Page 166 - Profile's Unit Trusts & Collective Investments - March 2025

P. 166

CHAPTER 9

M&G Global Equity Feeder Fund

Sector: Global–Equity–General

Portfolio manager: Michael Cook

Benchmark: MSCI All Country World index

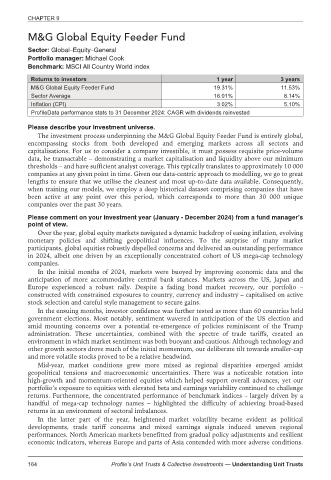

Returns to investors 1 year 3 years

M&G Global Equity Feeder Fund 19.31% 11.53%

Sector Average 16.01% 8.14%

Inflation (CPI) 3.02% 5.10%

ProfileData performance stats to 31 December 2024: CAGR with dividends reinvested

Please describe your investment universe.

The investment process underpinning the M&G Global Equity Feeder Fund is entirely global,

encompassing stocks from both developed and emerging markets across all sectors and

capitalisations. For us to consider a company investible, it must possess requisite price-volume

data, be transactable – demonstrating a market capitalisation and liquidity above our minimum

thresholds – and have sufficient analyst coverage. This typically translates to approximately 10 000

companies at any given point in time. Given our data-centric approach to modelling, we go to great

lengths to ensure that we utilise the cleanest and most up-to-date data available. Consequently,

when training our models, we employ a deep historical dataset comprising companies that have

been active at any point over this period, which corresponds to more than 30 000 unique

companies over the past 30 years.

Please comment on your investment year (January - December 2024) from a fund manager’s

point of view.

Over the year, global equity markets navigated a dynamic backdrop of easing inflation, evolving

monetary policies and shifting geopolitical influences. To the surprise of many market

participants, global equities robustly dispelled concerns and delivered an outstanding performance

in 2024, albeit one driven by an exceptionally concentrated cohort of US mega-cap technology

companies.

In the initial months of 2024, markets were buoyed by improving economic data and the

anticipation of more accommodative central bank stances. Markets across the US, Japan and

Europe experienced a robust rally. Despite a fading bond market recovery, our portfolio –

constructed with constrained exposures to country, currency and industry – capitalised on active

stock selection and careful style management to secure gains.

In the ensuing months, investor confidence was further tested as more than 60 countries held

government elections. Most notably, sentiment wavered in anticipation of the US election and

amid mounting concerns over a potential re-emergence of policies reminiscent of the Trump

administration. These uncertainties, combined with the spectre of trade tariffs, created an

environment in which market sentiment was both buoyant and cautious. Although technology and

other growth sectors drove much of the initial momentum, our deliberate tilt towards smaller-cap

and more volatile stocks proved to be a relative headwind.

Mid-year, market conditions grew more mixed as regional disparities emerged amidst

geopolitical tensions and macroeconomic uncertainties. There was a noticeable rotation into

high-growth and momentum-oriented equities which helped support overall advances, yet our

portfolio’s exposure to equities with elevated beta and earnings variability continued to challenge

returns. Furthermore, the concentrated performance of benchmark indices – largely driven by a

handful of mega-cap technology names – highlighted the difficulty of achieving broad-based

returns in an environment of sectoral imbalances.

In the latter part of the year, heightened market volatility became evident as political

developments, trade tariff concerns and mixed earnings signals induced uneven regional

performances. North American markets benefitted from gradual policy adjustments and resilient

economic indicators, whereas Europe and parts of Asia contended with more adverse conditions.

164 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts