Page 313 - Profile's Unit Trusts & Collective Investments - September 2025

P. 313

Domestic funds Novare High Growth Fund

Novare High Growth Fund

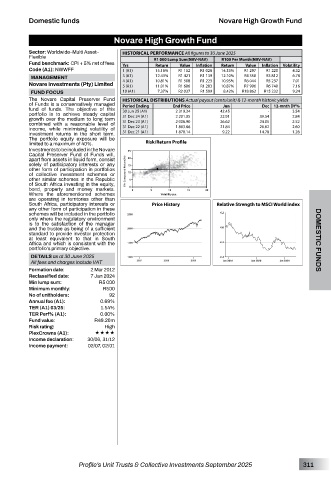

Sector: Worldwide–Multi Asset– HISTORICAL PERFORMANCE All figures to 30 June 2025

Flexible R1 000 Lump Sum(NAV-NAV) R100 Per Month(NAV-NAV)

Fund benchmark: CPI + 5% net of fees Yrs Return Value Inflation Return Value Inflation Volatility

Code (A1): NWWFF 1 (A1) 15.16% R1 152 R1 028 14.35% R1 297 R1 220 4.32

3 (A1) 12.43% R1 421 R1 139 12.10% R4 358 R3 812 6.78

MANAGEMENT

Novare Investments (Pty) Limited 4 (A1) 10.81% R1 508 R1 223 10.95% R6 044 R5 237 7.01

7.16

5 (A1)

R6 740

R1 283

10.87%

R7 996

R1 686

11.01%

FUND FOCUS 10 (A1) 7.37% R2 037 R1 599 8.42% R18 862 R15 232 9.24

The Novare Capital Preserver Fund HISTORICAL DISTRIBUTIONS Actual payout (cents/unit) & 12-month historic yields

of Funds is a conservatively managed Period Ending End Price Jun Dec 12-mnth DY%

fund of funds. The objective of this

portfolio is to achieve steady capital 30 Jun 25 (A1) 2 319.34 42.45 - 3.54

growth over the medium to long term 31 Dec 24 (A1) 2 201.05 22.91 39.54 2.84

combined with a reasonable level of 31 Dec 23 (A1) 2 006.90 26.62 24.05 2.52

income, while minimising volatility of 31 Dec 22 (A1) 1 863.66 21.84 26.62 2.60

investment returns in the short term. 31 Dec 21 (A1) 1 870.14 9.22 14.78 1.28

The portfolio equity exposure will be

limited to a maximum of 40%. Risk/Return Profile

Investments to be included in the Novare

Capital Preserver Fund of Funds will,

apart from assets in liquid form, consist

solely of participatory interests or any

other form of participation in portfolios

of collective investment schemes or

other similar schemes in the Republic

of South Africa investing in the equity,

bond, property and money markets.

Where the aforementioned schemes

are operating in territories other than

South Africa, participatory interests or Price History Relative Strength to MSCI World index

any other form of participation in these

schemes will be included in the portfolio

only where the regulatory environment

is to the satisfaction of the manager

and the trustee as being of a sufficient

standard to provide investor protection

at least equivalent to that in South DOMESTIC FUNDS

Africa and which is consistent with the

portfolio’s primary objective.

DETAILS as at 30 June 2025

All fees and charges include VAT

Formation date: 2 Mar 2012

Reclassified date: 7 Jan 2024

Min lump sum: R5 000

Minimum monthly: R500

No of unitholders: 92

Annual fee (A1): 0.69%

TER (A1) 03/25: 1.54%

TER Perf% (A1): 0.00%

Fund value: R49.20m

Risk rating: High

PlexCrowns (A1): ««««

Income declaration: 30/06, 31/12

Income payment: 02/07, 02/01

Profile’s Unit Trusts & Collective Investments September 2025 311