Page 195 - Profile's Unit Trusts & Collective Investments - March 2025

P. 195

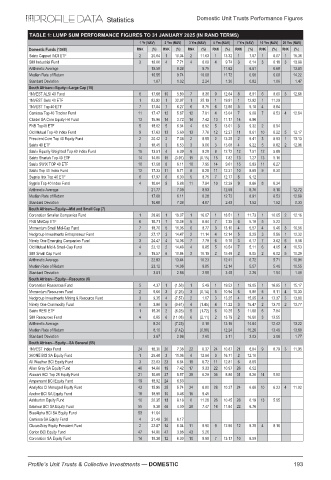

Statistics Domestic Unit Trusts Performance Figures

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JANUARY 2025 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1568) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Satrix Capped INDI ETF 2 20.04 1 10.34 2 11.63 1 13.32 1 7.67 1 8.07 1 15.36

SIM Industrial Fund 3 19.06 4 7.71 4 6.69 4 9.74 3 6.14 3 6.18 3 13.88

Arithmetic Average 19.59 9.38 9.75 11.62 6.61 6.68 13.81

Median Rate of Return 19.55 9.74 10.09 11.72 6.60 6.69 14.22

Standard Deviation 1.07 1.02 2.24 1.30 0.82 1.06 1.47

South African—Equity—Large Cap (15)

1NVEST ALSI 40 Fund 8 17.68 10 5.80 7 8.36 9 12.64 8 8.91 6 8.60 3 12.68

1NVEST Swix 40 ETF 1 83.92 1 32.97 1 25.19 1 19.91 1 12.92 1 11.29

1NVEST Top 40 ETF 7 17.84 7 6.27 6 8.75 6 12.86 5 9.18 4 8.84

Camissa Top 40 Tracker Fund 11 17.47 12 5.67 12 7.91 4 13.04 7 9.08 7 8.53 4 12.64

Citadel SA Core Equity H4 Fund 13 15.96 14 3.72 14 7.42 13 11.17 14 6.86

FNB Top40 ETF 5 18.02 5 6.34 4 8.92 5 13.01 3 9.32 2 8.94

Old Mutual Top 40 Index Fund 9 17.63 13 5.60 13 7.76 12 12.27 11 8.61 10 8.22 5 12.17

Prescient Core Top 40 Equity Fund 2 20.42 2 7.08 2 9.55 2 13.25 2 9.41 3 8.93 1 13.13

Satrix 40 ETF 3 18.45 3 6.53 3 9.06 3 13.08 4 9.22 5 8.82 2 12.96

Satrix Equally Weighted Top 40 Index Fund 15 13.51 4 6.39 9 8.28 8 12.72 12 7.51 12 5.88

Satrix Shariah Top 40 ETF 14 14.80 15 (3.97) 15 (0.15) 15 7.82 13 7.27 13 5.16

Satrix SWIX TOP 40 ETF 10 17.58 8 6.11 10 7.95 14 9.61 15 5.83 11 6.27

Satrix Top 40 Index Fund 12 17.33 11 5.71 8 8.28 11 12.31 10 8.65 9 8.30

Sygnia Itrix Top 40 ETF 6 17.97 6 6.30 5 8.75 7 12.77 6 9.12

Sygnia Top 40 Index Fund 4 18.04 9 5.88 11 7.94 10 12.39 9 8.66 8 8.34

Arithmetic Average 21.77 7.09 8.93 12.59 8.70 8.16 12.72

Median Rate of Return 17.68 6.11 8.28 12.72 8.91 8.53 12.68

Standard Deviation 16.68 7.38 4.87 2.43 1.52 1.52 0.33

South African—Equity—Mid and Small Cap (7)

Coronation Smaller Companies Fund 1 28.80 1 19.07 1 16.07 1 18.51 1 11.73 1 10.05 2 12.16

FNB MidCap ETF 6 18.71 7 10.08 5 8.84 7 7.35 6 5.18 5 5.23

Momentum Small Mid-Cap Fund 7 18.70 5 11.06 6 8.77 3 13.10 4 5.57 4 5.46 3 10.56

Nedgroup Investments Entrepreneur Fund 2 27.17 3 14.47 2 11.14 4 12.14 5 5.25 3 5.56 1 12.32

Ninety One Emerging Companies Fund 3 24.47 4 14.06 7 7.78 6 9.76 3 6.17 7 3.62 6 9.58

Old Mutual Mid & Small-Cap Fund 4 23.12 2 14.48 4 8.85 5 10.54 7 5.11 6 4.05 4 10.53

SIM Small Cap Fund 5 19.57 6 10.84 3 10.19 2 15.48 2 8.05 2 6.02 5 10.29

Arithmetic Average 22.93 13.44 10.23 12.41 6.72 5.71 10.91

Median Rate of Return 23.12 14.06 8.85 12.14 5.57 5.46 10.55

Standard Deviation 3.81 2.88 2.59 3.45 2.26 1.94 1.00

South African—Equity—Resource (6)

Coronation Resources Fund 5 4.37 1 (1.58) 1 5.49 1 19.53 1 19.05 1 16.95 1 15.17

Momentum Resources Fund 2 9.66 3 (7.26) 3 (0.14) 5 10.94 6 9.80 5 9.11 4 10.33

Nedgroup Investments Mining & Resource Fund 3 9.35 4 (7.57) 2 1.07 3 13.25 4 15.05 4 13.37 3 13.60

Ninety One Commodity Fund 6 3.86 5 (9.61) 4 (1.45) 4 11.22 3 15.47 2 13.70 2 13.77

Satrix RESI ETF 1 15.36 2 (6.28) 5 (1.72) 6 10.25 5 11.88 6 7.84

SIM Resources Fund 4 6.85 6 (11.08) 6 (2.11) 2 13.79 2 16.60 3 13.55

Arithmetic Average 8.24 (7.23) 0.19 13.16 14.64 12.42 13.22

Median Rate of Return 8.10 (7.42) (0.80) 12.24 15.26 13.46 13.69

Standard Deviation 3.87 2.98 2.60 3.11 3.03 3.06 1.77

South African—Equity—SA General (55)

1NVEST Index Fund 24 18.30 20 7.38 22 8.37 24 10.87 21 6.84 9 6.79 3 11.95

36ONE BCI SA Equity Fund 1 25.48 3 11.06 4 12.54 3 16.71 2 12.10

All Weather BCI Equity Fund 3 22.03 23 6.84 19 8.72 11 12.81 6 8.85

Allan Gray SA Equity Fund 46 14.86 19 7.42 17 9.33 22 10.97 26 6.52

Aluwani BCI Top 25 Equity Fund 21 18.65 37 5.57 39 6.29 36 8.86 31 5.20 14 5.90

Ampersand BCI Equity Fund 19 18.92 24 6.63

Analytics Ci Managed Equity Fund 43 15.99 35 5.74 34 6.80 28 10.37 24 6.68 10 6.33 4 11.02

Anchor BCI SA Equity Fund 18 18.99 10 8.46 15 9.45

Ashburton Equity Fund 10 20.35 13 8.18 6 11.26 26 10.45 28 6.19 13 5.95

Bateleur BCI SA Equity Fund 55 9.38 46 4.00 29 7.47 16 11.84 22 6.76

BlueAlpha BCI SA Equity Fund 53 11.64

Camissa SA Equity Fund 4 21.49 30 6.17

ClucasGray Equity Prescient Fund 2 22.87 14 8.04 11 9.90 9 12.86 12 8.25 4 8.16

Corion BCI Equity Fund 47 14.80 47 3.86 43 5.26

Coronation SA Equity Fund 14 19.38 12 8.30 10 9.99 7 13.17 10 8.59

Profile’s Unit Trusts & Collective Investments — DOMESTIC 193