Page 241 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 241

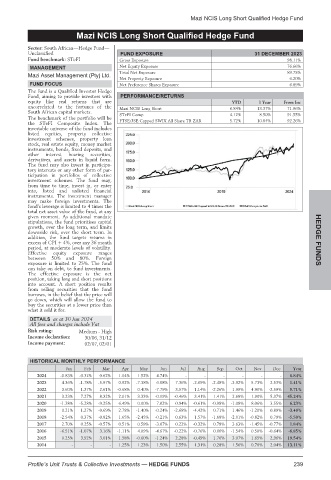

Mazi NCIS Long Short Qualified Hedge Fund

Mazi NCIS Long Short Qualified Hedge Fund

Mazi NCIS Long Short Qualified Hedge Fund

Sector: South African—Hedge Fund—

Unclassified FUND EXPOSURE 31 DECEMBER 2023

Fund benchmark: STeFI Gross Exposure 98.11%

MANAGEMENT Net Equity Exposure 76.66%

Total Net Exposure 89.75%

Mazi Asset Management (Pty) Ltd.

Net Property Exposure 6.20%

FUND FOCUS Net Preference Shares Exposure 6.89%

The fund is a Qualified Investor Hedge

Fund, aiming to provide investors with PERFORMANCE/RETURNS

equity like real returns that are YTD 1 Year From Inc

uncorrelated to the fortunes of the Mazi NCIS Long Short 6.84% 13.37% 71.96%

South African capital markets. STeFI Comp 4.12% 8.50% 91.55%

The benchmark of the portfolio will be

the STeFI Composite Index. The FTSE/JSE Capped SWIX All Share TR ZAR 5.72% 10.04% 92.26%

investable universe of the fund includes

listed equities, property collective

investment schemes, property loan

stock, real estate equity, money market

instruments, bonds, fixed deposits, and

other interest bearing securities,

derivatives, and assets in liquid form.

The fund may also invest in participa-

tory interests or any other form of par-

ticipation in portfolios of collective

investment schemes. The fund may,

from time to time, invest in, or enter

into, listed and unlisted financial

instruments. The investment manager

may make foreign investments. The

fund’s leverage is limited to 4 times the

total net asset value of the fund, at any

given moment. As additional mandate

stipulations, the fund prioritises capital

growth, over the long term, and limits HEDGE

downside risk, over the short term. In

addition, the fund targets returns in

excess of CPI + 4%, over any 36 month

period, at moderate levels of volatility.

Effective equity exposure ranges FUNDS

between 50% and 80%. Foreign

exposure is limited to 25%. The fund

can take on debt, to fund investments.

The effective exposure is the net

position, taking long and short positions

into account. A short position results

from selling securities that the fund

borrows, in the belief that the price will

go down, which will allow the fund to

buy the securities at a lower price than

what it sold it for.

DETAILS as at 30 Jun 2024

All fees and charges include Vat

Risk rating: Medium - High

Income declaration: 30/06, 31/12

Income payment: 02/07, 02/01

HISTORICAL MONTHLY PERFORMANCE

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year

2024 -0.83% -0.32% 0.62% 1.04% 1.52% 4.74% - - - - - - 6.84%

2023 4.36% -1.78% -5.97% 0.92% -7.38% 6.08% 7.36% -2.69% -2.48% -3.92% 5.73% 2.53% 1.41%

2022 3.60% 1.37% 2.61% -0.68% 0.40% -7.79% 3.57% 1.14% -2.26% 1.99% 4.90% -2.59% 5.71%

2021 3.23% 7.27% 8.32% 2.01% 3.33% -0.19% -0.46% 3.41% 1.41% 2.68% 1.90% 5.37% 45.24%

2020 -1.38% -5.28% -9.25% 6.49% 0.00% 7.02% 0.94% -0.61% -0.98% -1.08% 8.06% 3.55% 6.23%

2019 0.21% 1.27% -0.69% 2.78% -1.40% -0.24% -2.68% -4.42% 0.71% 1.46% -1.20% 0.89% -3.48%

2018 -2.54% 0.37% -0.82% 1.65% -2.45% -0.21% 0.63% 1.57% -1.68% -2.01% -0.82% 0.79% -5.50%

2017 2.70% 0.25% -0.57% 0.51% 0.58% -3.07% 0.22% -0.32% 0.78% 3.63% -1.45% -0.77% 1.84%

2016 -6.51% -1.07% 3.16% -1.11% 4.09% -4.67% -0.22% -0.76% 0.00% -1.54% 0.50% -0.64% -8.85%

2015 0.25% 3.92% 3.01% 1.58% -0.60% -1.24% 2.28% -0.49% 1.76% 3.07% 1.65% 2.96% 19.54%

2014 - - - 1.25% 1.23% 1.50% 2.55% 1.31% 0.28% 1.56% 0.70% 2.04% 13.11%

Profile’s Unit Trusts & Collective Investments — HEDGE FUNDS 239