Page 58 - Profile's Unit Trusts & Collective Investments - September 2025

P. 58

Chapter 3 Costs and pricing

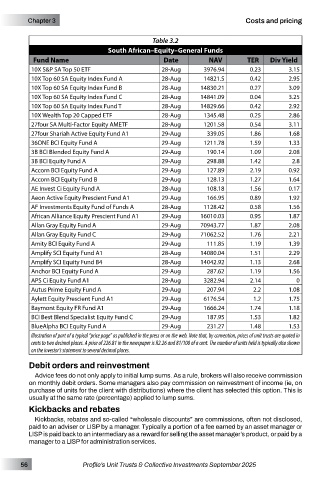

Table 3.2

South African–Equity–General Funds

Fund Name Date NAV TER Div Yield

10X S&P SA Top 50 ETF 28-Aug 3976.94 0.23 3.15

10X Top 60 SA Equity Index Fund A 28-Aug 14821.5 0.42 2.95

10X Top 60 SA Equity Index Fund B 28-Aug 14830.21 0.27 3.09

10X Top 60 SA Equity Index Fund C 28-Aug 14841.09 0.04 3.25

10X Top 60 SA Equity Index Fund T 28-Aug 14829.66 0.42 2.92

10X Wealth Top 20 Capped ETF 28-Aug 1345.48 0.25 2.86

27four SA Multi-Factor Equity AMETF 28-Aug 1201.58 0.54 3.11

27four Shariah Active Equity Fund A1 29-Aug 339.05 1.86 1.68

36ONE BCI Equity Fund A 29-Aug 1211.78 1.59 1.33

3B BCI Blended Equity Fund A 29-Aug 190.14 1.09 2.08

3B BCI Equity Fund A 29-Aug 298.88 1.42 2.8

Accorn BCI Equity Fund A 29-Aug 127.89 2.19 0.92

Accorn BCI Equity Fund B 29-Aug 128.13 1.27 1.64

AE Invest Ci Equity Fund A 28-Aug 108.18 1.56 0.17

Aeon Active Equity Prescient Fund A1 29-Aug 166.95 0.89 1.92

AF Investments Equity Fund of Funds A 28-Aug 1128.42 0.58 1.56

African Alliance Equity Prescient Fund A1 29-Aug 16010.03 0.95 1.87

Allan Gray Equity Fund A 29-Aug 70943.77 1.87 2.08

Allan Gray Equity Fund C 29-Aug 71062.52 1.76 2.21

Amity BCI Equity Fund A 29-Aug 111.85 1.19 1.39

Amplify SCI Equity Fund A1 28-Aug 14080.04 1.51 2.29

Amplify SCI Equity Fund B4 28-Aug 14042.92 1.13 2.68

Anchor BCI Equity Fund A 29-Aug 287.62 1.19 1.56

APS Ci Equity Fund A1 28-Aug 3282.94 2.14 0

Autus Prime Equity Fund A 29-Aug 207.94 2.2 1.08

Aylett Equity Prescient Fund A1 29-Aug 6176.54 1.2 1.75

Baymont Equity FR Fund A1 29-Aug 1666.24 1.74 1.18

BCI Best Blend Specialist Equity Fund C 29-Aug 187.95 1.53 1.82

BlueAlpha BCI Equity Fund A 29-Aug 231.27 1.48 1.53

Illustration of part of a typical “price page” as published in the press or on the web. Note that, by convention, prices of unit trusts are quoted in

cents to two decimal places. A price of 226.81 in the newspaper is R2.26 and 81/100 of a cent. The number of units held is typically also shown

on the investor’s statement to several decimal places.

Debit orders and reinvestment

Advice fees do not only apply to initial lump sums. As a rule, brokers will also receive commission

on monthly debit orders. Some managers also pay commission on reinvestment of income (ie, on

purchase of units for the client with distributions) where the client has selected this option. This is

usually at the same rate (percentage) applied to lump sums.

Kickbacks and rebates

Kickbacks, rebates and so-called “wholesale discounts” are commissions, often not disclosed,

paid to an adviser or LISP by a manager. Typically a portion of a fee earned by an asset manager or

LISP is paid back to an intermediary as a reward for selling the asset manager’s product, or paid by a

manager to a LISP for administration services.

56 Profile’s Unit Trusts & Collective Investments September 2025