Page 176 - Profile's Unit Trusts & Collective Investments - March 2025

P. 176

CHAPTER 9

Steyn Capital Equity Prescient Fund

Sector: South African–Equity–General

Portfolio manager: Andre Steyn

Benchmark: FTSE/JSE Shareholder Weighted Total Return Index net of fees

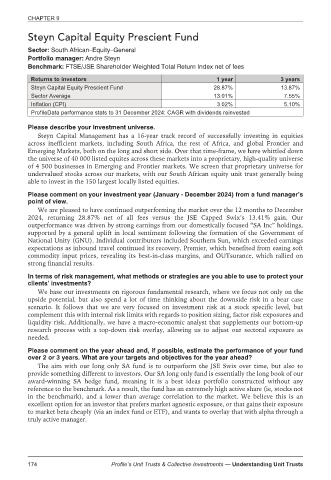

Returns to investors 1 year 3 years

Steyn Capital Equity Prescient Fund 28.87% 13.87%

Sector Average 13.01% 7.55%

Inflation (CPI) 3.02% 5.10%

ProfileData performance stats to 31 December 2024: CAGR with dividends reinvested

Please describe your investment universe.

Steyn Capital Management has a 16-year track record of successfully investing in equities

across inefficient markets, including South Africa, the rest of Africa, and global Frontier and

Emerging Markets, both on the long and short side. Over that time-frame, we have whittled down

the universe of 40 000 listed equites across these markets into a proprietary, high-quality universe

of 4 500 businesses in Emerging and Frontier markets. We screen that proprietary universe for

undervalued stocks across our markets, with our South African equity unit trust generally being

able to invest in the 150 largest locally listed equities.

Please comment on your investment year (January - December 2024) from a fund manager’s

point of view.

We are pleased to have continued outperforming the market over the 12 months to December

2024, returning 28.87% net of all fees versus the JSE Capped Swix’s 13.41% gain. Our

outperformance was driven by strong earnings from our domestically focused “SA Inc” holdings,

supported by a general uplift in local sentiment following the formation of the Government of

National Unity (GNU). Individual contributors included Southern Sun, which exceeded earnings

expectations as inbound travel continued its recovery, Premier, which benefited from easing soft

commodity input prices, revealing its best-in-class margins, and OUTsurance, which rallied on

strong financial results.

In terms of risk management, what methods or strategies are you able to use to protect your

clients’ investments?

We base our investments on rigorous fundamental research, where we focus not only on the

upside potential, but also spend a lot of time thinking about the downside risk in a bear case

scenario. It follows that we are very focused on investment risk at a stock specific level, but

complement this with internal risk limits with regards to position sizing, factor risk exposures and

liquidity risk. Additionally, we have a macro-economic analyst that supplements our bottom-up

research process with a top-down risk overlay, allowing us to adjust our sectoral exposure as

needed.

Please comment on the year ahead and, if possible, estimate the performance of your fund

over 2 or 3 years. What are your targets and objectives for the year ahead?

The aim with our long only SA fund is to outperform the JSE Swix over time, but also to

provide something different to investors. Our SA long only fund is essentially the long book of our

award-winning SA hedge fund, meaning it is a best ideas portfolio constructed without any

reference to the benchmark. As a result, the fund has an extremely high active share (ie, stocks not

in the benchmark), and a lower than average correlation to the market. We believe this is an

excellent option for an investor that prefers market agnostic exposure, or that gains their exposure

to market beta cheaply (via an index fund or ETF), and wants to overlay that with alpha through a

truly active manager.

174 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts