Page 23 - Profile's Unit Trusts & Collective Investments - September 2025

P. 23

How to use this book

The FET and NQF references in the chapter should be read in the context “this information

relevant to unit standard 242612 outcome 2” (for example). The NQF references do

not imply that an associated paragraph or section fulfils the outcome requirements.

In some cases – especially where NQF requires a case study – additional work and research

must be done.

In terms of amendments to the FAIS Act 45 of 2013 (Section 6A and 8A) and reviews of

sub-ordinate legislation, such as the FSCA’s Board Notices (BN) and/or conduct standards

concerning “fit and proper requirements,” an authorised financial service provider, key individual,

representative of the provider and key individual of the FSP must develop and maintain their abilities,

skills and knowledge relating to continuing professional development.

Board Notice 194, published in December 2017, replaces earlier versions of the Registrar’s

Determination of Fit and Proper Requirements for FSPs and defines revised CPD requirements.

Individuals rendering services across more than one class of business must complete at least 18

CPD hours per annum; those providing services across more than one subclass within a single class

of business, at least 12 hours per annum; and at least 6 hours per annum where the individual focuses

on one subclass. Subject to certain exemptions (such as Category I long term insurance reps), the

new Fit and Proper CPD requirements apply to all FSPs, key individuals and representatives.

In terms of Section 32 of the Regulations, FSPs are responsible for ensuring that key individuals

and representatives receive relevant and appropriate CPD training. FSPs must also maintain

competence registers and evidence of CPD activities.

Note that FPI membership requires 35 CPD points. Where the FSP is a professional member of

the FPI and has completed the necessary FPI CPD requirements, they will also have met the FSCA

CPD requirements.

By reading this publication, FPI members, in compliance with the FPI CPD policy and membership

regulations, may claim CPD points under the abovementioned category.

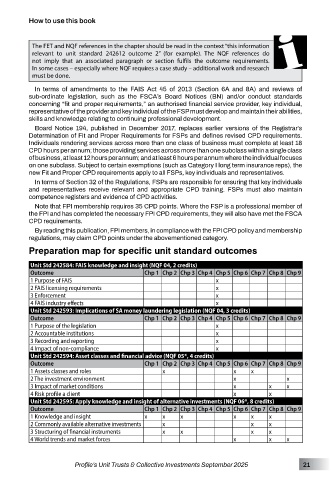

Preparation map for specific unit standard outcomes

Unit Std 242584: FAIS knowledge and insight (NQF 04, 2 credits)

Outcome Chp 1 Chp 2 Chp 3 Chp 4 Chp 5 Chp 6 Chp 7 Chp 8 Chp 9

1 Purpose of FAIS x

2 FAIS licensing requirements x

3 Enforcement x

4 FAIS industry effects x

Unit Std 242593: Implications of SA money laundering legislation (NQF 04, 3 credits)

Outcome Chp 1 Chp 2 Chp 3 Chp 4 Chp 5 Chp 6 Chp 7 Chp 8 Chp 9

1 Purpose of the legislation x

2 Accountable institutions x

3 Recording and reporting x

4 Impact of non-compliance x

Unit Std 242594: Asset classes and financial advice (NQF 05*, 4 credits)

Outcome Chp 1 Chp 2 Chp 3 Chp 4 Chp 5 Chp 6 Chp 7 Chp 8 Chp 9

1 Assets classes and roles x x x

2 The investment environment x x

3 Impact of market conditions x x x

4 Risk profile a client x x

Unit Std 242595: Apply knowledge and insight of alternative investments (NQF 06*, 8 credits)

Outcome Chp 1 Chp 2 Chp 3 Chp 4 Chp 5 Chp 6 Chp 7 Chp 8 Chp 9

1 Knowledge and insight x x x x x x

2 Commonly available alternative investments x x x

3 Structuring of financial instruments x x x x

4 World trends and market forces x x x

Profile’s Unit Trusts & Collective Investments September 2025 21