Page 155 - Profile's Unit Trusts & Collective Investments - September 2025

P. 155

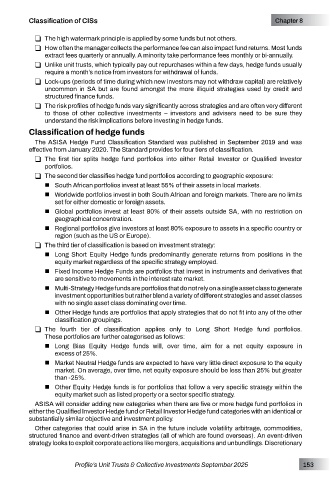

Classification of CISs Chapter 8

R The high watermark principle is applied by some funds but not others.

R How often the manager collects the performance fee can also impact fund returns. Most funds

extract fees quarterly or annually. A minority take performance fees monthly or bi-annually.

R Unlike unit trusts, which typically pay out repurchases within a few days, hedge funds usually

require a month’s notice from investors for withdrawal of funds.

R Lock-ups (periods of time during which new investors may not withdraw capital) are relatively

uncommon in SA but are found amongst the more illiquid strategies used by credit and

structured finance funds.

R The risk profiles of hedge funds vary significantly across strategies and are often very different

to those of other collective investments – investors and advisers need to be sure they

understand the risk implications before investing in hedge funds.

Classification of hedge funds

The ASISA Hedge Fund Classification Standard was published in September 2019 and was

effective from January 2020. The Standard provides for four tiers of classification.

R The first tier splits hedge fund portfolios into either Retail Investor or Qualified Investor

portfolios.

R The second tier classifies hedge fund portfolios according to geographic exposure:

South African portfolios invest at least 55% of their assets in local markets.

Worldwide portfolios invest in both South African and foreign markets. There are no limits

set for either domestic or foreign assets.

Global portfolios invest at least 80% of their assets outside SA, with no restriction on

geographical concentration.

Regional portfolios give investors at least 80% exposure to assets in a specific country or

region (such as the US or Europe).

R The third tier of classification is based on investment strategy:

Long Short Equity Hedge funds predominantly generate returns from positions in the

equity market regardless of the specific strategy employed.

Fixed Income Hedge Funds are portfolios that invest in instruments and derivatives that

are sensitive to movements in the interest rate market.

Multi-Strategy Hedge funds are portfolios that do not rely on a single asset class to generate

investment opportunities but rather blend a variety of different strategies and asset classes

with no single asset class dominating over time.

Other Hedge funds are portfolios that apply strategies that do not fit into any of the other

classification groupings.

R The fourth tier of classification applies only to Long Short Hedge fund portfolios.

These portfolios are further categorised as follows:

Long Bias Equity Hedge funds will, over time, aim for a net equity exposure in

excess of 25%.

Market Neutral Hedge funds are expected to have very little direct exposure to the equity

market. On average, over time, net equity exposure should be less than 25% but greater

than -25%.

Other Equity Hedge funds is for portfolios that follow a very specific strategy within the

equity market such as listed property or a sector specific strategy.

ASISA will consider adding new categories when there are five or more hedge fund portfolios in

either the Qualified Investor Hedge fund or Retail Investor Hedge fund categories with an identical or

substantially similar objective and investment policy.

Other categories that could arise in SA in the future include volatility arbitrage, commodities,

structured finance and event-driven strategies (all of which are found overseas). An event-driven

strategy looks to exploit corporate actions like mergers, acquisitions and unbundlings. Discretionary

Profile’s Unit Trusts & Collective Investments September 2025 153