Page 191 - Profile's Unit Trusts & Collective Investments - March 2025

P. 191

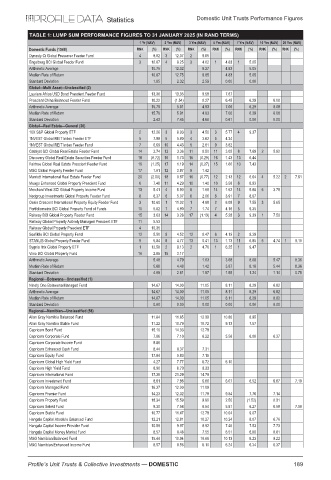

Statistics Domestic Unit Trusts Performance Figures

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JANUARY 2025 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1568) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Dynasty Ci Global Preserver Feeder Fund 4 8.02 3 12.07 2 9.85

Engelberg BCI Global Feeder Fund 3 10.67 4 8.25 3 4.62 1 4.83 1 5.05

Arithmetic Average 10.75 12.02 8.27 4.83 5.05

Median Rate of Return 10.87 12.75 9.85 4.83 5.05

Standard Deviation 1.85 2.32 2.59 0.00 0.00

Global—Multi Asset—Unclassified (2)

Laurium Africa USD Bond Prescient Feeder Fund 13.36 13.35 9.58 7.67

Prescient China Balanced Feeder Fund 18.22 (1.54) 0.27 6.45 6.29 8.08

Arithmetic Average 15.79 5.91 4.93 7.06 6.29 8.08

Median Rate of Return 15.79 5.91 4.93 7.06 6.29 8.08

Standard Deviation 2.43 7.45 4.66 0.61 0.00 0.00

Global—Real Estate—General (20)

10X S&P Global Property ETF 2 12.26 3 8.93 3 4.50 3 5.77 4 9.37

1NVEST Global REIT Index Feeder ETF 5 7.99 5 5.80 4 3.62 5 4.34

1NVEST Global REIT Index Feeder Fund 7 6.69 10 4.43 5 2.81 9 3.82

Catalyst SCI Global Real Estate Feeder Fund 14 3.74 13 3.36 11 0.50 11 3.05 8 7.69 2 5.92

Discovery Global Real Estate Securities Feeder Fund 18 (0.72) 16 1.73 15 (0.29) 16 1.43 13 6.44

Fairtree Global Real Estate Prescient Feeder Fund 19 (1.25) 17 1.19 14 (0.27) 15 1.60 10 7.43

M&G Global Property Feeder Fund 17 1.01 12 3.87 9 1.42

Marriott International Real Estate Feeder Fund 20 (2.00) 18 0.87 16 (0.77) 12 2.13 12 6.64 4 5.22 2 7.61

Meago Enhanced Global Property Prescient Fund 6 7.48 11 4.29 10 1.40 10 3.58 6 8.93

Merchant West SCI Global Property Income Fund 13 5.41 4 5.90 8 1.69 14 1.62 14 5.88 6 3.79

Nedgroup Investments Global Property Feeder Fund 8 6.37 6 5.07 6 2.06 8 3.91 7 8.67

Oasis Crescent International Property Equity Feeder Fund 3 10.60 1 11.02 1 4.88 2 6.08 9 7.55 3 5.65

Portfoliometrix BCI Global Property Fund of Funds 10 5.82 7 4.80 7 1.74 7 4.16 5 9.35

Reitway BCI Global Property Feeder Fund 15 3.63 14 3.28 17 (1.19) 4 5.28 3 9.39 1 7.50

Reitway Global Property Actively Managed Prescient ETF 11 5.53

Reitway Global Property Prescient ETF 4 10.35

Sesfikile BCI Global Property Fund 12 5.50 9 4.52 12 0.47 6 4.19 2 9.39

STANLIB Global Property Feeder Fund 9 5.84 8 4.77 13 0.41 13 1.73 11 6.85 5 4.74 1 9.10

Sygnia Itrix Global Property ETF 1 12.58 2 9.13 2 4.76 1 6.25 1 9.47

Visio BCI Global Property Fund 16 2.85 15 3.17

Arithmetic Average 5.48 4.79 1.63 3.68 8.08 5.47 8.36

Median Rate of Return 5.68 4.48 1.42 3.87 8.18 5.44 8.36

Standard Deviation 4.08 2.61 1.87 1.59 1.24 1.14 0.75

Regional—Botswana—Unclassified (1)

Ninety One Botswana Managed Fund 14.67 14.00 11.05 8.11 8.29 6.82

Arithmetic Average 14.67 14.00 11.05 8.11 8.29 6.82

Median Rate of Return 14.67 14.00 11.05 8.11 8.29 6.82

Standard Deviation 0.00 0.00 0.00 0.00 0.00 0.00

Regional—Namibian—Unclassified (58)

Allan Gray Namibia Balanced Fund 11.84 11.85 12.39 10.86 8.95

Allan Gray Namibia Stable Fund 11.22 10.79 10.72 9.13 7.57

Capricorn Bond Fund 15.10 14.33 12.78

Capricorn Corporate Fund 7.86 7.10 6.22 5.56 6.00 6.37

Capricorn Corporate Income Fund 8.86

Capricorn Enhanced Cash Fund 8.44 8.37 7.31

Capricorn Equity Fund 17.84 5.83 7.15

Capricorn Global High Yield Fund 4.27 7.77 8.72 6.10

Capricorn High Yield Fund 8.90 8.79 8.33

Capricorn International Fund 17.39 21.29 14.79

Capricorn Investment Fund 8.61 7.86 6.86 6.07 6.52 6.87 7.19

Capricorn Managed Fund 16.37 12.00 11.09

Capricorn Premier Fund 14.23 12.32 11.78 9.84 7.76 7.14

Capricorn Property Fund 18.34 15.59 9.90 2.50 (1.52) 0.31

Capricorn Selekt Fund 8.30 7.56 6.54 5.81 6.27 6.58 7.00

Capricorn Stable Fund 10.77 11.47 12.78 10.04 9.07

Hangala Capital Absolute Balanced Fund 12.21 12.81 10.27 10.24 8.07 6.76

Hangala Capital Income Provider Fund 10.59 9.97 8.92 7.46 7.53 7.73

Hangala Capital Money Market Fund 8.57 8.48 7.55 6.51 6.80 6.81

M&G Namibian Balanced Fund 15.44 10.94 10.66 10.13 8.23 8.22

M&G Namibian Enhanced Income Fund 8.57 8.56 8.10 6.24 6.34 6.37

Profile’s Unit Trusts & Collective Investments — DOMESTIC 189