Page 341 - Profile's Unit Trusts & Collective Investments - March 2025

P. 341

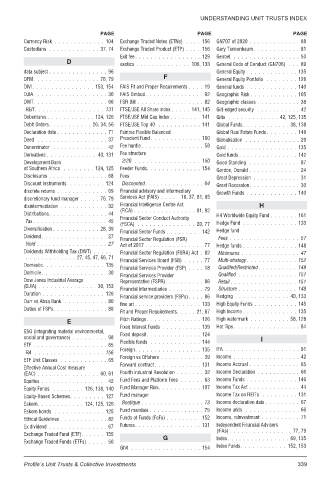

UNDERSTANDING UNIT TRUSTS INDEX

PAGE PAGE PAGE

Currency Risk ............. 104 Exchange Traded Notes (ETNs) .... 156 GN707 of 2020 ............. 88

Custodians ............. 37, 74 Exchange Traded Product (ETP) .... 156 Gary Tannenbaum............ 81

Exit fee................. 129 Genbel.................. 50

D exotics .............. 106, 133 General Code of Conduct (GN706) . . . 89

data subject ............... 96 General Equity ............. 135

F

DFM................. 76, 79 General Equity Portfolio ........ 128

DIVI................ 153, 154 FAIS Fit and Proper Requirements .... 19 General funds ............. 140

DJIA................... 30 FAIS Ombud............... 92 Geographic Risk ............ 105

DWT................... 66 FSR Bill ................. 82 Geographic classes ........... 38

REIT.................. 131 FTSE/JSE All Share index ..... 141, 145 Gilt-edged security ........... 42

Debentures ............ 124, 126 FTSE/JSE Mid Cap index ........ 141 Gilts ............. 42, 125, 135

Debit Orders........... 26, 34, 56 FTSE/JSE Top 40 ........... 141 Global Funds ............ 38, 138

Declaration date ............. 71 Fairtree Flexible Balanced Global Real Estate Funds ........ 148

Deed .................. 37 Prescient Fund ............. 160 Globalisation .............. 29

Denominator .............. 42 Fee hurdle ................ 58 Gold .................. 135

Derivatives ............. 40, 131 Fee structure Gold funds ............... 142

Development Bank 2/20 ................. 150 Good Standing ............. 87

of Southern Africa ........ 124, 125 Feeder Funds.............. 154 Gordon, Donald ............. 24

Disclosures ............... 68 Fees Great Depression ............ 31

Discount instruments.......... 124 Discounted ............... 64 Great Recession............. 30

discrete returns ............. 69 Financial advisory and Intermediary Growth Funds ............. 140

discretionary fund manager ..... 76, 79 Services Act (FAIS) ..... 18, 37, 81, 85

disintermediation ............ 32 Financial Intelligence Centre Act H

(FICA) ................ 81, 92

Distributions............... 44 H4 Worldwide Equity Fund ....... 161

Financial Sector Conduct Authority

Tax ................... 45

(FSCA) ............... 20, 77 Hedge Fund .............. 133

Diversification ............ 28, 39 Hedge fund

Financial Sector Funds ......... 142

Dividend................. 27 Fees .................. 57

Financial Sector Regulation (FSR)

Yield .................. 27 Act of 2017 ............... 77 Hedge funds .............. 148

Dividends Withholding Tax (DWT) ..... Financial Sector Regulation (FSRA) Act . 82 Minimums ............... 47

............. 27, 45, 47, 66, 71

Financial Services Board (FSB) ..... 77 Multi-strategy ............. 152

Domestic................ 135

Financial Services Provider (FSP) .... 18 Quailifed/Restricted .......... 149

Domicile................. 30

Financial Services Provider Qualified ............... 151

Dow Jones Industrial Average Representative (FSPR).......... 86 Retail ................. 151

(DJIA) ............... 30, 153

Financial intermediaries ......... 79 Structure ............... 148

Duration ................ 126

Financial service providers (FSPs) .... 86 Hedging .............. 40, 133

Durr vs Absa Bank............ 80

fine art ................. 133 High Equity Funds ........... 145

Duties of FSPs.............. 88

Fit and Proper Requirements..... 21, 87 High Income .............. 135

E Fitch Ratings .............. 126 High watermark .......... 58, 128

Fixed Interest Funds .......... 139 Hot Tips ................. 84

ESG (integrating material environmental, Fixed deposit.............. 124

social and governance) ......... 98 I

Flexible funds ............. 144

ETF ................... 65

Foreign................. 135 IFA ................... 91

RA .................. 156

Foreign vs Offshore ........... 39 Income ................. 42

ETF Unit Classes ............ 65

Forward contract ............ 131 Income Accrual ............. 65

Effective Annual Cost measure

(EAC) ................ 60, 61 Fourth Industrial Revolution ....... 32 Income Declaration ........... 66

Equities ................. 42 Fund Fees and Platform Fees ...... 63 Income Funds ............. 146

Equity Funds ........ 126, 138, 140 Fund Manager Risk........... 107 Income Tax Act ............. 44

Equity-Based Schemes......... 127 Fund manager Income Tax on REITs ......... 131

Eskom............ 124, 125, 126 Boutique ................ 73 Income declaration date ......... 67

Eskom bonds ............. 125 Fund mandate .............. 75 Income units .............. 66

Ethical Guidelines ............ 82 Funds of Funds (FoFs) ......... 152 Income, reinvestment .......... 71

Ex dividend ............... 67 Futures................. 131 Independent Financial Advisers

(IFAs) ................ 77, 79

Exchange Traded Fund (ETF)...... 155

G Index................ 69, 135

Exchange Traded Funds (ETFs) ..... 50

GIVI .................. 154 Index Funds............ 152, 153

Profile’s Unit Trusts & Collective Investments 339