Page 222 - Profile's Unit Trusts & Collective Investments - September 2025

P. 222

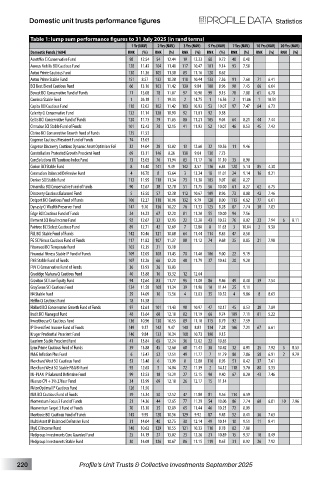

Domestic unit trusts performance figures Statistics

Table 1: lump sum performance figures to 31 July 2025 (in rand terms)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1604) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

AssetMix Ci Conservative Fund 98 12.54 54 12.44 19 12.33 68 9.72 48 8.48

Aureus Nobilis BCI Cautious Fund 128 11.43 104 11.40 117 10.47 101 9.14 93 7.58

Autus Prime Cautious Fund 130 11.36 105 11.38 85 11.16 120 8.62

Autus Prime Stable Fund 151 8.57 132 10.38 118 10.44 133 7.36 91 7.60 71 6.41

BCI Best Blend Cautious Fund 66 13.16 103 11.42 130 9.84 108 8.96 98 7.45 66 6.64

Bovest BCI Conservative Fund of Funds 71 13.08 78 11.87 97 10.98 99 9.15 78 7.88 61 6.78

Camissa Stable Fund 1 26.18 1 19.33 2 14.75 1 16.56 2 11.86 1 10.51

Capita BCI Cautious Fund 110 12.02 102 11.42 103 10.93 53 10.07 97 7.47 64 6.73

Celerity Ci Conservative Fund 132 11.14 120 10.90 92 11.01 92 9.38

Celtis BCI Conservative Fund of Funds 120 11.73 79 11.85 80 11.21 105 9.04 64 8.21 44 7.44

Cinnabar SCI Stable Fund of Funds 101 12.42 70 12.15 41 11.93 52 10.07 46 8.53 45 7.43

Citrine BCI Conservative Growth Fund of Funds 125 11.53

Cogence Cautious Prescient Fund of Funds 74 13.03

Cogence Discovery Cautious Dynamic Asset Optimiser FoF 32 14.04 28 13.02 13 12.60 32 10.56 11 9.46

Constellation Protected Growth Prescient Fund 69 13.11 146 8.26 138 9.04 130 7.73

CoreSolutions OUTcautious Index Fund 73 13.03 76 11.94 83 11.17 16 11.10 33 8.90

Corion BCI Stable Fund 8 15.40 141 9.49 142 8.57 136 6.84 120 5.14 85 4.30

Coronation Balanced Defensive Fund 4 16.70 8 13.64 3 13.24 18 11.01 24 9.14 16 8.21

Denker SCI Stable Fund 112 11.95 110 11.34 73 11.38 103 9.07 60 8.27

Dinamika BCI Conservative Fund of Funds 90 12.67 38 12.78 51 11.75 56 10.00 61 8.27 62 6.75

Discovery Cautious Balanced Fund 5 15.50 57 12.38 112 10.67 109 8.96 73 8.08 42 7.46

Dotport BCI Cautious Fund of Funds 106 12.27 118 10.96 132 9.79 128 8.00 113 6.62 77 6.01

Dynasty Ci Wealth Preserver Fund 147 9.70 136 10.22 76 11.33 125 8.28 87 7.74 30 7.83

Edge BCI Cautious Fund of Funds 24 14.23 67 12.20 81 11.20 55 10.00 94 7.56

Element SCI Real Income Fund 92 12.67 32 12.93 22 12.28 43 10.32 76 8.02 23 7.94 6 8.11

Fairtree BCI Select Cautious Fund 89 12.71 42 12.69 7 12.88 8 11.63 3 10.84 2 9.50

FAL BCI Stable Fund of Funds 142 10.46 121 10.88 64 11.44 114 8.85 47 8.50

FG SCI Venus Cautious Fund of Funds 117 11.82 107 11.37 88 11.12 74 9.68 35 8.85 21 7.98

Fibonacci BCI Temperate Fund 103 12.35 21 13.18

Financial Fitness Stable IP Fund of Funds 109 12.05 100 11.43 70 11.40 106 9.00 22 9.19

FNB Stable Fund of Funds 107 12.26 66 12.20 48 11.79 37 10.42 20 9.20

FVV Ci Conservative Fund of Funds 36 13.93 26 13.03

Gradidge Mahura Ci Cautious Fund 40 13.88 16 13.32 12 12.64

Graviton SCI Low Equity Fund 94 12.64 83 11.77 95 11.00 86 9.46 49 8.48 39 7.54

GraySwan SCI Cautious Fund 124 11.58 108 11.34 39 11.98 10 11.44 25 9.11

H4 Stable Fund 29 14.09 10 13.56 4 13.03 35 10.52 4 9.86 8 8.63

Helfin Ci Cautious Fund 18 14.58

Hollard BCI Conservative Growth Fund of Funds 97 12.61 101 11.43 98 10.97 47 10.17 45 8.53 28 7.89

Instit BCI Managed Fund 48 13.64 68 12.18 82 11.19 66 9.74 109 7.11 81 5.22

Investhouse Ci Cautious Fund 136 10.96 130 10.55 89 11.10 115 8.79 92 7.59

IP Diversified Income Fund of Funds 149 9.37 142 9.47 140 8.83 134 7.28 106 7.21 67 6.61

Kruger Prudential Prescient Fund 146 9.84 133 10.34 108 10.73 100 9.15

Laurium Stable Prescient Fund 41 13.84 65 12.24 36 12.02 22 10.85

Lynx Prime Cautious Fund of Funds 39 13.88 45 12.60 68 11.43 38 10.42 32 8.91 25 7.92 5 8.53

M&G Inflation Plus Fund 6 15.47 52 12.51 49 11.77 7 11.79 80 7.86 58 6.91 2 9.79

Merchant West SCI Cautious Fund 53 13.48 6 13.99 8 12.80 110 8.93 51 8.42 37 7.61

Merchant West SCI Stable P&G® Fund 93 12.65 5 14.04 72 11.39 2 14.12 118 5.70 80 5.53

MI-PLAN IP Balanced Defensive Fund 99 12.53 18 13.29 27 12.15 90 9.40 67 8.20 43 7.46

Mianzo CPI + 3% 27four Fund 34 13.99 69 12.18 26 12.17 15 11.14

MitonOptimal IP Cautious Fund 126 11.50

MM BCI Cautious Fund of Funds 59 13.34 50 12.52 47 11.80 81 9.56 114 6.59

Momentum Focus 3 Fund of Funds 21 14.36 44 12.65 77 11.29 54 10.06 86 7.74 60 6.81 10 7.96

Momentum Target 3 Fund of Funds 70 13.10 35 12.89 65 11.44 46 10.23 72 8.09

Montrose BCI Cautious Fund of Funds 145 9.95 128 10.56 129 9.92 87 9.45 52 8.41 36 7.63

Multi Asset IP Balanced Defensive Fund 31 14.04 40 12.75 30 12.14 49 10.14 10 9.51 11 8.41

MyQ Ci Income Fund 140 10.62 129 10.55 121 10.33 116 8.78 82 7.80

Nedgroup Investments Core Guarded Fund 25 14.19 27 13.02 23 12.26 21 10.89 15 9.37 10 8.49

Nedgroup Investments Stable Fund 30 14.08 126 10.67 86 11.15 119 8.65 31 8.92 26 7.92

220 Profile’s Unit Trusts & Collective Investments September 2025