Page 343 - Profile's Unit Trusts & Collective Investments - March 2025

P. 343

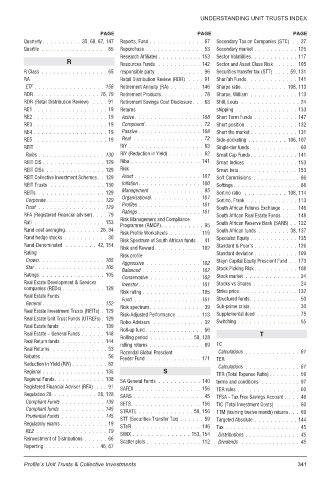

UNDERSTANDING UNIT TRUSTS INDEX

PAGE PAGE PAGE

Quarterly .......... 35, 60, 67, 147 Reports, Fund .............. 67 Secondary Tax on Companies (STC) . . 27

Quartile ................. 65 Repurchase ............... 53 Secondary market ........... 125

Research Affiliates ........... 153 Sector Volatilities............ 117

R Resources Funds ........... 142 Sector and Asset Class Risk ...... 105

R Class ................. 65 responsible party ............ 96 Securities transfer tax (STT) .... 59, 131

RA Retail Distribution Review (RDR) .... 91 Shari’ah Funds ............. 141

ETF .................. 156 Retirement Annuity (RA) ........ 146 Sharpe ratio............ 108, 113

RDR................. 76, 79 Retirement Products........... 78 Sharpe, William ............ 113

RDR (Retail Distribution Review) .... 91 Retirement Savings Cost Disclosure . . . 63 Shill, Louis ............... 24

RE1 ................... 19 Returns shipping ................ 133

RE2 ................... 19 Active ................. 108 Short Term Funds ........... 147

RE3 ................... 19 Compound ............... 72 Short position ............. 132

RE4 ................... 19 Passive ................ 108 Short the market ............ 131

RE5 ................... 19 Real .................. 72 Side-pocketing .......... 106, 107

REIT RiY ................... 63 Single-tier funds ............. 60

Rules ................. 130 RiY (Reduction in Yield) ......... 62 Small Cap Funds ............ 141

REIT CIS ................ 129 Riba .................. 141 Smart Indices ............. 153

REIT CISs ............... 129 Risk Smart beta ............... 153

REIT Collective Investment Schemes . . 129 Asset ................. 107 Soft Commisions ............ 86

REIT Trusts .............. 130 Inflation ................ 100 Softings ................. 86

Management .............. 95

REITs ................. 129 Sortino ratio ........... 108, 114

Organisational............. 107

Corporate ............... 129 Sortino, Frank ............. 113

Profiles ................ 101

Trust ................. 129 South African Futures Exchange .... 146

Ratings ................ 101

RFA (Registered Financial adviser).... 79 South African Real Estate Funds .... 148

Risk Management and Compliance

Rafi .................. 153 South African Reserve Bank (SARB) . . 122

Programme (RMCP)........... 95

Rand cost averaging......... 26, 34 South African funds ........ 38, 137

Risk Profile Worksheets ........ 115

Rand hedge stocks ........... 30 Specialist Equity ............ 135

Risk Spectrum of South African funds . . 41

Rand-Denominated ........ 42, 154 Standard & Poor’s ........... 126

Risk and Reward ............ 102

Rating Standard deviation ........... 109

Risk profile

Crown................. 105 Steyn Capital Equity Prescient Fund . . 173

Aggressive .............. 102

Star .................. 105 Stock Picking Risk ........... 108

Balanced ............... 102

Ratings................. 105 Stock market .............. 24

Conservative ............. 102

Real Estate Development & Services Investor ................ 101 Stocks vs Shares ............ 24

companies (REDs) ........... 129

Risk rating ............... 105 Strike price............... 132

Real Estate Funds

Fund ................. 101 Structured funds............. 50

General ................ 152

Risk spectrum.............. 39 Sub-prime crisis............. 30

Real Estate Investment Trusts (REITs) . 129

Risk-Adjusted Performance ...... 113 Supplemental deed ........... 75

Real Estate Unit Trust Funds (UTREFs) . 129

Robo-Advisers ............. 32 Switching ................ 55

Real Estate funds ........... 139

Roll-up fund ............... 66

Real Estate – General Funds ...... 148 T

Rolling period ........... 58, 128

Real Return funds ........... 144

rolling returns .............. 69 TC

Real Returns .............. 53

Rozendal Global Prescient Calculations .............. 61

Rebates ................. 56 Feeder Fund .............. 171 TER

Reduction in Yield (RiY) ......... 62

Calculations .............. 61

Regional ................ 135 S

TER (Total Expense Ratio)........ 59

Regional Funds............. 138 SA General Funds ........... 140 terms and conditions .......... 97

Registered Financial Adviser (RFA) . . . 91 SAFEX ................. 156 TER rules ................ 60

Regulation 28 ........... 28, 128 SARS .................. 45 TFSA - Tax Free Savings Account .... 46

Compliant Funds ........... 139 SETS.................. 156 TIC (Total Investment Costs) ...... 60

Compliant funds ........... 145

STRATE .............. 59, 156 TTM (training twelve month) returns . . . 69

Prudential Funds ........... 145

STT (Securities Transfer Tax) ...... 59 Targeted Absolute ........... 144

Regulatory exams ............ 19

STeFI.................. 146 Tax ................... 45

RE2 .................. 19

SWIX ............... 153, 154 Distributions .............. 45

Reinvestment of Distributions ...... 66

Scatter plots .............. 112 Dividends ............... 45

Reporting .............. 46, 67

Profile’s Unit Trusts & Collective Investments 341