Page 194 - Profile's Unit Trusts & Collective Investments - March 2025

P. 194

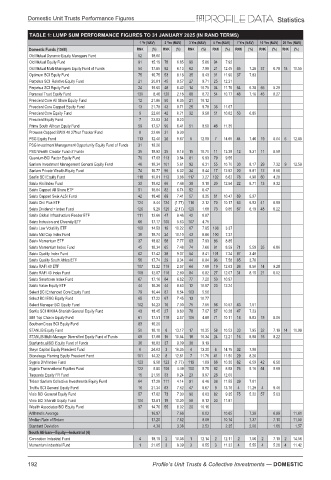

Domestic Unit Trusts Performance Figures Statistics

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JANUARY 2025 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1568) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Old Mutual Dynamic Equity Managers Fund 52 18.00

Old Mutual Equity Fund 91 15.19 78 6.85 99 5.86 94 7.92

Old Mutual Multi-Managers Equity Fund of Funds 54 17.85 92 6.13 62 7.99 21 12.45 45 7.28 37 6.79 18 10.55

Optimum BCI Equity Fund 75 16.75 53 8.18 35 9.43 31 11.90 37 7.83

Perpetua SCI Relative Equity Fund 21 20.01 45 8.57 27 9.71 25 12.21

Perpetua SCI Equity Fund 24 19.60 48 8.42 14 10.75 34 11.76 64 6.28 55 5.29

Personal Trust Equity Fund 130 8.46 120 2.16 88 6.72 54 10.77 48 7.16 46 6.27

Prescient Core All Share Equity Fund 12 21.86 50 8.35 21 10.12

Prescient Core Capped Equity Fund 13 21.78 43 8.71 25 9.78 36 11.67

Prescient Core Equity Fund 9 22.00 42 8.71 32 9.58 51 10.82 53 6.85

Prescient Equity Fund 7 22.83 34 9.23

Prime South African Equity Fund 59 17.57 90 6.41 51 8.50 46 11.35

Prowess Capped SWIX 40 27four Tracker Fund 8 22.06 31 9.30

PSG Equity Fund 113 12.40 26 9.67 5 12.99 7 14.65 44 7.46 19 8.04 6 12.88

PSG Investment Management Opportunity Equity Fund of Funds 31 19.26

PSG Wealth Creator Fund of Funds 35 18.93 35 9.18 15 10.70 11 13.38 12 9.31 11 8.58

Quantum BCI Factor Equity Fund 70 17.03 113 3.84 81 6.93 79 9.55

Sanlam Investment Management General Equity Fund 46 18.34 101 5.61 92 6.31 55 10.70 30 8.17 29 7.32 9 12.59

Sanlam Private Wealth Equity Fund 74 16.77 96 6.02 34 9.44 17 12.82 20 8.81 12 8.56

Sasfin BCI Equity Fund 118 10.81 112 3.88 117 3.27 102 6.62 78 4.98 60 4.28

Satrix Alsi Index Fund 33 19.02 66 7.48 39 9.19 20 12.54 22 8.71 13 8.32

Satrix Capped All Share ETF 51 18.04 82 6.74 52 8.47

Satrix Capped Swix ALSI Fund 42 18.48 69 7.41 57 8.35 61 10.47 69 5.97

Satrix Divi Plus ETF 124 9.44 124 (1.77) 118 2.12 70 10.17 63 6.53 41 6.59

Satrix Dividend + Index Fund 126 9.29 125 (2.17) 120 1.68 73 9.85 67 6.19 48 6.22

Satrix Global Infrastructure Feeder ETF 111 12.66 47 8.46 42 8.87

Satrix Inclusion and Diversity ETF 66 17.17 100 5.63 107 4.75

Satrix Low Volatility ETF 100 14.53 19 10.22 67 7.85 108 3.37

Satrix Mid Cap Index Fund 38 18.74 24 10.10 43 8.86 100 7.37

Satrix Momentum ETF 37 18.82 58 7.77 63 7.93 86 8.85

Satrix Momentum Index Fund 45 18.34 65 7.48 74 7.66 91 8.59 71 5.59 35 6.86

Satrix Quality Index Fund 62 17.42 38 9.07 54 8.41 101 7.24 87 3.40

Satrix Quality South Africa ETF 56 17.74 29 9.34 44 8.84 96 7.58 85 3.76

Satrix RAFI 40 ETF 107 13.22 119 2.57 64 7.88 19 12.63 26 8.50 14 8.28

Satrix RAFI 40 Index Fund 109 12.87 116 2.80 84 6.82 27 12.07 31 8.15 21 8.02

Satrix Smartcore Index Fund 67 17.16 84 6.62 77 7.20 50 10.97

Satrix Value Equity ETF 44 18.36 44 8.63 12 10.97 23 12.24

Select BCI Enhanced Core Equity Fund 79 16.44 87 6.54 103 5.56

Select BCI ESG Equity Fund 65 17.22 67 7.45 13 10.77

Select Manager BCI Equity Fund 102 14.23 76 7.00 75 7.55 56 10.57 43 7.51

Sentio SCI HIKMA Shariah General Equity Fund 43 18.45 27 9.60 78 7.07 67 10.28 47 7.23

SIM Top Choice Equity Fund 61 17.51 118 2.57 106 4.88 71 10.11 18 8.83 18 8.06

SouthernCross BCI Equity Fund 83 16.20

STANLIB Equity Fund 50 18.10 6 13.17 17 10.35 58 10.53 33 7.95 32 7.19 14 10.99

STANLIB Multi-Manager Diversified Equity Fund of Funds 69 17.08 15 10.54 18 10.34 24 12.21 16 8.98 16 8.22

Starfunds.ai BCI Equity Fund of Funds 36 18.83 37 9.09 38 9.19

Steyn Capital Equity Prescient Fund 6 24.03 3 16.35 4 13.30 6 14.75 32 7.98

Stonehage Fleming Equity Prescient Fund 101 14.32 8 12.61 7 11.76 41 11.50 29 8.26

Sygnia DIVI Index Fund 123 9.58 123 (1.77) 119 1.89 66 10.30 62 6.59 42 6.56

Sygnia Transnational Equities Fund 122 9.80 108 4.49 100 5.75 92 8.58 76 5.16 54 5.69

Taquanta Equity FR Fund 15 21.55 33 9.24 23 9.97 28 12.00

Trésor Sanlam Collective Investments Equity Fund 64 17.28 111 4.14 91 6.46 38 11.55 39 7.81

Truffle SCI General Equity Fund 16 21.34 63 7.62 47 8.67 9 13.76 4 11.29 4 9.46

Visio BCI General Equity Fund 57 17.62 73 7.30 90 6.63 82 9.35 75 5.22 57 5.03

Visio BCI Shariah Equity Fund 104 13.81 18 10.30 59 8.13 33 11.81

Wealth Associates BCI Equity Fund 97 14.76 55 8.02 20 10.16

Arithmetic Average 16.97 7.66 8.03 10.65 7.38 6.99 11.61

Median Rate of Return 17.20 7.62 8.08 10.74 7.37 7.10 11.50

Standard Deviation 4.38 3.38 2.53 2.35 2.00 1.66 1.57

South African—Equity—Industrial (4)

Coronation Industrial Fund 4 18.19 2 10.08 1 12.14 2 12.11 2 7.06 2 7.19 2 14.56

Momentum Industrial Fund 1 21.05 3 9.39 3 8.55 3 11.32 4 5.55 4 5.26 4 11.42

192 Profile’s Unit Trusts & Collective Investments — DOMESTIC