Page 311 - Profile's Unit Trusts & Collective Investments - September 2025

P. 311

Domestic funds Novare Balanced Fund

Novare Balanced Fund

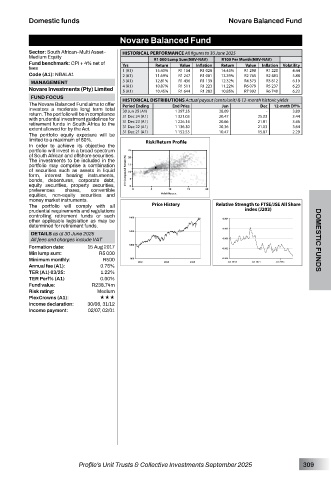

Sector: South African–Multi Asset– HISTORICAL PERFORMANCE All figures to 30 June 2025

Medium Equity R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: CPI + 4% net of

Value

Value

fees Yrs Return R1 154 Inflation Return R1 298 Inflation Volatility

1 (A1)

15.43%

14.45%

R1 028

R1 220

4.44

Code (A1): NBALA1 2 (A1) 11.69% R1 247 R1 081 13.39% R2 765 R2 483 5.88

MANAGEMENT 3 (A1) 12.81% R1 436 R1 139 12.32% R4 373 R3 812 6.19

Novare Investments (Pty) Limited 4 (A1) 10.87% R1 511 R1 223 11.22% R6 079 R5 237 6.23

R1 283

6.23

R6 740

5 (A1)

R1 644

10.45%

R7 992

10.85%

FUND FOCUS HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

The Novare Balanced Fund aims to offer Period Ending End Price Jun Dec 12-mnth DY%

investors a moderate long term total

return. The portfolio will be in compliance 30 Jun 25 (A1) 1 397.35 28.09 - 3.80

with prudential investment guidelines for 31 Dec 24 (A1) 1 321.03 20.47 25.03 3.44

retirement funds in South Africa to the 31 Dec 23 (A1) 1 226.14 20.66 21.81 3.46

extent allowed for by the Act. 31 Dec 22 (A1) 1 136.30 20.36 21.03 3.64

The portfolio equity exposure will be 31 Dec 21 (A1) 1 152.55 10.47 15.87 2.29

limited to a maximum of 60%. Risk/Return Profile

In order to achieve its objective the

portfolio will invest in a broad spectrum

of South African and offshore securities.

The investments to be included in the

portfolio may comprise a combination

of securities such as assets in liquid

form, interest bearing instruments,

bonds, debentures, corporate debt,

equity securities, property securities,

preferences shares, convertible

equities, non-equity securities and

money market instruments.

The portfolio will comply with all Price History Relative Strength to FTSE/JSE All Share

prudential requirements and regulations index (J203)

controlling retirement funds or such

other applicable legislation as may be

determined for retirement funds.

DETAILS as at 30 June 2025

All fees and charges include VAT DOMESTIC FUNDS

Formation date: 15 Aug 2017

Min lump sum: R5 000

Minimum monthly: R500

Annual fee (A1): 0.75%

TER (A1) 03/25: 1.22%

TER Perf% (A1) 0.00%

Fund value: R238.74m

Risk rating: Medium

PlexCrowns (A1): «««

Income declaration: 30/06, 31/12

Income payment: 02/07, 02/01

Profile’s Unit Trusts & Collective Investments September 2025 309