Page 163 - Profile's Unit Trusts & Collective Investments - March 2025

P. 163

Fund Manager Interviews

Which asset classes do you expect will give the best total rates of return over the next few

years?

Fixed income may outperform well on a 12-month timeline, but we think emerging market

equities and in particular Emerging Asia (ex-China) can perform well over the next few years.

Offshore investments are heavily influenced by the rand. Please give your view on the rand

over the next 1, 3 and 5 years.

We have no view over 1 year but in general we expect the rand to depreciate over the longer

term relative to most developed market currencies.

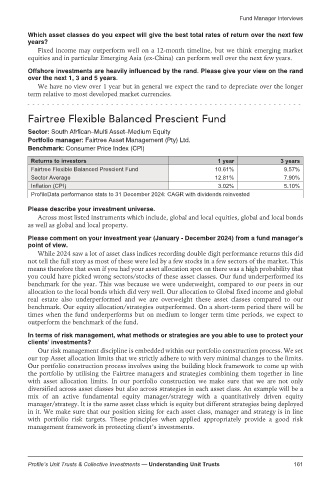

Fairtree Flexible Balanced Prescient Fund

Sector: South Afrfican–Multi Asset–Medium Equity

Portfolio manager: Fairtree Asset Management (Pty) Ltd.

Benchmark: Consumer Price Index (CPI)

Returns to investors 1 year 3 years

Fairtree Flexible Balanced Prescient Fund 10.61% 9.57%

Sector Average 12.81% 7.90%

Inflation (CPI) 3.02% 5.10%

ProfileData performance stats to 31 December 2024: CAGR with dividends reinvested

Please describe your investment universe.

Across most listed instruments which include, global and local equities, global and local bonds

as well as global and local property.

Please comment on your investment year (January - December 2024) from a fund manager’s

point of view.

While 2024 saw a lot of asset class indices recording double digit performance returns this did

not tell the full story as most of these were led by a few stocks in a few sectors of the market. This

means therefore that even if you had your asset allocation spot on there was a high probability that

you could have picked wrong sectors/stocks of these asset classes. Our fund underperformed its

benchmark for the year. This was because we were underweight, compared to our peers in our

allocation to the local bonds which did very well. Our allocation to Global fixed income and global

real estate also underperformed and we are overweight these asset classes compared to our

benchmark. Our equity allocation/strategies outperformed. On a short-term period there will be

times when the fund underperforms but on medium to longer term time periods, we expect to

outperform the benchmark of the fund.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

Our risk management discipline is embedded within our portfolio construction process. We set

our top Asset allocation limits that we strictly adhere to with very minimal changes to the limits.

Our portfolio construction process involves using the building block framework to come up with

the portfolio by utilising the Fairtree managers and strategies combining them together in line

with asset allocation limits. In our portfolio construction we make sure that we are not only

diversified across asset classes but also across strategies in each asset class. An example will be a

mix of an active fundamental equity manager/strategy with a quantitatively driven equity

manager/strategy. It is the same asset class which is equity but different strategies being deployed

in it. We make sure that our position sizing for each asset class, manager and strategy is in line

with portfolio risk targets. These principles when applied appropriately provide a good risk

management framework in protecting client’s investments.

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 161