Page 342 - Profile's Unit Trusts & Collective Investments - March 2025

P. 342

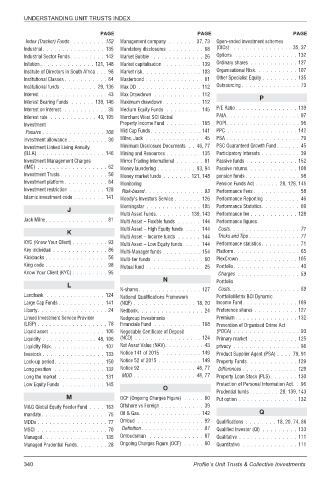

UNDERSTANDING UNIT TRUSTS INDEX

PAGE PAGE PAGE

Index (Tracker) Funds ......... 152 Management company ....... 37, 73 Open-ended investment schemes

Industrial ................ 135 Mandatory disclosures ......... 68 (OICs) ................ 35, 37

Industrial Sector Funds......... 142 Market Bubble ............. 26 Options ................ 132

Inflation.............. 121, 148 Market capitalisation .......... 139 Ordinary shares ............ 127

Institute of Directors in South Africa . . . 98 Market risk ............... 103 Organisational Risk........... 107

Institutional Classes ........... 64 Masterbond ............... 81 Other Specialist Equity ......... 135

Institutional funds ......... 29, 136 Max DD ................ 112 Outsourcing ............... 73

Interest ................. 43 Max Drawdown ............ 112

P

Interest Bearing Funds ...... 139, 146 Maximum drawdown.......... 112

Interest on interest............ 35 Medium Equity Funds ......... 145 P/E Ratio................ 139

Interest rate ............ 43, 105 Merchant West SCI Global PAIA................... 97

Investment Property Income Fund ......... 165 POPI................... 96

Passive ................ 108 Mid Cap Funds ............. 141 PPC .................. 142

investment allowance .......... 30 Milne, Jack ............... 45 PSA ................... 79

Investment Linked Living Annuity Minimum Disclosure Documents . . 46, 77 PSC Guaranteed Growth Fund ...... 45

(ILLA) ................. 146 Mining and Resources ......... 135 Participatory Interests .......... 39

Investment Management Charges Mirror Trading International ....... 81 Passive funds ............. 152

(IMC) .................. 62 Money laundering .......... 93, 94 Passive returns............. 108

Investment Trusts ............ 50 Money market funds ....... 121, 148 pension funds .............. 98

Investment platform ........... 64 Monitoring Pension Funds Act ...... 28, 128, 145

Investment restriction ......... 128 Risk-based ............... 93 Performance Fees ............ 58

Islamic investment code ........ 141 Moody’s Investors Service ....... 126 Performance Reporting ......... 46

Morningstar .............. 105 Performance Statistics.......... 69

J

Multi Asset Funds......... 139, 143 Performance fee ............ 128

Jack Milne................ 81 Multi Asset – Flexible funds ...... 144 Performance figures

Multi Asset – High Equity funds .... 144 Costs.................. 71

K

Multi Asset – Income funds ...... 144 Tricks and Tips ............. 71

KYC (Know Your Client) ......... 93 Multi Asset – Low Equity funds..... 144 Performance statistics.......... 71

Key individual .............. 86 Multi-Manager funds .......... 154 Platform ................. 65

Kickbacks ................ 56 Multi-tier funds ............. 60 PlexCrown ............... 105

King code ................ 98 Mutual fund ............... 25 Portfolio ................. 40

Know Your Client (KYC) ......... 95 Charges ................ 59

N Portfolio

L

N-shares ................ 127 Costs.................. 59

Landbank ............... 124 National Qualifications Framework PortfolioMetrix BCI Dynamic

Large Cap Funds ............ 141 (NQF) ................ 18, 20 Income Fund .............. 169

Liberty.................. 24 Nedbank................. 24 Preference shares ........... 127

Linked Investment Service Provider Nedgroup Investments Premium ................ 132

(LISP) .................. 78 Financials Fund ............ 168 Prevention of Organised Crime Act

Liquid asset .............. 106 Negotiable Certificate of Deposit (POCA) ................. 93

Liquidity .............. 48, 106 (NCD) ................. 124 Primary market............. 125

Liquidity Risk.............. 107 Net Asset Value (NAV).......... 43 privacy ................. 96

livestock ................ 133 Notice 141 of 2015 .......... 149 Product Supplier Agent (PSA) .... 79, 91

Lock-up period............. 150 Notice 52 of 2015 ........... 149 Property Funds............. 129

Long position ............. 132 Notice 92 .............. 46, 77 Differences .............. 129

Long the market ............ 131 MDD ................ 46, 77 Property Loan Stock (PLS) ....... 130

Low Equity Funds ........... 145 Protection of Personal Information Act. . 96

O

Prudential funds ....... 28, 139, 143

M OCF (Ongoing Charges Figure) ..... 60 Put option ............... 132

M&G Global Equity Feeder Fund .... 163 Offshore vs Foreign ........... 39

mandate................. 75 Oil & Gas................ 142 Q

MDDs .................. 77 Ombud ................. 92 Qualifications ........ 18, 20, 74, 86

MSCI .................. 70 Definition................ 87 Qualified Investor (QI) ......... 133

Managed................ 135 Ombudsman .............. 87 Qualitative ............... 111

Managed Prudential Funds........ 28 Ongoing Charges Figure (OCF) ..... 60 Quantitative .............. 111

340 Profile’s Unit Trusts & Collective Investments