Page 245 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 245

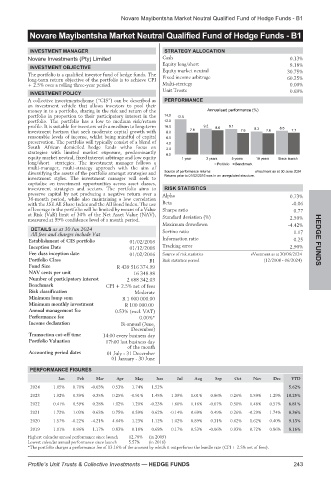

Novare Mayibentsha Market Neutral Qualified Fund of Hedge Funds - B1

Novare Mayibentsha Market Neutral Qualified Fund of Hedge Funds - B1

Novare Mayibentsha Market Neutral Qualified Fund of Hedge Funds - B1

INVESTMENT MANAGER STRATEGY ALLOCATION

Novare Investments (Pty) Limited Cash 0.13%

Equity long/short 8.18%

INVESTMENT OBJECTIVE

Equity market neutral 30.75%

The portfolio is a qualified investor fund of hedge funds. The

long-term return objective of the portfolio is to achieve CPI Fixed income arbitrage 60.25%

+ 2.5% over a rolling three-year period. Multi-strategy 0.00%

Unit Trusts 0.69%

INVESTMENT POLICY

A collective investmentscheme (“CIS”) can be described as PERFORMANCE

an investment vehicle that allows investors to pool their

money in to a portfolio, sharing in the risk and return of the

portfolio in proportion to their participatory interest in the

portfolio. The portfolio has a low to medium risk/return

profile. It is suitable for investors with a medium to long-term

investment horizon that seek moderate capital growth with

reasonable levels of income, whilst being mindful of capital

preservation. The portfolio will typically consist of a blend of

South African domiciled hedge funds witha focus on

strategies with limited market exposure, predominantly

equity market neutral, fixed interest arbitrage and low equity

long/short strategies. The investment manager follows a

multi-manager, multi-strategy approach with the aim of

diversifying the assets of the portfolio amongst strategies and

investment styles. The investment manager will seek to

capitalise on investment opportunities across asset classes,

investment strategies and sectors. The portfolio aims to RISK STATISTICS

preserve capital by not producing a negative return over a Alpha

36-month period, while also maintaining a low correlation 0.73%

with the JSE All Share Index and the All Bond Index. The use Beta -0.06

of leverage in the portfolio will be limited by means of a Value Sharpe ratio 0.77

at Risk (VaR) limit of 30% of the Net Asset Value (NAV), Standard deviation (%)

measured at 99% confidence level of a month period. 2.50%

Maximum drawdown -4.42%

DETAILS as at 30 Jun 2024 Sortino ratio HEDGE

All fees and charges include Vat 1.17

Establishment of CIS portfolio 01/02/2016 Information ratio 0.25

Inception Date 01/12/2008 Tracking error 2.90%

Fee class inception date 01/02/2016 Source of risk statistics eVestment as at 30/06/2024 FUNDS

Portfolio Class B1 Risk statistics period (12/2008 - 06/2024)

Fund Size R 439 516 374.99

NAV cents per unit 16 348.98

Number of participatory interest 2 688 342.03

Benchmark CPI + 2.5% net of fees

Risk classification Moderate

Minimum lump sum R 1 000 000.00

Minimum monthly investment R 100 000.00

Annual management fee 0.53% (excl. VAT)

Performance fee 0.00%*

Income declaration Bi-annual (June,

December)

Transaction cut-off time 14:00 every business day

Portfolio Valuation 17h00 last business day

of the month

Accounting period dates 01 July - 31 December

01 January - 30 June

PERFORMANCE FIGURES

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD

2024 1.05% 0.70% -0.03% 0.53% 1.74% 1.52% 5.62%

2023 1.92% 0.39% 0.35% 0.25% -0.91% 1.45% 1.39% 1.01% 0.86% 0.26% 1.59% 1.29% 10.25%

2022 0.41% 0.59% 0.28% 1.02% 1.20% -0.23% 1.60% 1.16% -0.07% 0.50% 1.48% 0.57% 8.81%

2021 1.72% 1.03% 0.63% 0.75% 0.59% 0.62% -0.14% 0.69% 0.49% 0.26% -0.29% 1.74% 8.36%

2020 1.57% -0.22% -4.21% 4.64% 1.23% 1.12% 1.02% 0.89% 0.31% 0.62% 1.62% 0.40% 9.13%

2019 1.01% 0.86% 1.17% 0.83% 0.18% 0.68% 0.17% 0.53% -0.06% 0.93% 0.72% 0.86% 8.16%

Highest calendar annual performance since launch 12.78% (in 2009)

Lowest calendar annual performance since launch 5.57% (in 2016)

*The portfolio charges a performance fee of 13.16% of the amount by which it outperforms the hurdle rate (CPI + 2.5% net of fees).

Profile’s Unit Trusts & Collective Investments — HEDGE FUNDS 243