Page 20 - Profile's Unit Trusts & Collective Investments - September 2025

P. 20

How to use this book

A note on terminology

Both the Collective Investment Schemes Control Act (CISCA) and the National Qualifications

Framework (NQF) introduced new terminology which should be used where possible.

The term “learner”, for example, has been adopted, perhaps because it is more encompassing

than old terminology like “scholar” (someone who is at school) or “student” (which tends to imply

attendance at college or university). “Learner” encompasses something of the old concept of

“apprentice” (ie, a student who receives on-the-job training and experience).

An example from CISCA is the use of “portfolio” to describe what has always been called a “fund”.

In other words, a unit trust fund is now correctly called a portfolio of a collective investment scheme,

although fund remains popular and widely used. Another example: what was called a “unit” (in a

“fund”) is now correctly called a participatory interest in a collective investment scheme.

To assist readers in not getting confused with the new terminology, notes, sidebars and definitions

in the text highlight old and new terms and give examples of usage.

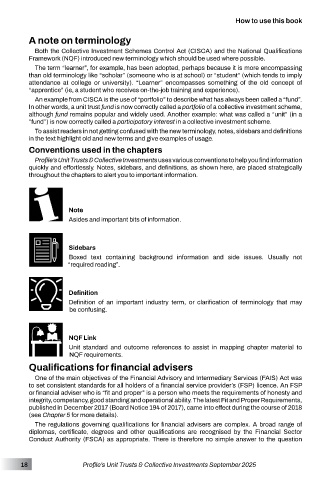

Conventions used in the chapters

Profile’s Unit Trusts & Collective Investments uses various conventions to help you find information

quickly and effortlessly. Notes, sidebars, and definitions, as shown here, are placed strategically

throughout the chapters to alert you to important information.

Note

Asides and important bits of information.

Sidebars

Boxed text containing background information and side issues. Usually not

“required reading”.

Definition

Definition of an important industry term, or clarification of terminology that may

be confusing.

NQF Link

Unit standard and outcome references to assist in mapping chapter material to

NQF requirements.

Qualifications for financial advisers

One of the main objectives of the Financial Advisory and Intermediary Services (FAIS) Act was

to set consistent standards for all holders of a financial service provider’s (FSP) licence. An FSP

or financial adviser who is “fit and proper” is a person who meets the requirements of honesty and

integrity, competancy, good standing and operational ability. The latest Fit and Proper Requirements,

published in December 2017 (Board Notice 194 of 2017), came into effect during the course of 2018

(see Chapter 5 for more details).

The regulations governing qualifications for financial advisers are complex. A broad range of

diplomas, certificate, degrees and other qualifications are recognised by the Financial Sector

Conduct Authority (FSCA) as appropriate. There is therefore no simple answer to the question

18 Profile’s Unit Trusts & Collective Investments September 2025