Page 211 - Profile's Unit Trusts & Collective Investments - March 2025

P. 211

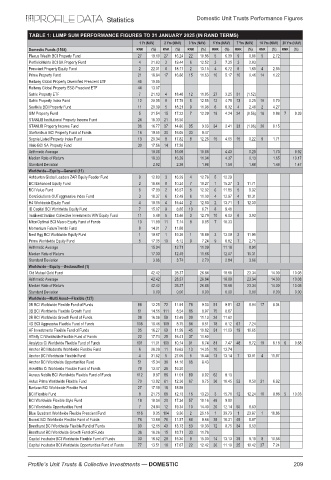

Statistics Domestic Unit Trusts Performance Figures

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JANUARY 2025 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1568) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Plexus Wealth BCI Property Fund 27 18.19 27 16.24 22 10.86 5 6.39 9 0.86 5 2.72

PortfolioMetrix BCI SA Property Fund 4 21.93 3 19.44 6 12.52 3 7.35 3 2.83

Prescient Property Equity Fund 2 22.31 6 18.17 2 13.15 4 6.72 8 1.69 4 2.95

Prime Property Fund 21 18.94 17 16.86 15 11.63 10 5.17 10 0.46 14 1.22

Reitway Global Property Diversified Prescient ETF 46 10.95

Reitway Global Property ESG Prescient ETF 44 13.07

Satrix Property ETF 7 21.13 4 18.48 12 11.85 27 3.25 31 (1.52)

Satrix Property Index Fund 12 20.35 9 17.79 5 12.55 12 4.75 13 0.29 10 1.70

Sesfikile BCI Property Fund 11 20.39 5 18.21 9 11.98 6 6.32 4 2.48 2 4.27

SIM Property Fund 5 21.54 15 17.22 7 12.29 19 4.24 24 (0.56) 18 0.88 7 9.39

STANLIB Institutional Property Income Fund 24 18.33 21 16.50

STANLIB Property Income Fund 36 16.77 37 14.80 35 9.03 34 2.41 33 (1.96) 20 0.15

Starfunds.ai BCI Property Fund of Funds 16 19.55 30 16.05 33 9.47

Sygnia Listed Property Index Fund 13 20.34 8 17.82 8 12.26 15 4.65 15 0.22 9 1.71

Visio BCI SA Property Fund 30 17.56 14 17.58

Arithmetic Average 18.06 16.08 10.68 4.43 0.29 1.73 9.92

Median Rate of Return 18.33 16.39 11.04 4.37 0.13 1.65 10.17

Standard Deviation 2.92 2.36 1.86 1.59 1.68 1.48 1.47

Worldwide—Equity—General (11)

Ashburton Global Leaders ZAR Equity Feeder Fund 9 12.80 3 16.29 4 12.78 5 12.29

BCI Enhanced Equity Fund 2 18.66 8 10.24 7 10.27 1 15.27 3 11.71

BCI Value Fund 6 17.33 2 16.57 5 12.32 6 11.85 5 9.32

CoreSolutions OUTaggressive Index Fund 3 18.37 6 12.49 6 11.00 4 12.97 4 10.31

H4 Worldwide Equity Fund 4 18.15 4 15.44 2 12.93 2 13.71 1 12.33

ID Capital BCI Worldwide Equity Fund 7 15.07 9 8.85 10 6.71 8 9.46

Imalivest Sanlam Collective Investments WW Equity Fund 11 5.48 5 13.46 3 12.79 10 6.03 6 3.93

MitonOptimal BCI Macro Equity Fund of Funds 10 11.89 11 7.14 8 8.95 7 10.33

Momentum FutureTrends Fund 8 14.01 7 11.88

Nest Egg BCI Worldwide Equity Fund 1 19.67 1 19.36 1 15.89 3 13.09 2 11.99

Prime Worldwide Equity Fund 5 17.35 10 8.12 9 7.24 9 6.82 7 2.75

Arithmetic Average 15.34 12.71 11.09 11.18 8.91

Median Rate of Return 17.33 12.49 11.66 12.07 10.31

Standard Deviation 3.96 3.74 2.70 2.84 3.66

Worldwide—Equity—Unclassified (1)

Old Mutual Gold Fund 42.42 28.37 26.84 18.68 23.34 14.00 10.08

Arithmetic Average 42.42 28.37 26.84 18.68 23.34 14.00 10.08

Median Rate of Return 42.42 28.37 26.84 18.68 23.34 14.00 10.08

Standard Deviation 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Worldwide—Multi Asset—Flexible (127)

3B BCI Worldwide Flexible Fund of Funds 88 12.25 72 11.91 78 9.33 51 9.81 42 9.04 17 8.34

3B BCI Worldwide Flexible Growth Fund 61 14.56 111 8.54 86 8.97 75 8.67

3B BCI Worldwide Growth Fund of Funds 38 16.06 58 12.49 39 11.13 24 11.62

4D BCI Aggressive Flexible Fund of Funds 108 10.46 109 8.75 94 8.51 78 8.12 67 7.24

AF Investments Flexible Fund of Funds 35 16.27 69 11.99 45 10.82 31 11.03 19 10.65

Affinity Ci Worldwide Flexible Fund of Funds 22 17.74 25 16.41 37 11.60

Analytics Ci Worldwide Flexible Fund of Funds 101 11.01 100 10.14 91 8.74 81 7.47 48 8.72 19 8.18 6 9.68

Anchor BCI Moderate Worldwide Flexible Fund 6 26.29 11 19.63 13 14.05 10 13.74

Anchor BCI Worldwide Flexible Fund 4 31.52 5 27.05 5 18.44 13 13.14 7 13.01 4 11.97

Anchor BCI Worldwide Opportunities Fund 51 15.34 38 14.16 96 8.43

AssetMix Ci Worldwide Flexible Fund of Funds 79 13.47 26 16.30

Aureus Nobilis BCI Worldwide Flexible Fund of Funds 112 9.97 86 11.01 89 8.92 62 9.13

Autus Prime Worldwide Flexible Fund 70 13.82 61 12.36 67 9.75 36 10.45 52 8.50 31 6.92

Bartizan BCI Worldwide Flexible Fund 27 17.19 16 18.58

BCI Flexible Fund 8 21.75 66 12.13 16 13.23 3 15.76 12 12.24 10 9.86 5 10.03

BCI Worldwide Flexible Style Fund 18 18.04 20 17.34 57 10.16 49 9.90

BCI Worldwide Opportunities Fund 7 24.84 12 19.34 10 14.40 20 12.14 50 8.63

Blue Quadrant Worldwide Flexible Prescient Fund 116 9.35 104 9.30 2 25.16 1 39.73 1 23.87 1 18.86

Bovest BCI Worldwide Flexible Fund of Funds 76 13.59 78 11.57 68 9.66 39 10.31 45 8.87

Brenthurst BCI Worldwide Flexible Fund of Funds 90 12.15 43 13.73 53 10.33 72 8.75 34 9.53

Brenthurst BCI Worldwide Growth Fund of Funds 36 16.26 15 18.71 33 11.76

Capital Incubator BCI Worldwide Flexible Fund of Funds 33 16.52 29 15.30 9 15.00 14 13.13 39 9.19 8 10.58

Capital Incubator BCI Worldwide Opportunities Fund of Funds 77 13.51 18 17.67 22 12.42 30 11.10 25 10.42 27 7.24

Profile’s Unit Trusts & Collective Investments — DOMESTIC 209