Page 37 - Profile's Unit Trusts & Collective Investments - September 2025

P. 37

Basic concepts Chapter 2

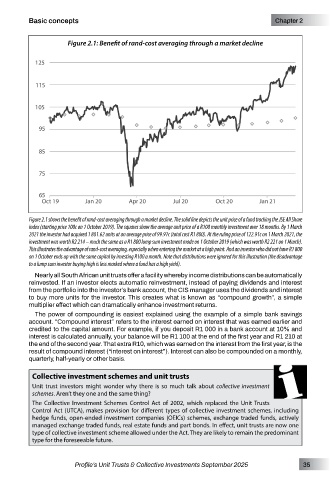

Figure 2.1: Benefit of rand-cost averaging through a market decline

Figure 2.1 shows the benefit of rand-cost averaging through a market decline. The solid line depicts the unit price of a fund tracking the JSE All Share

index (starting price 100c on 1 October 2019). The squares show the average unit price of a R100 monthly investment over 18 months. By 1 March

2021 the investor had acquired 1 801.62 units at an average price of 99.91c (total cost R1 800). At the ruling price of 122.91c on 1 March 2021, the

investment was worth R2 214 – much the same as a R1 800 lump sum investment made on 1 October 2019 (which was worth R2 221 on 1 March).

This illustrates the advantage of rand-cost averaging, especially when entering the market at a high point. And an investor who did not have R1 800

on 1 October ends up with the same capital by investing R100 a month. Note that distributions were ignored for this illustration (the disadvantage

to a lump sum investor buying high is less marked where a fund has a high yield).

Nearly all South African unit trusts offer a facility whereby income distributions can be automatically

reinvested. If an investor elects automatic reinvestment, instead of paying dividends and interest

from the portfolio into the investor’s bank account, the CIS manager uses the dividends and interest

to buy more units for the investor. This creates what is known as “compound growth”, a simple

multiplier effect which can dramatically enhance investment returns.

The power of compounding is easiest explained using the example of a simple bank savings

account. “Compound interest” refers to the interest earned on interest that was earned earlier and

credited to the capital amount. For example, if you deposit R1 000 in a bank account at 10% and

interest is calculated annually, your balance will be R1 100 at the end of the first year and R1 210 at

the end of the second year. That extra R10, which was earned on the interest from the first year, is the

result of compound interest (“interest on interest”). Interest can also be compounded on a monthly,

quarterly, half-yearly or other basis.

Collective investment schemes and unit trusts

Unit trust investors might wonder why there is so much talk about collective investment

schemes. Aren’t they one and the same thing?

The Collective Investment Schemes Control Act of 2002, which replaced the Unit Trusts

Control Act (UTCA), makes provision for different types of collective investment schemes, including

hedge funds, open-ended investment companies (OEICs) schemes, exchange traded funds, actively

managed exchange traded funds, real estate funds and part bonds. In effect, unit trusts are now one

type of collective investment scheme allowed under the Act. They are likely to remain the predominant

type for the foreseeable future.

Profile’s Unit Trusts & Collective Investments September 2025 35