Page 66 - Profile's Unit Trusts & Collective Investments - September 2025

P. 66

Chapter 3 Costs and pricing

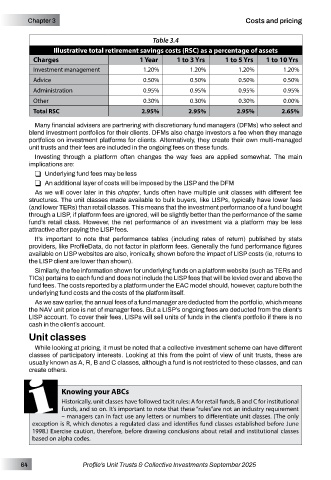

Table 3.4

Illustrative total retirement savings costs (RSC) as a percentage of assets

Charges 1 Year 1 to 3 Yrs 1 to 5 Yrs 1 to 10 Yrs

Investment management 1.20% 1.20% 1.20% 1.20%

Advice 0.50% 0.50% 0.50% 0.50%

Administration 0.95% 0.95% 0.95% 0.95%

Other 0.30% 0.30% 0.30% 0.00%

Total RSC 2.95% 2.95% 2.95% 2.65%

Many financial advisers are partnering with discretionary fund managers (DFMs) who select and

blend investment portfolios for their clients. DFMs also charge investors a fee when they manage

portfolios on investment platforms for clients. Alternatively, they create their own multi-managed

unit trusts and their fees are included in the ongoing fees on these funds.

Investing through a platform often changes the way fees are applied somewhat. The main

implications are:

R Underlying fund fees may be less

R An additional layer of costs will be imposed by the LISP and the DFM

As we will cover later in this chapter, funds often have multiple unit classes with different fee

structures. The unit classes made available to bulk buyers, like LISPs, typically have lower fees

(and lower TERs) than retail classes. This means that the investment performance of a fund bought

through a LISP, if platform fees are ignored, will be slightly better than the performance of the same

fund’s retail class. However, the net performance of an investment via a platform may be less

attractive after paying the LISP fees.

It’s important to note that performance tables (including rates of return) published by stats

providers, like ProfileData, do not factor in platform fees. Generally the fund performance figures

available on LISP websites are also, ironically, shown before the impact of LISP costs (ie, returns to

the LISP client are lower than shown).

Similarly, the fee information shown for underlying funds on a platform website (such as TERs and

TICs) pertains to each fund and does not include the LISP fees that will be levied over and above the

fund fees. The costs reported by a platform under the EAC model should, however, capture both the

underlying fund costs and the costs of the platform itself.

As we saw earlier, the annual fees of a fund manager are deducted from the portfolio, which means

the NAV unit price is net of manager fees. But a LISP’s ongoing fees are deducted from the client’s

LISP account. To cover their fees, LISPs will sell units of funds in the client’s portfolio if there is no

cash in the client’s account.

Unit classes

While looking at pricing, it must be noted that a collective investment scheme can have different

classes of participatory interests. Looking at this from the point of view of unit trusts, these are

usually known as A, R, B and C classes, although a fund is not restricted to these classes, and can

create others.

Knowing your ABCs

Historically, unit classes have followed tacit rules: A for retail funds, B and C for institutional

funds, and so on. It’s important to note that these “rules”are not an industry requirement

– managers can in fact use any letters or numbers to differentiate unit classes. (The only

exception is R, which denotes a regulated class and identifies fund classes established before June

1998.) Exercise caution, therefore, before drawing conclusions about retail and institutional classes

based on alpha codes.

64 Profile’s Unit Trusts & Collective Investments September 2025