Page 162 - Profile's Unit Trusts & Collective Investments - March 2025

P. 162

CHAPTER 9

Please give your views regarding interest rate trends and the yield curve over the next 1 to 2

years. What interest rates can investors expect? Do you anticipate further repo rate cuts?

The trajectory of global interest rates through 2025 and potentially into 2026 will largely

depend on inflation trends worldwide and whether central banks can successfully bring inflation

back to their target ranges.

In 2024, several major central banks, including the South African Reserve Bank (SARB), began

reducing interest rates in response to easing inflation. However, by the latter part of 2024, it

became clear that inflation was stickier than initially expected, leading to the prevailing outlook of

“higher rates for longer”.

From a South African perspective, after the 25 basis point rate cut in January 2025, we do not

anticipate further aggressive rate cuts for the remainder of the year, as the MPC seems reluctant to

cut into an increasing inflation backdrop. However, if the Federal Reserve remains in play and

lowers rates further, there may be a possibility of one additional rate cut by the SARB.

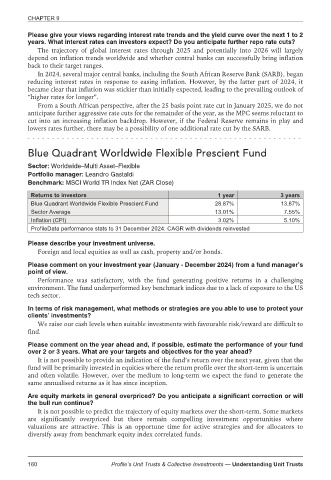

Blue Quadrant Worldwide Flexible Prescient Fund

Sector: Worldwide–Multi Asset–Flexible

Portfolio manager: Leandro Gastaldi

Benchmark: MSCI World TR Index Net (ZAR Close)

Returns to investors 1 year 3 years

Blue Quadrant Worldwide Flexible Prescient Fund 28.87% 13.87%

Sector Average 13.01% 7.55%

Inflation (CPI) 3.02% 5.10%

ProfileData performance stats to 31 December 2024: CAGR with dividends reinvested

Please describe your investment universe.

Foreign and local equities as well as cash, property and/or bonds.

Please comment on your investment year (January - December 2024) from a fund manager’s

point of view.

Performance was satisfactory, with the fund generating positive returns in a challenging

environment. The fund underperformed key benchmark indices due to a lack of exposure to the US

tech sector.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

We raise our cash levels when suitable investments with favourable risk/reward are difficult to

find.

Please comment on the year ahead and, if possible, estimate the performance of your fund

over 2 or 3 years. What are your targets and objectives for the year ahead?

It is not possible to provide an indication of the fund’s return over the next year, given that the

fund will be primarily invested in equities where the return profile over the short-term is uncertain

and often volatile. However, over the medium to long-term we expect the fund to generate the

same annualised returns as it has since inception.

Are equity markets in general overpriced? Do you anticipate a significant correction or will

the bull run continue?

It is not possible to predict the trajectory of equity markets over the short-term. Some markets

are significantly overpriced but there remain compelling investment opportunities where

valuations are attractive. This is an opportune time for active strategies and for allocators to

diversify away from benchmark equity index correlated funds.

160 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts