/09, 03/03

PORTFOLIO ALLOCATION 97 129 % of Fund Value (R ‘000) % of Fund Difference

June 2025

December 2024

DOMESTIC FUNDS Egypt 491 680 27.49% 395 501 25.39% - 0.19%

Sector

Value (R ‘000)

84 512

0.00%

5.43%

5.43%

Africa

2.10%

13 512

0.87%

France

12 095

0.68%

Kenya

0.64%

21.95%

21.31%

392 642

331 960

5 727

0.36%

6 523

0.00%

Liquid Assets

0.37%

151 120

198 608

12.75%

Mauritius

8.45%

- 4.30%

1.00%

14 752

17 861

0.95%

0.05%

Morocco

152 416

2.22%

Nigeria

9.79%

12.01%

214 769

312 232

280 326

18.00%

Other Regions

17.46%

United Kingdom

80 307

0.01%

92 453

5.16%

USA

5.17%

TOTAL 1 788 504 - 100.00% - 1 557 621 0 100.00% - - 0.54% -

14.82%

TOP HOLDINGS BY VALUE

June 2025 December 2024

Short Name/ Sector Units Value % of Units Value % of

JSE Code Name (000’s) (R ‘000) Fund (000’s) (R ‘000) Fund Difference

COMMINTERBANK Foreign 9 843 297 615 16.64% 7 051 205 444 13.19% 92 172

FOREIGNEQ Foreign - 201 191 11.25% - 212 832 13.66% - 11 642

SAFARICOM Foreign 46 511 159 863 8.94% 46 511 115 719 7.43% 44 145

EQUITYBANK Foreign 17 394 116 939 6.54% 17 394 122 593 7.87% - 5 654

SONATEL Foreign 118 96 817 5.41% 118 84 512 5.43% 12 305

USA C Foreign - 92 453 5.17% - 80 307 5.16% 12 146

MCBGROUP Foreign 508 88 129 4.93% 830 148 754 9.55% - 60 625

EASTCOEGYPT Foreign 7 414 79 777 4.46% 6 314 69 137 4.44% 10 640

KENYACOMMBANK Foreign 12 268 78 596 4.39% 10 754 65 281 4.19% 13 315

FOREIGNBO Foreign - 63 571 3.55% - 54 444 3.50% 9 127

TOTAL 1 274 951 71.29% 1 159 022 74.41%

Price History Relative Strength to MSCI World index

304 Profile’s Unit Trusts & Collective Investments September 2025