Page 212 - Profile's Unit Trusts & Collective Investments - March 2025

P. 212

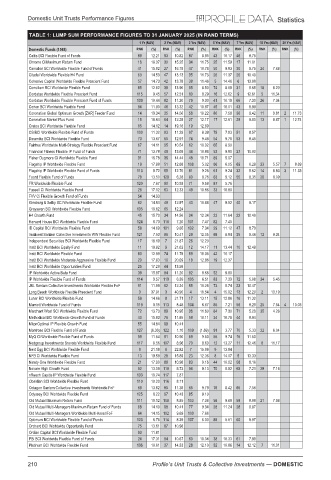

Domestic Unit Trusts Performance Figures Statistics

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JANUARY 2025 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1568) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Celtis BCI Flexible Fund of Funds 89 12.21 93 10.82 87 8.95 43 10.17 46 8.75

Chrome Ci Maximum Return Fund 16 18.37 30 15.25 34 11.75 25 11.59 17 11.01

Cinnabar SCI Worldwide Flexible Fund of Funds 41 15.92 27 16.18 47 10.74 50 9.83 30 9.75 24 7.68

Citadel Worldwide Flexible H4 Fund 63 14.53 47 13.13 35 11.73 26 11.37 26 10.40

Cohesive Capital Worldwide Flexible Prescient Fund 57 14.73 42 13.78 38 11.46 5 14.46 6 13.08

Consilium BCI Worldwide Flexible Fund 85 12.62 39 13.96 95 8.50 74 8.69 31 9.65 18 8.20

Cordatus Worldwide Flexible Prescient Fund 115 9.45 57 12.51 80 9.29 16 12.62 9 12.61 5 11.34

Cordatus Worldwide Flexible Prescient Fund of Funds 109 10.44 82 11.30 79 9.30 41 10.19 66 7.30 26 7.34

Corion BCI Worldwide Flexible Fund 94 11.80 46 13.32 42 10.87 45 10.01 43 8.98

Coronation Global Optimum Growth [ZAR] Feeder Fund 14 19.34 35 14.56 56 10.22 80 7.58 36 9.42 11 9.81 2 11.73

Coronation Market Plus Fund 15 18.64 64 12.25 27 12.17 17 12.61 29 9.80 13 8.87 1 12.74

Cratos BCI Worldwide Flexible Fund 65 14.12 14 19.16 19 12.69

CS BCI Worldwide Flexible Fund of Funds 100 11.32 83 11.29 97 8.39 79 7.83 51 8.57

Dinamika BCI Worldwide Flexible Fund 73 13.67 50 12.97 74 9.48 54 9.76 53 8.45

Fairtree Worldwide Multi-Strategy Flexible Prescient Fund 67 14.11 95 10.54 62 10.02 65 8.90

Financial Fitness Flexible IP Fund of Funds 71 13.78 48 13.08 44 10.84 53 9.80 27 10.00

Fisher Dugmore Ci Worldwide Flexible Fund 31 16.78 36 14.44 48 10.71 89 5.07

Flagship IP Worldwide Flexible Fund 19 17.98 51 12.88 108 5.02 86 6.05 69 6.29 33 5.57 7 8.89

Flagship IP Worldwide Flexible Fund of Funds 113 9.72 55 12.76 81 9.26 61 9.24 32 9.62 14 8.83 3 11.33

Foord Flexible Fund of Funds 78 13.50 120 6.28 90 8.76 63 9.12 55 8.35 20 8.09

FR Worldwide Flexible Fund 120 7.67 90 10.93 71 9.58 87 5.76

Fussell Ci Worldwide Flexible Fund 28 17.12 63 12.33 49 10.66 33 10.80

FVV Ci Flexible Growth Fund of Funds 54 14.93

Ginsburg & Selby SCI Worldwide Flexible Fund 62 14.54 49 12.97 43 10.84 47 9.92 40 9.17

Grayswan SCI Worldwide Flexible Fund 105 10.62 65 12.24

H4 Growth Fund 45 15.70 34 14.56 24 12.34 23 11.64 22 10.49

Harvard House BCI Worldwide Flexible Fund 124 6.73 118 7.20 101 7.47 82 7.40

ID Capital BCI Worldwide Flexible Fund 58 14.69 101 9.85 102 7.34 29 11.12 47 8.73

Imalivest Sanlam Collective Investments WW Flexible Fund 121 7.53 96 10.47 29 12.05 68 8.84 35 9.46 12 9.34

Independent Securities BCI Worldwide Flexible Fund 17 18.19 7 21.87 26 12.20

Instit BCI Worldwide Equity Fund 11 19.92 9 21.02 12 14.17 11 13.44 10 12.49

Instit BCI Worldwide Flexible Fund 83 12.99 74 11.78 59 10.06 42 10.17

Instit BCI Worldwide Moderate Aggressive Flexible Fund 20 17.93 10 20.09 18 12.86 19 12.37

Instit BCI Worldwide Opportunities Fund 25 17.29 44 13.58

IP Worldwide Active Beta Fund 39 15.97 84 11.20 92 8.68 52 9.80

IP Worldwide Flexible Fund of Funds 114 9.57 119 6.39 105 6.51 83 7.39 72 5.08 34 5.45

JBL Sanlam Collective Investments Worldwide Flexible FoF 91 11.89 62 12.34 55 10.26 73 8.74 23 10.47

Long Beach Worldwide Flexible Prescient Fund 3 37.91 3 40.90 4 18.54 4 15.02 13 12.20 2 13.19

Lunar BCI Worldwide Flexible Fund 59 14.66 8 21.71 17 13.11 15 12.88 16 11.32

Marriott Worldwide Fund of Funds 119 8.15 113 8.48 104 6.67 85 7.21 56 8.29 25 7.54 4 10.03

Merchant West SCI Worldwide Flexible Fund 72 13.73 89 10.95 36 11.60 84 7.30 71 5.29 35 4.28

Methodical BCI Worldwide Growth Fund of Funds 40 15.93 76 11.65 58 10.11 34 10.78 44 8.94

MitonOptimal IP Flexible Growth Fund 55 14.84 99 10.41

Montrose BCI Flexible Fund of Funds 127 (6.30) 122 1.10 109 (1.69) 91 3.77 70 5.33 32 6.04

MyQ Ci Worldwide Flexible Fund of Funds 99 11.54 91 10.90 69 9.63 55 9.74 15 11.50

Nedgroup Investments Bravata Worldwide Flexible Fund 117 8.56 107 8.96 70 9.60 12 13.27 11 12.46 6 11.17

Nest Egg BCI Worldwide Flexible Fund 9 21.18 6 22.82 7 15.98 9 13.84

NFB Ci Worldwide Flexible Fund 13 19.59 28 15.89 23 12.36 8 14.07 5 13.33

Ninety One Worldwide Flexible Fund 21 17.90 88 10.98 83 9.16 44 10.02 58 8.16

Novare High Growth Fund 82 13.09 110 8.73 84 9.13 70 8.82 68 7.21 29 7.16

nReach Capitis IP Worldwide Flexible Fund 103 10.74 117 7.87

Obsidian SCI Worldwide Flexible Fund 110 10.20 116 8.11

Octagon Sanlam Collective Investments Worldwide FoF 69 13.82 80 11.38 65 9.79 76 8.42 65 7.56

Odyssey BCI Worldwide Flexible Fund 125 6.22 97 10.43 85 9.10

Old Mutual Maximum Return Fund 111 10.12 108 8.85 103 7.06 56 9.69 59 8.09 21 7.98

Old Mutual Multi-Managers Maximum Return Fund of Funds 68 14.10 98 10.41 77 9.34 28 11.24 28 9.87

Old Mutual Multi-Managers Worldwide Multi-Asset FoF 64 14.15 102 9.69 100 7.66

Optimum BCI Worldwide Flexible Fund of Funds 123 6.76 114 8.39 107 6.00 88 5.51 60 8.07

Orchard BCI Worldwide Opportunity Fund 75 13.61 87 10.98

Ordian Capital BCI Worldwide Flexible Fund 93 11.81

PBi BCI Worldwide Flexible Fund of Funds 24 17.31 94 10.67 60 10.04 38 10.33 61 7.99

Platinum BCI Worldwide Flexible Fund 106 10.61 37 14.33 28 12.10 32 10.86 14 12.12 7 11.01

210 Profile’s Unit Trusts & Collective Investments — DOMESTIC