Page 342 - Profile's Unit Trusts & Collective Investments - September 2025

P. 342

Remo Thematic Growth Fund Offshore funds

Remo Thematic Growth Fund

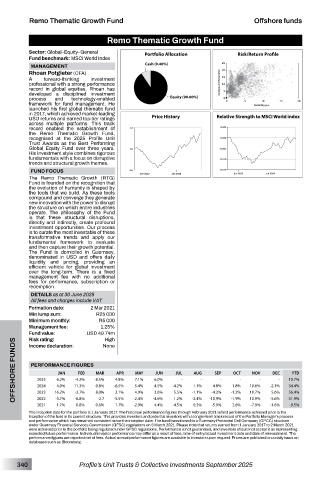

Sector: Global–Equity–General Portfolio Allocation Risk/Return Profile

Fund benchmark: MSCI World Index

MANAGEMENT

Rhoan Potgieter (CFA)

A forward-thinking investment

professional with a strong performance

record in global equities, Rhoan has

developed a disciplined investment

process and technology-enabled

framework for fund management. He

launched his first global thematic fund

in 2017, which achieved market-leading

USD returns and earned top-tier ratings Price History Relative Strength to MSCI World index

across multiple platforms. This track

record enabled the establishment of

the Remo Thematic Growth Fund,

recognised at the 2025 Profile Unit

Trust Awards as the Best Performing

Global Equity Fund over three years.

His investment style combines rigorous

fundamentals with a focus on disruptive

trends and structural growth themes.

FUND FOCUS

The Remo Thematic Growth (RTG)

Fund is founded on the recognition that

the evolution of humanity is shaped by

the tools that we build. As these tools

compound and converge they generate

new innovation with the power to disrupt

the structure on which entire industries

operate. The philosophy of the Fund

is that these structural disruptions,

directly and indirectly, create profound

investment opportunities. Our process

is to curate the most investable of these

transformative trends and apply our

fundamental framework to evaluate

and then capture their growth potential.

The Fund is domiciled in Guernsey,

denominated in USD and offers daily

liquidity and pricing, providing an

efficient vehicle for global investment

over the long-term. There is a fixed

management fee with no additional

fees for performance, subscription or

redemption.

DETAILS as at 30 June 2025

All fees and charges include VAT

Formation date: 2 Mar 2021

Min lump sum: R25 000

Minimum monthly: R5 000

Management fee: 1.25%

Fund value: USD 49.74m

High

Risk rating:

OFFSHORE FUNDS PERFORMANCE FIGURES -8.5% -6.5% MAY 6.0% -4.2% - AUG - 4.8% - 1.8% - 10.6% - -2.1% - 10.7%

Income declaration:

None

APR

JAN

FEB

MAR

OCT

SEP

DEC

NOV

JUL

JUN

YTD

7.1%

-4.2%

4.8%

2025

6.2%

1.1%

34.4%

2024

5.4%

4.5%

11.3%

4.0%

0.8%

5.5%

56.4%

3.6%

4.9%

2023

5.6%

-4.2%

2.1%

-1.9%

1.2%

-2.4%

-6.8%

2022

-5.7%

-2.7

10.9%

-5.9%

2.6%

-9.5%

-1.6%

-7.9%

0.6%

0.8%

-2.9%

2021 16.2% -2.7% 8.0% -5.5% -2.4% -4.6% -4.5% -1.1% -10.9% -1.2% 10.7% -5.6% -31.9%

1.7%

1.7%

0.3%

4.4%

The inception date for the portfolio is 1 January 2017. The historical performance figures through February 2021 reflect performance achieved prior to the

inception of the fund in its current structure. This provides investors and potential investors with a longer-term track record of the Portfolio Manager’s process

and performance which has remained consistent since the inception date. The fund transitioned to a Guernsey Protected Cell Company (GPCC) structure

under Guernsey Financial Services Commission (GFSC) regulations on 3 March 2021. Please note that returns earned from 1 January 2017 to 2 March 2021

were achieved prior to the portfolio being regulated under GFSC regulations. Performance is not guaranteed, and investors should not accept it as representing

expected future performance. Individual investor performance may differ as a result of fees, time of entry/actual investment date and date of reinvestment. The

performance figures are reported net of fees. Actual annual performance figures are available to investors upon request. Prices are published on a daily basis on

databases such as Bloomberg.

340 Profile’s Unit Trusts & Collective Investments September 2025