Page 171 - Profile's Unit Trusts & Collective Investments - March 2025

P. 171

Fund Manager Interviews

service delivery and infrastructure from government. Increased business and consumer confidence

should lead to better economic growth and prosperity. If our newly elected Government of

National Unity (GNU) remains co-operative and works successfully together over the next 5 years,

we could see a period of relative rand strength over this period on the back of improved investor

sentiment.

The rand has strengthened from R19.00/USD at the end of May 2024 to R18.66/USD at the

end of February 2025. Our model of real effective exchange rates has the rand about 10% or so

undervalued against US dollar currently, which itself is largely a function of US dollar strength, but

around fair value on a trade-weighted basis. All things considered, the rand could be anywhere

between 5% and 20% undervalued (depending on the model used). The rand may depreciate in

nominal terms over the medium to long term, it is likely to strengthen in real terms (ie, depreciate

by less than inflation differentials), if not remain stable at least. Potential relative rand strength

over the next few years could provide South African investors the opportunity to increase their

offshore allocations at more favourable exchange rates.

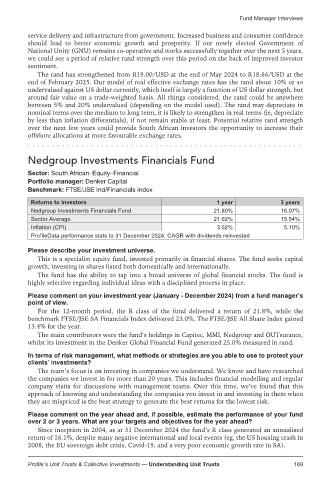

Nedgroup Investments Financials Fund

Sector: South African–Equity–Financial

Portfolio manager: Denker Capital

Benchmark: FTSE/JSE Ind/Financials index

Returns to investors 1 year 3 years

Nedgroup Investments Financials Fund 21.80% 16.07%

Sector Average 21.02% 15.54%

Inflation (CPI) 3.02% 5.10%

ProfileData performance stats to 31 December 2024: CAGR with dividends reinvested

Please describe your investment universe.

This is a specialist equity fund, invested primarily in financial shares. The fund seeks capital

growth, investing in shares listed both domestically and internationally.

The fund has the ability to tap into a broad universe of global financial stocks. The fund is

highly selective regarding individual ideas with a disciplined process in place.

Please comment on your investment year (January - December 2024) from a fund manager’s

point of view.

For the 12-month period, the R class of the fund delivered a return of 21.8%, while the

benchmark FTSE/JSE SA Financials Index delivered 23.0%. The FTSE/JSE All Share Index gained

13.4% for the year.

The main contributors were the fund’s holdings in Capitec, MMI, Nedgroup and OUTsurance,

whilst its investment in the Denker Global Financial Fund generated 25.0% measured in rand.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

The team’s focus is on investing in companies we understand. We know and have researched

the companies we invest in for more than 20 years. This includes financial modelling and regular

company visits for discussions with management teams. Over this time, we’ve found that this

approach of knowing and understanding the companies you invest in and investing in them when

they are mispriced is the best strategy to generate the best returns for the lowest risk.

Please comment on the year ahead and, if possible, estimate the performance of your fund

over 2 or 3 years. What are your targets and objectives for the year ahead?

Since inception in 2004, as at 31 December 2024 the fund’s R class generated an annualised

return of 16.1%, despite many negative international and local events (eg, the US housing crash in

2008, the EU sovereign debt crisis, Covid-19, and a very poor economic growth rate in SA).

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 169