Page 216 - Profile's Unit Trusts & Collective Investments - September 2025

P. 216

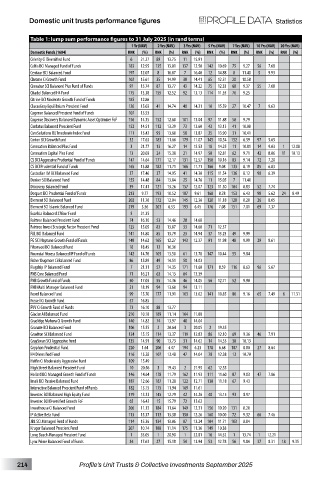

Domestic unit trusts performance figures Statistics

Table 1: lump sum performance figures to 31 July 2025 (in rand terms)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1604) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Celerity Ci Diversified Fund 6 21.27 89 13.75 11 15.91

Celtis BCI Managed Fund of Funds 183 12.95 135 13.01 137 12.50 142 10.69 75 9.27 56 7.68

Centaur BCI Balanced Fund 197 12.07 8 16.87 7 16.40 12 14.88 8 11.40 5 9.93

Chrome Ci Growth Fund 102 15.61 35 14.99 38 14.41 65 12.51 20 10.58

Cinnabar SCI Balanced Plus Fund of Funds 97 15.74 87 13.77 43 14.22 75 12.33 68 9.37 55 7.68

Citadel Balanced H4 Fund 175 13.38 155 12.52 92 13.13 114 11.55 76 9.25

Citrine BCI Moderate Growth Fund of Funds 185 12.86

ClucasGray Equilibrium Prescient Fund 126 15.03 41 14.74 40 14.31 10 15.59 27 10.47 7 9.63

Cogence Balanced Prescient Fund of Funds 107 15.53

Cogence Discovery Balanced Dynamic Asset Optimiser FoF 156 14.35 152 12.60 101 13.04 97 11.88 58 9.79

Cordatus Balanced Prescient Fund 152 14.51 112 13.39 73 13.60 43 13.13 41 10.08

CoreSolutions OUTmoderate Index Fund 111 15.42 93 13.60 58 13.87 25 13.90 31 10.41

Corion BCI Growth Fund 32 17.63 183 11.66 179 11.07 145 10.54 152 6.59 97 5.65

Coronation Balanced Plus Fund 3 21.77 13 16.27 14 15.53 18 14.25 11 10.81 14 9.03 1 12.08

Coronation Capital Plus Fund 13 20.03 24 15.30 21 14.97 50 12.81 62 9.71 42 8.06 11 10.13

CS BCI Aggressive Prudential Fund of Funds 147 14.64 171 12.17 131 12.57 158 10.16 83 9.14 72 7.20

CS BCI Prudential Fund of Funds 165 13.88 182 11.71 166 11.71 166 9.08 133 8.19 85 6.83

Custodian IM BCI Balanced Fund 37 17.46 37 14.95 41 14.30 115 11.54 136 8.12 90 6.39

Denker SCI Balanced Fund 155 14.48 84 13.84 25 14.76 11 15.05 7 11.40

Discovery Balanced Fund 39 17.41 121 13.26 157 12.07 123 11.30 104 8.83 52 7.74

Dotport BCI Prudential Fund of Funds 213 9.77 193 10.52 187 9.61 168 8.78 153 6.43 98 5.62 24 8.49

Element SCI Balanced Fund 202 11.76 172 12.04 145 12.36 128 11.18 128 8.28 26 8.65

Element SCI Islamic Balanced Fund 219 3.56 203 6.53 193 6.45 176 7.08 151 7.01 69 7.37

Excelsia Balanced 27four Fund 5 21.35

Fairtree Balanced Prescient Fund 74 16.10 53 14.46 28 14.68

Fairtree Invest Strategic Factor Prescient Fund 125 15.05 83 13.87 33 14.60 71 12.37

FAL BCI Balanced Fund 141 14.80 85 13.79 23 14.94 37 13.23 49 9.99

FG SCI Neptune Growth Fund of Funds 148 14.62 165 12.27 143 12.37 91 11.98 48 9.99 29 8.61

Fibonacci BCI Balanced Fund 18 18.45 12 16.36

Financial Fitness Balanced IP Fund of Funds 142 14.76 105 13.50 61 13.78 147 10.44 55 9.84

Fisher Dugmore Ci Balanced Fund 86 15.89 49 14.51 50 14.03

Flagship IP Balanced Fund 7 21.11 57 14.35 171 11.60 171 8.59 116 8.63 96 5.67

FNB Core Balanced Fund 71 16.21 63 14.15 84 13.39

FNB Growth Fund of Funds 50 17.03 55 14.36 46 14.05 56 12.71 52 9.90

FNB Multi Manager Balanced Fund 21 18.19 94 13.60 94 13.11

Foord Balanced Fund 99 15.70 177 11.91 103 13.02 141 10.85 80 9.16 65 7.49 6 11.31

Fussell Ci Growth Fund 57 16.85

FVV Ci Growth Fund of Funds 73 16.10 88 13.77

Glacier AI Balanced Fund 210 10.18 189 11.14 164 11.88

Gradidge Mahura Ci Growth Fund 140 14.82 74 13.97 48 14.04

Granate BCI Balanced Fund 106 15.55 2 20.64 3 20.05 2 19.35

Graviton SCI Balanced Fund 124 15.15 114 13.37 119 12.83 86 12.10 69 9.36 46 7.91

GraySwan SCI Aggressive Fund 135 14.91 90 13.73 31 14.62 14 14.55 38 10.13

Gryphon Prudential Fund 220 1.64 206 4.47 194 6.23 178 6.68 107 8.80 27 8.64

H4 Diversified Fund 116 15.28 107 13.48 47 14.04 70 12.38 13 10.70

Helfin Ci Moderately Aggressive Fund 109 15.49

High Street Balanced Prescient Fund 10 20.56 3 19.43 2 21.95 62 12.55

Hollard BCI Managed Growth Fund of Funds 146 14.64 178 11.79 162 11.93 111 11.60 87 9.03 47 7.86

Imali BCI Passive Balanced Fund 187 12.66 187 11.28 122 12.71 130 11.18 67 9.43

Interactive Balanced Prescient Fund of Funds 182 13.15 175 11.94 169 11.61

Investec BCI Balanced High Equity Fund 179 13.33 145 12.79 42 14.26 40 13.15 93 8.97

Investec BCI Diversified Growth FoF 65 16.42 15 15.79 72 13.62

Investhouse Ci Balanced Fund 206 11.13 184 11.64 149 12.31 156 10.20 131 8.20

IP Active Beta Fund 113 15.37 113 13.38 150 12.26 160 10.00 72 9.32 66 7.46

JBL SCI Managed Fund of Funds 114 15.36 134 13.06 87 13.24 104 11.71 103 8.84

Kruger Balanced Prescient Fund 207 10.74 188 11.14 175 11.36 149 10.38

Long Beach Managed Prescient Fund 1 35.05 1 20.90 1 22.81 16 14.52 1 13.74 1 12.21

Lynx Prime Balanced Fund of Funds 34 17.63 27 15.18 54 13.94 53 12.78 56 9.84 37 8.31 18 9.35

214 Profile’s Unit Trusts & Collective Investments September 2025