Page 221 - Profile's Unit Trusts & Collective Investments - September 2025

P. 221

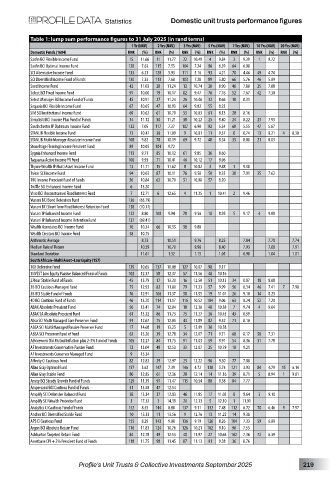

Statistics Domestic unit trusts performance figures

Table 1: lump sum performance figures to 31 July 2025 (in rand terms)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1604) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Sasfin BCI Flexible Income Fund 15 11.66 11 11.77 22 10.49 4 9.84 3 9.39 1 9.72

Sasfin BCI Optimal Income Fund 128 7.63 115 7.55 104 7.24 86 6.39 64 6.08

SCI Alternative Income Fund 133 6.21 120 5.93 111 5.16 93 4.21 70 4.46 49 4.74

SCI Diversified Income Fund of Funds 130 7.33 113 7.68 103 7.28 89 5.80 66 5.76 46 5.89

Seed Income Fund 42 11.03 28 11.24 12 10.74 20 8.90 46 7.80 25 7.88

Select BCI Fixed Income Fund 97 10.00 79 10.17 82 9.47 76 7.76 52 7.67 42 7.30

Select Manager BCI Income Fund of Funds 45 10.91 27 11.24 26 10.46 32 8.66 18 8.31

Sequoia BCI Flexible Income Fund 67 10.65 47 10.93 64 9.82 55 8.23

SIM SCI Institutional Income Fund 69 10.62 61 10.70 53 10.03 61 8.13 28 8.16

Simplisiti BCI Income Plus Fund of Funds 34 11.12 30 11.21 38 10.22 25 8.80 24 8.22 23 7.93

Southchester IP Optimum Income Fund 132 7.05 117 7.37 107 6.90 92 5.34 68 5.55 47 5.67

STANLIB Flexible Income Fund 73 10.47 36 11.09 9 10.81 11 9.37 8 8.74 13 8.21 4 8.30

STANLIB Multi-Manager Absolute Income Fund 108 9.82 78 10.19 69 9.72 48 8.34 33 8.00 21 8.03

Stonehage Fleming Income Prescient Fund 89 10.05 104 9.72

Sygnia Enhanced Income Fund 113 9.71 85 10.12 61 9.85 36 8.60

Taquanta Active Income FR Fund 100 9.93 71 10.41 46 10.12 17 9.06

Thyme Wealth IP Multi Asset Income Fund 13 11.71 15 11.62 8 10.82 3 9.88 1 9.48

Trésor SCI Income Fund 94 10.03 87 10.11 76 9.58 50 8.33 38 7.91 35 7.62

TRG Income Prescient Fund of Funds 56 10.84 62 10.70 51 10.08 57 8.20

Truffle SCI Enhanced Income Fund 6 13.20

Visio BCI Unconstrained Fixed Interest Fund 7 12.71 6 12.65 4 11.35 1 10.41 2 9.46

Vunani BCI Bond Retention Fund 136 (65.79)

Vunani BCI Short Term Fixed Interest Retention Fund 138 (70.17)

Vunani IP Enhanced Income Fund 122 8.80 100 9.94 78 9.56 18 8.95 5 9.17 4 9.08

Vunani IP Enhanced Income Retention Fund 137 (69.41)

Wealth Associates BCI Income Fund 76 10.34 66 10.55 58 9.88

Wealth Creators BCI Income Fund 58 10.75

Arithmetic Average 8.73 10.51 9.76 8.25 7.84 7.70 7.74

Median Rate of Return 10.59 10.70 9.96 8.40 7.93 7.88 7.91

Standard Deviation 11.61 1.32 1.15 1.05 0.98 1.04 1.01

South African–Multi Asset–Low Equity (157)

10X Defensive Fund 139 10.65 137 10.08 127 10.07 98 9.17

1NVEST Low Equity Passive Balanced Fund of Funds 102 12.37 58 12.37 57 11.56 48 10.16

27four Stable Fund of Funds 45 13.79 17 13.30 16 12.50 51 10.13 34 8.87 18 8.08

3B BCI Cautious Managed Fund 75 12.92 82 11.80 79 11.23 57 9.99 56 8.34 46 7.41 7 7.98

3B BCI Stable Fund of Funds 76 12.91 106 11.37 58 11.55 19 11.01 26 9.10 14 8.23

4D BCI Cautious Fund of Funds 46 13.70 114 11.17 116 10.52 104 9.06 63 8.24 52 7.20

ABAX Absolute Prescient Fund 56 13.41 74 12.04 18 12.38 40 10.38 7 9.74 4 9.04

ABAX SA Absolute Prescient Fund 61 13.32 86 11.73 75 11.37 36 10.45 43 8.59

Absa SCI Multi Managed Core Preserver Fund 91 12.67 75 12.04 43 11.89 82 9.52 71 8.10

ABSA SCI Multi Managed Passive Preserver Fund 17 14.68 19 13.25 5 12.99 30 10.58

ABSA SCI Preserver Fund of Fund 63 13.26 39 12.78 34 12.07 71 9.71 68 8.17 50 7.31

Adviceworx Old Mutual Inflation plus 2-3% Fund of Funds 105 12.27 84 11.75 91 11.03 59 9.91 54 8.36 31 7.78

AF Investments Conservative Passive Fund 72 13.04 48 12.53 33 12.07 25 10.79 18 9.21

AF Investments Conserver Managed Fund 9 15.34

Affinity Ci Cautious Fund 82 12.83 29 12.97 25 12.22 96 9.30 77 7.88

Allan Gray Optimal Fund 157 5.62 147 7.39 146 4.72 138 5.74 121 3.93 84 4.79 15 6.14

Allan Gray Stable Fund 80 12.85 61 12.36 28 12.14 14 11.16 39 8.71 5 8.94 1 9.81

Amity BCI Steady Growth Fund of Funds 129 11.39 97 11.47 115 10.54 80 9.58 84 7.77

Ampersand BCI Cautious Fund of Funds 51 13.58 47 12.54

Amplify SCI Defensive Balanced Fund 58 13.34 37 12.83 46 11.85 17 11.03 8 9.64 3 9.10

Amplify SCI Wealth Protector Fund 3 17.32 3 14.39 20 12.33 5 12.10 1 11.91

Analytics Ci Cautious Fund of Funds 152 8.55 144 8.88 137 9.11 132 7.48 112 6.72 70 6.46 9 7.97

Anchor BCI Diversified Stable Fund 10 15.33 11 13.56 9 12.76 13 11.22 14 9.38

APS Ci Cautious Fund 155 8.29 143 9.00 136 9.19 126 8.26 104 7.33 59 6.89

Argon BCI Absolute Return Fund 116 11.83 124 10.76 126 10.21 102 9.10 96 7.55

Ashburton Targeted Return Fund 84 12.78 49 12.53 40 11.97 27 10.66 102 7.36 72 6.39

Assetbase CPI + 2% Prescient Fund of Funds 118 11.75 98 11.45 87 11.13 91 9.38 36 8.76

Profile’s Unit Trusts & Collective Investments September 2025 219