Page 340 - Profile's Unit Trusts & Collective Investments - March 2025

P. 340

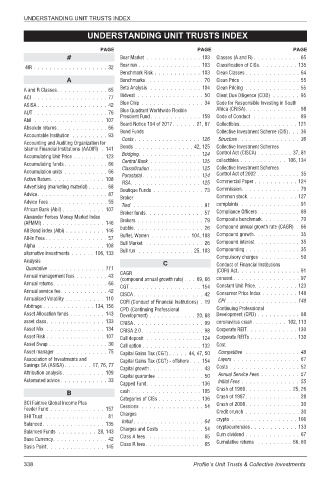

UNDERSTANDING UNIT TRUSTS INDEX

UNDERSTANDING UNIT TRUSTS INDEX

UNDERSTANDING UNIT TRUSTS INDEX

PAGE PAGE PAGE

# Bear Market .............. 103 Classes (A and R) ............ 65

4IR ................... 32 Bear run ................ 103 Classification of CISs.......... 135

Benchmark Risk ............ 103 Clean Classes .............. 64

A Benchmarks............... 70 Clean Price ............... 55

A and R Classes............. 65 Beta Analysis ............. 104 Clean Pricing .............. 55

ACI ................... 77 Bidvest ................. 50 Client Due Diligence (CDD) ....... 95

Blue Chip ................ 34 Code for Responsible Investing in South

ASISA .................. 42

Blue Quadrant Worldwide Flexible Africa (CRISA).............. 98

AUT ................... 76

Prescient Fund ............. 159 Code of Conduct ............ 89

Abil .................. 107

Board Notice 194 of 2017 ...... 21, 87 Collectibles............... 121

Absolute returns............. 66

Bond Funds Collective Investment Scheme (CIS) . . . 36

Accountable Institution ......... 93

Costs ................. 126 Structure ................ 36

Accounting and Auditing Organization for

Islamic Financial Institutions (AAOIFI) . 141 Bonds ............... 42, 125 Collective Investment Schemes

Bridging................ 124 Control Act (CISCA) ......... 37, 81

Accumulating Unit Price ........ 123

Central Bank ............. 125 collectibles ............ 106, 134

Accumulating funds ........... 66

Classification ............. 125 Collective Investment Schemes

Accumulation units ........... 66

Parastatal ............... 124 Control Act of 2002 ........... 35

Active Return.............. 108

RSA.................. 125 Commercial Paper ........... 124

Advertising (marketing material) ..... 68

Boutique Funds ............. 73 Commission............... 79

Advice.................. 87

Broker Common stock............. 127

Advice Fees ............... 55

Tied .................. 91 complaints ............... 91

African Bank (Abil) ........... 107

Broker funds............... 57 Compliance Officers ........... 89

Alexander Forbes Money Market Index Composite benchmark.......... 70

(AFMMI) ................ 146 Brokers ................. 79

bubble.................. 26 Compound annual growth rate (CAGR) . 66

All Bond index (Albi) .......... 146

Buffet, Warren .......... 104, 108 Compound growth............ 35

All-In Fees................ 57

Bull Market ............... 26 Compound interest ........... 35

Alpha ................. 108

Bull run .............. 25, 103 Compounding .............. 35

alternative investments ...... 106, 133

Compulsory charges .......... 59

Analysis

C Conduct of Financial Institutions

Quantative .............. 111 (COFI) Act ................ 91

CAGR

Annual management fees ........ 43

(compound annual growth rate) . . . 69, 66 consent ................. 97

Annual returns.............. 66

CGT .................. 154 Constant Unit Price........... 123

Annual service fee ............ 42

CISCA .................. 42 Consumer Price Index ......... 148

Annualised Volatility .......... 110

COFI (Conduct of Financial Institutions) . 19 CPI .................. 148

Arbitrage ............. 134, 156

CPD (Continuing Professional Continuing Professional

Asset Allocation funds ......... 143 Development) ............ 20, 88 Development (CPD) ........... 88

asset class............... 133 CRISA .................. 99 coronavirus crash......... 102, 113

Asset Mix ............... 134 CRISA 2.0 ................ 98 Corporate REIT............. 130

Asset Risk ............... 107 Call deposit .............. 124 Corporate REITs ............ 130

Asset Swap ............... 30 Call option ............... 132 Cost

Asset manager ............. 75 Capital Gains Tax (CGT) ..... 44, 47, 50 Competitive .............. 48

Association of Investments and Capital Gains Tax (CGT) - offshore . . . 154 Layers ................. 61

Savings SA (ASISA) ....... 17, 76, 77 Costs .................. 52

Capital growth.............. 43

Attribution analysis........... 109 Annual Service Fees .......... 57

Capital guarantee ............ 50

Automated advice ............ 33 Initial Fees ............... 55

Capped Fund.............. 136

B cash .................. 105 Crash of 1969 ............ 25, 26

Categories of CISs ........... 136 Crash of 1987 .............. 28

BCI Fairtree Global Income Plus Crash of 2008 .............. 30

Feeder Fund .............. 157 Cessions ................ 54

Charges Credit crunch .............. 30

BHI Trust ................ 81

Initial .................. 64 crypto ................. 106

Balanced................ 135

Charges and Costs ........... 54 cryptocurrencies ............ 133

Balanced Funds .......... 28, 143

Class A fees............... 65 Cum dividend .............. 67

Base Currency.............. 42

Class R fees............... 65 Cumulative returns ......... 66, 69

Basis Point............... 145

338 Profile’s Unit Trusts & Collective Investments