Page 215 - Profile's Unit Trusts & Collective Investments - September 2025

P. 215

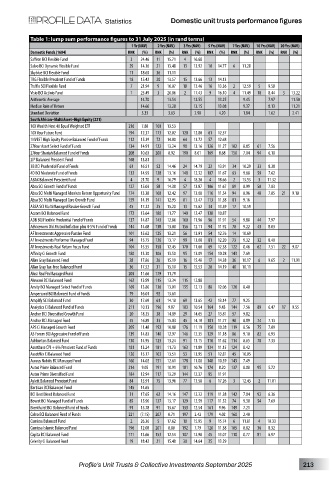

Statistics Domestic unit trusts performance figures

Table 1: lump sum performance figures to 31 July 2025 (in rand terms)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1604) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Saffron BCI Flexible Fund 3 24.46 11 15.71 4 16.68

Salvo BCI Dynamic Flexible Fund 29 14.16 21 13.48 13 13.92 10 14.77 6 11.28

Skyblue BCI Flexible Fund 11 18.65 36 11.11

TRG Flexible Prescient Fund of Funds 18 15.42 20 13.57 15 13.66 13 14.13

Truffle SCI Flexible Fund 7 21.94 9 16.07 18 13.46 16 13.36 2 12.59 5 9.58

Visio BCI Actinio Fund 1 25.49 3 20.86 2 17.43 9 16.10 4 11.49 10 8.44 3 13.22

Arithmetic Average 14.70 13.54 12.55 13.25 9.45 7.97 11.50

Median Rate of Return 14.66 13.28 13.15 13.08 9.37 8.13 11.21

Standard Deviation 5.33 3.63 2.98 4.20 1.84 1.62 2.41

South African–Multi Asset–High Equity (221)

10X Wealth Next 40 Equal Weighted ETF 216 7.88 100 13.53

10X Your Future Fund 194 12.37 173 12.02 120 12.80 61 12.57

1NVEST High Equity Passive Balanced Fund of Funds 112 15.39 72 14.00 64 13.72 57 12.68

27four Asset Select Fund of Funds 134 14.91 122 13.24 90 13.16 126 11.27 102 8.85 61 7.56

27four Shariah Balanced Fund of Funds 208 10.63 200 8.92 190 8.61 169 8.68 150 7.04 94 6.10

2IP Balanced Prescient Fund 168 13.81

3B BCI Prudential Fund of Funds 61 16.51 52 14.46 24 14.79 23 13.91 34 10.29 33 8.38

4D BCI Moderate Fund of Funds 132 14.93 128 13.16 148 12.32 107 11.67 63 9.68 59 7.62

ABAX Balanced Prescient Fund 4 21.70 9 16.79 4 18.20 4 18.66 2 13.53 3 11.32

Absa SCI Growth Fund of Funds 127 15.03 58 14.30 57 13.87 106 11.67 89 8.99 50 7.83

Absa SCI Multi Managed Absolute Return Opportunity Fund 174 13.38 160 12.42 97 13.08 116 11.54 94 8.96 48 7.85 21 9.10

Absa SCI Multi Managed Core Growth Fund 159 14.19 141 12.95 81 13.47 113 11.58 81 9.16

ABSA SCI Multi Managed Passive Growth Fund 45 17.22 25 15.20 13 15.62 34 13.39 17 10.59

Accorn BCI Balanced Fund 172 13.64 180 11.77 140 12.47 138 10.87

ADB BCI Flexible Prudential Fund of Funds 137 14.87 143 12.86 160 11.96 96 11.91 54 9.88 44 7.97

Adviceworx Old Mutual Inflation plus 4-5% Fund of Funds 144 14.68 138 13.00 156 12.11 94 11.92 78 9.22 43 8.03

AF Investments Aggressive Passive Fund 101 15.62 125 13.21 56 13.91 54 12.76 14 10.69

AF Investments Performer Managed Fund 94 15.75 126 13.17 99 13.08 81 12.20 73 9.32 32 8.40

AF Investments Real Return Focus Fund 104 15.55 158 12.45 170 11.60 69 12.38 122 8.46 62 7.51 22 9.07

Affinity Ci Growth Fund 180 13.30 106 13.50 95 13.09 154 10.28 143 7.69

Allan Gray Balanced Fund 28 17.86 26 15.19 16 15.48 17 14.38 36 10.17 6 9.65 2 11.91

Allan Gray Tax-Free Balanced Fund 36 17.52 31 15.10 15 15.53 20 14.19 40 10.11

Alusi RealFin Managed Fund 203 11.66 179 11.79

Aluwani BCI Balanced Fund 162 13.99 115 13.34 115 12.88

Amity BCI Managed Select Fund of Funds 169 13.80 136 13.01 155 12.13 88 12.06 126 8.40

Ampersand BCI Balanced Fund of Funds 79 16.01 92 13.61

Amplify SCI Balanced Fund 30 17.69 61 14.18 69 13.65 42 13.14 77 9.25

Analytics Ci Balanced Fund of Funds 211 10.13 196 9.87 183 10.54 164 9.43 144 7.56 89 6.47 17 9.55

Anchor BCI Diversified Growth Fund 20 18.35 38 14.89 29 14.65 27 13.81 57 9.82

Anchor BCI Managed Fund 55 16.89 33 15.03 45 14.10 101 11.77 98 8.89 74 7.13

APS Ci Managed Growth Fund 205 11.48 192 10.88 176 11.19 150 10.38 119 8.56 75 7.09

AS Forum BCI Aggressive Fund of Funds 139 14.83 140 12.97 146 12.35 129 11.18 86 9.10 82 6.93

Ashburton Balanced Fund 130 14.95 123 13.24 91 13.15 110 11.62 114 8.65 70 7.33

Assetbase CPI + 6% Prescient Fund of Funds 181 13.24 181 11.73 163 11.89 134 11.15 124 8.42

AssetMix Ci Balanced Fund 120 15.17 103 13.51 53 13.95 51 12.81 45 10.05

Aureus Nobilis BCI Managed Fund 160 14.02 151 12.61 178 11.08 148 10.39 145 7.49

Autus Prime Balanced Fund 214 9.05 191 10.91 181 10.76 174 8.20 137 8.08 95 5.72

Autus Prime Diversified Fund 184 12.94 117 13.29 144 12.37 95 11.91

Aylett Balanced Prescient Fund 84 15.91 75 13.96 77 13.58 6 17.26 3 12.45 2 11.81

Bartizan BCI Balanced Fund 145 14.65

BCI Best Blend Balanced Fund 31 17.65 62 14.16 147 12.32 119 11.38 142 7.84 92 6.36

Bovest BCI Managed Fund of Funds 85 15.90 127 13.17 129 12.59 117 11.52 74 9.30 54 7.69

Brenthurst BCI Balanced Fund of Funds 91 15.78 91 13.67 133 12.54 161 9.96 149 7.21

Caleo BCI Balanced Fund of Funds 221 (7.15) 207 0.71 197 2.42 179 4.02 160 2.40

Camissa Balanced Fund 2 26.36 5 17.62 10 15.95 9 15.74 6 11.81 4 10.33

Camissa Islamic Balanced Fund 196 12.08 201 8.80 192 7.79 120 11.38 105 8.82 36 8.32

Capita BCI Balanced Fund 171 13.66 153 12.54 107 12.98 45 13.07 110 8.77 81 6.97

Celerity Ci Balanced Fund 19 18.42 21 15.48 30 14.64 35 13.29

Profile’s Unit Trusts & Collective Investments September 2025 213