Page 334 - Profile's Unit Trusts & Collective Investments - September 2025

P. 334

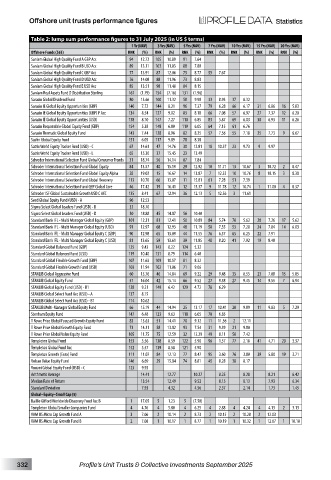

Offshore unit trusts performance figures

Table 2: lump sum performance figures to 31 July 2025 (in US $ terms)

1 Yr (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 15 Yrs (NAV) 20 Yrs (NAV)

Offshore Funds (563) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Sanlam Global High Quality Fund A GBP Acc 94 12.72 105 10.89 91 7.64

Sanlam Global High Quality Fund B USD Acc 89 13.11 103 11.03 88 7.80

Sanlam Global High Quality Fund C GBP Acc 77 13.91 87 12.06 75 8.77 55 7.67

Sanlam Global High Quality Fund D USD Acc 76 14.08 88 11.96 73 8.83

Sanlam Global High Quality Fund E USD Acc 85 13.51 98 11.40 84 8.15

Sanlam Real Assets Fund D Distribution Sterling 167 (1.79) 154 (7.16) 131 (1.96)

Sarasin Global Dividend Fund 80 13.66 100 11.32 58 9.98 33 8.93 37 8.32

Sarasin IE Global Equity Opportunities (GBP) 140 7.72 144 8.21 96 7.37 79 6.28 66 6.17 31 6.86 16 5.83

Sarasin IE Global Equity Opportunities (GBP) P Acc 134 8.54 127 9.02 83 8.18 66 7.08 57 6.97 27 7.37 12 6.20

Sarasin IE Global Equity Opportunities (USD) 138 8.10 147 7.27 110 6.85 83 5.87 69 6.03 30 6.93 11 6.26

Sarasin Responsible Global Equity Fund (GBP) 154 5.38 148 6.80 119 6.05 64 7.15 61 6.76

Sarasin Thematic Global Equity Fund 143 7.44 128 8.96 82 8.25 57 7.56 55 7.18 25 7.73 9 6.67

Sasfin Global Equity Fund 151 6.05 117 9.89 78 8.38

Satrix World Equity Tracker Fund (USD) - C 67 14.61 47 14.76 30 12.81 18 10.37 23 9.73 9 9.97

Satrix World Equity Tracker Fund (USD) - L 65 15.30 37 15.45 23 13.49

Schroder International Selection Fund Global Consumer Trends 31 18.74 56 14.14 87 7.84

Schroder International Selection Fund Global Equity 84 13.57 40 15.19 29 12.92 10 11.71 13 10.67 3 10.72 2 8.47

Schroder International Selection Fund Global Equity Alpha 28 19.02 15 16.67 14 13.87 7 12.33 10 10.76 8 10.15 3 8.38

Schroder International Selection Fund Global Recovery 113 10.70 66 13.07 11 15.81 61 7.28 51 7.39

Schroder International Selection Fund QEP Global Core 46 17.42 19 16.41 12 15.37 9 11.78 12 10.74 1 11.00 4 8.37

Schroder ISF Global Sustainable Growth USD C ACC 135 8.41 67 12.94 36 12.13 5 12.56 3 11.61

Seed Global Equity Fund (USD) - A 96 12.53

Sigma Select Global Leaders Fund (USD) - B 32 18.70

Sigma Select Global Leaders Fund (USD) - D 30 18.88 45 14.87 56 10.40

Standard Bank IFL - Multi Manager Global Equity (GBP) 101 12.31 81 12.41 50 10.89 84 5.74 70 5.62 28 7.26 17 5.62

Standard Bank IFL - Multi Manager Global Equity (USD) 91 12.97 68 12.93 48 11.19 58 7.55 53 7.28 24 7.84 14 6.03

Standard Bank IFL - Multi Manager Global Equity C (GBP) 90 12.98 65 13.09 44 11.55 76 6.37 65 6.25 22 7.91

Standard Bank IFL - Multi Manager Global Equity C (USD) 81 13.65 59 13.61 39 11.85 48 8.20 41 7.92 19 8.48

Standard Global Balanced Fund (GBP) 125 9.43 143 8.22 124 5.32

Standard Global Balanced Fund (USD) 119 10.40 131 8.79 114 6.40

Standard Global Flexible Growth Fund (GBP) 107 11.63 109 10.57 81 8.32

Standard Global Flexible Growth Fund (USD) 103 11.94 102 11.06 71 9.06

STANLIB Global Aggressive Fund 60 15.76 46 14.84 69 9.22 29 9.48 35 8.55 23 7.88 15 5.85

STANLIB Global Equity Fund 57 16.04 42 15.14 66 9.52 27 9.58 27 9.45 14 9.55 7 6.94

STANLIB Global Equity Fund (USD) - B1 128 9.21 149 6.42 129 4.72 78 6.29

STANLIB Global Select Fund Acc (USD) - A 137 8.15

STANLIB Global Select Fund Acc (USD) - B1 114 10.62

STANLIB Multi-Manager Global Equity Fund 66 15.19 44 14.94 25 13.17 17 10.41 20 9.89 11 9.83 5 7.29

Stenham Equity Fund 147 6.48 123 9.63 118 6.05 70 6.85

T Rowe Price Global Focused Growth Equity Fund 83 13.63 51 14.41 70 9.12 11 11.56 2 12.11

T Rowe Price Global Growth Equity Fund 73 14.31 58 13.82 93 7.54 31 9.39 21 9.80

T Rowe Price Global Value Equity Fund 105 11.75 75 12.59 32 12.29 49 8.11 50 7.42

Templeton Global Fund 153 5.56 138 8.59 122 5.90 96 1.57 77 2.18 41 4.71 20 3.37

Templeton Global Fund Acc 152 5.57 139 8.58 121 5.90

Templeton Growth (Euro) Fund 111 11.07 84 12.13 77 8.47 95 3.60 76 3.80 39 5.80 19 3.71

Vulcan Value Equity Fund 146 6.69 29 15.84 74 8.81 45 8.28 38 8.17

Vunani Global Equity Fund (USD) - C 123 9.93

Arithmetic Average 14.41 12.77 10.27 8.25 8.28 8.21 6.42

Median Rate of Return 13.54 12.49 9.52 8.15 8.13 7.93 6.34

Standard Deviation 7.93 4.32 4.56 2.37 2.14 1.73 1.45

Global–Equity–Small Cap (5)

Baillie Gifford Worldwide Discovery Fund Acc B 1 17.05 5 1.23 5 (7.50)

Templeton Global Smaller Companies Fund 4 4.76 4 5.80 4 6.25 4 2.88 4 4.24 4 4.13 2 3.13

VAM US Micro Cap Growth Fund A 3 7.06 2 10.14 2 8.73 2 10.15 2 10.28 2 12.03

VAM US Micro Cap Growth Fund B 2 7.08 1 10.17 1 8.77 1 10.19 1 10.32 1 12.07 1 10.10

332 Profile’s Unit Trusts & Collective Investments September 2025