Page 244 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 244

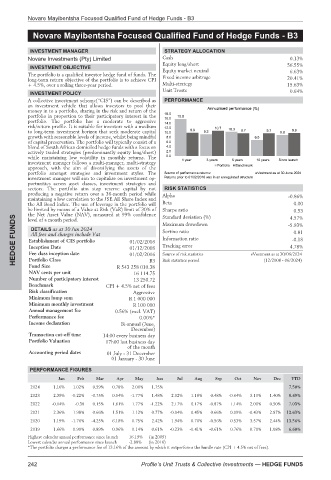

Novare Mayibentsha Focused Qualified Fund of Hedge Funds - B3

Novare Mayibentsha Focused Qualified Fund of Hedge Funds - B3

Novare Mayibentsha Focused Qualified Fund of Hedge Funds - B3

INVESTMENT MANAGER STRATEGY ALLOCATION

Novare Investments (Pty) Limited Cash 0.13%

Equity long/short 56.55%

INVESTMENT OBJECTIVE

Equity market neutral 6.63%

The portfolio is a qualified investor hedge fund of funds. The

long-term return objective of the portfolio is to achieve CPI Fixed income arbitrage 20.41%

+ 4.5%, over a rolling three-year period. Multi-strategy 15.63%

Unit Trusts 0.64%

INVESTMENT POLICY

A collective investment scheme(“CIS”) can be described as PERFORMANCE

an investment vehicle that allows investors to pool their

money in to a portfolio, sharing in the risk and return of the

portfolio in proportion to their participatory interest in the

portfolio. The portfolio has a moderate to aggressive

risk/return profile. It is suitable for investors with a medium

to long-term investment horizon that seek moderate capital

growth with reasonable levels of income, whilst being mindful

of capital preservation. The portfolio will typically consist of a

blend of South African domiciled hedge funds with a focus on

actively traded strategies (predominantly equity long/short)

while maintaining low volatility in monthly returns. The

investment manager follows a multi-manager, multi-strategy

approach, with the aim of diversifying the assets of the

portfolio amongst strategies and investment styles. The

investment manager will aim to capitalise on investment op-

portunities across asset classes, investment strategies and

sectors. The portfolio aim stop reserve capital by not RISK STATISTICS

producing a negative return over a 36-month period while Alpha

maintaining a low correlation to the JSE All Share Index and -0.86%

the All Bond Index. The use of leverage in the portfolio will Beta 0.00

be limited by means of a Value at Risk (VaR) limit of 30% of Sharpe ratio 0.53

the Net Asset Value (NAV), measured at 99% confidence Standard deviation (%) 4.57%

FUNDS DETAILS as at 30 Jun 2024 Maximum drawdown -5.93%

level of a month period.

Sortino ratio

0.81

All fees and charges include Vat

Information ratio

-0.18

HEDGE Establishment of CIS portfolio 01/02/2016 Tracking error eVestment as at 30/06/2024

Inception Date

4.78%

01/12/2008

Fee class inception date

01/02/2016

Source of risk statistics

Portfolio Class

Risk statistics period

(12/2008 - 06/2024)

B3

Fund Size

NAV cents per unit R 543 258 010.38

16 114.75

Number of participatory interest 13 250.72

Benchmark CPI + 4.5% net of fees

Risk classification Aggressive

Minimum lump sum R 1 000 000

Minimum monthly investment R 100 000

Annual management fee 0.56% (excl. VAT)

Performance fee 0.00%*

Income declaration Bi-annual (June,

December)

Transaction cut-off time 14:00 every business day

Portfolio Valuation 17h00 last business day

of the month

Accounting period dates 01 July - 31 December

01 January - 30 June

PERFORMANCE FIGURES

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD

2024 1.16% 1.02% 0.59% 0.78% 2.00% 1.75% 7.50%

2023 2.39% -0.22% -0.75% 0.54% -1.77% 1.48% 2.02% 1.18% 0.48% -0.64% 3.10% 1.40% 9.49%

2022 -0.14% -0.38 0.15% 1.61% 1.77% -1.22% 2.17% 0.17% -0.87% 1.14% 2.00% 0.50% 7.03%

2021 2.36% 1.98% 0.66% 1.51% 1.12% 0.77% -0.04% 0.45% 0.66% 0.09% -0.43% 2.87% 12.63%

2020 1.19% -1.76% -4.25% 6.18% 0.75% 2.42% 1.94% 0.70% -0.56% 0.53% 3.57% 2.44% 13.56%

2019 1.66% 0.90% 0.89% 0.96% 0.14% 0.61% -0.23% -0.41% -0.61% 0.76% 0.70% 1.08% 6.60%

Highest calendar annual performance since launch 16.19% (in 2009)

Lowest calendar annual performance since launch -2.88% (in 2016)

*The portfolio charges a performance fee of 13.16% of the amount by which it outperforms the hurdle rate (CPI + 4.5% net of fees).

242 Profile’s Unit Trusts & Collective Investments — HEDGE FUNDS