Page 64 - Profile's Unit Trusts & Collective Investments - September 2025

P. 64

Chapter 3 Costs and pricing

Effective annual cost measure

ASISA announced in 2016 the introduction of a new method of disclosing the costs of financial

products, the EAC. Since June 2017 EAC has been in force for all products launched after

1 April 2010, and it now applies (since June 2018) to all products launched after 1 April 2000.

Older products had to be EAC compliant by 1 June 2019. Note that at this stage the EAC is not an

MDD requirement.

The EAC, which does not replace any existing standards, applies to all financial products with

an investment component offered by ASISA members, not just collective investment schemes.

EACs allow investors to compare different types of products and different channels, including unit

trusts, endowment policies, wrapper funds, retirement annuities (RAs), preservation funds and

living annuities (LAs).

The reason for another cost measure is that the TER does not allow for all the expenses associated

with fixed term products. Unlike the TER, the EAC makes it possible to compare costs over defined

periods, which is important for charges like initial fees which need to be amortised over the life spans

of product options to achieve fairly comparable results.

The EAC comprises four components which are calculated separately and then combined to

reflect the total EAC:

R Investment management charges (IMC): costs and charges associated with management of

all underlying investment portfolios

R Advice charges: initial and annual fees, both lump sum and recurring

R Administration charges: all costs of administration

R Other charges: a category for all remaining costs, including exit charges, penalties, loyalty

bonuses, guarantees, smoothing or risk benefits, wrap fund charges and risk benefits (such

as waiver of premium)

Four mandatory disclosure periods are required, as illustrated in Table 3.3. For open-ended

products this is one, three, five and 10 years. For “term” products the 10-year column must reflect

the “end of term” period, as defined, or age 55 term in the case of an RA or other retirement product.

The need for disclosure periods arises because of once-off costs. In the case of unit trusts, for

example, a compulsory initial charge that is expressed as a percentage of a lump sum investment

must be amortised on a straight line basis over the relevant disclosure period (ie, the initial charge is

divided by the number of years).

The EAC must be calculated once a year by end March (using data up to 31 December).

Technically, the EAC standard provides for a combination of calculation methodologies in order

to cope with the wide range of products to which it applies. Like reduction in yield (RiY), EAC is

a forward projection, but certain costs must be based on historical data (eg, for IMC, the TER

principles are specified). Where an RiY methodology has to be used (for example, where a payout

depends on the term and the capital value on termination), the EAC standard specifies a growth rate

of 6% per annum (gross).

Table 3.3 illustrates EAC disclosure for a financial product that includes a compulsory initial

charge, a compulsory advice fee, and an exit charge if held for less than 10 years. The latter is

reflected in ‘Other’. Note that the ‘Other’ row may be omitted from the table if all values are zero.

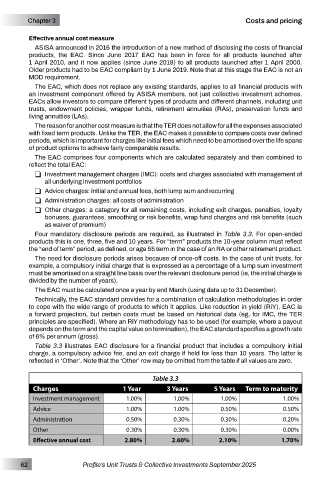

Table 3.3

Charges 1 Year 3 Years 5 Years Term to maturity

Investment management 1.00% 1.00% 1.00% 1.00%

Advice 1.00% 1.00% 0.50% 0.50%

Administration 0.50% 0.30% 0.30% 0.20%

Other 0.30% 0.30% 0.30% 0.00%

Effective annual cost 2.80% 2.60% 2.10% 1.70%

62 Profile’s Unit Trusts & Collective Investments September 2025