Page 338 - Profile's Unit Trusts & Collective Investments - September 2025

P. 338

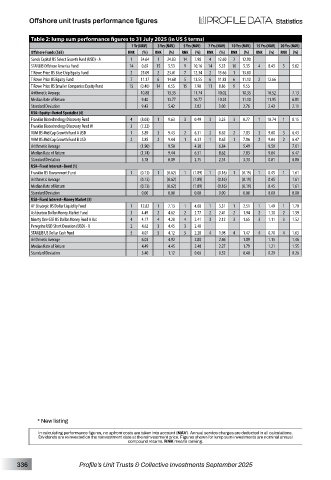

Offshore unit trusts performance figures

Table 2: lump sum performance figures to 31 July 2025 (in US $ terms)

1 Yr (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 15 Yrs (NAV) 20 Yrs (NAV)

Offshore Funds (563) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Sands Capital US Select Growth Fund (USD) - A 1 34.64 1 24.83 14 7.98 4 12.60 2 12.90

STANLIB Offshore America Fund 14 0.65 15 5.53 9 10.16 14 5.33 10 5.35 4 8.43 3 5.62

T Rowe Price US Blue Chip Equity Fund 2 25.09 2 23.01 7 12.34 2 13.66 1 13.80

T Rowe Price US Equity Fund 7 11.17 6 14.68 5 13.55 6 11.83 6 11.10 2 12.66

T Rowe Price US Smaller Companies Equity Fund 15 (0.40) 14 6.55 15 7.90 11 8.86 9 9.55

Arithmetic Average 10.88 13.35 11.74 10.02 10.35 10.52 7.13

Median Rate of Return 9.40 13.77 10.77 10.24 11.10 11.95 6.81

Standard Deviation 9.43 5.42 2.82 3.00 2.76 2.43 2.11

USA–Equity–Varied Specialist (4)

Franklin Biotechnology Discovery Fund 4 (8.03) 1 9.63 3 0.49 3 3.25 3 0.77 1 10.74 1 8.15

Franklin Biotechnology Discovery Fund W 3 (7.32)

VAM US Mid Cap Growth Fund A USD 1 3.89 3 9.43 2 6.31 2 8.62 2 7.83 3 9.00 3 6.43

VAM US Mid Cap Growth Fund B USD 2 3.85 2 9.44 1 6.33 1 8.65 1 7.86 2 9.04 2 6.47

Arithmetic Average (1.90) 9.50 4.38 6.84 5.49 9.59 7.01

Median Rate of Return (1.74) 9.44 6.31 8.62 7.83 9.04 6.47

Standard Deviation 5.78 0.09 2.75 2.54 3.33 0.81 0.80

USA–Fixed Interest–Bond (1)

Franklin US Government Fund 1 (0.13) 1 (0.62) 1 (1.89) 1 (0.16) 1 (0.19) 1 0.45 1 1.61

Arithmetic Average (0.13) (0.62) (1.89) (0.16) (0.19) 0.45 1.61

Median Rate of Return (0.13) (0.62) (1.89) (0.16) (0.19) 0.45 1.61

Standard Deviation 0.00 0.00 0.00 0.00 0.00 0.00 0.00

USA–Fixed Interest–Money Market (5)

AF Strategic US Dollar Liquidity Fund 1 12.82 1 7.13 1 4.08 1 3.31 1 2.51 1 1.49 1 1.70

Ashburton Dollar Money Market Fund 3 4.49 2 4.62 2 2.77 2 2.41 2 1.94 2 1.30 2 1.59

Ninety One GSF US Dollar Money Fund A Acc 4 4.17 4 4.28 4 2.41 3 2.12 3 1.65 3 1.11 3 1.52

Peregrine USD Short Duration (USD) - R 2 4.62 3 4.45 3 2.48

STANLIB US Dollar Cash Fund 5 4.07 5 4.12 5 2.28 4 1.98 4 1.47 4 0.70 4 1.03

Arithmetic Average 6.03 4.92 2.80 2.46 1.89 1.15 1.46

Median Rate of Return 4.49 4.45 2.48 2.27 1.79 1.21 1.55

Standard Deviation 3.40 1.12 0.66 0.52 0.40 0.29 0.26

* New listing

In calculating performance figures, no upfront costs are taken into account (NAV). Annual service charges are deducted in all calculations.

Dividends are reinvested on the reinvestment date at the reinvestment price. Figures shown for lump sum investments are nominal annual

compound returns. RNK means ranking.

336 Profile’s Unit Trusts & Collective Investments September 2025