Page 58 - Profile's Unit Trusts & Collective Investments - March 2025

P. 58

CHAPTER 3

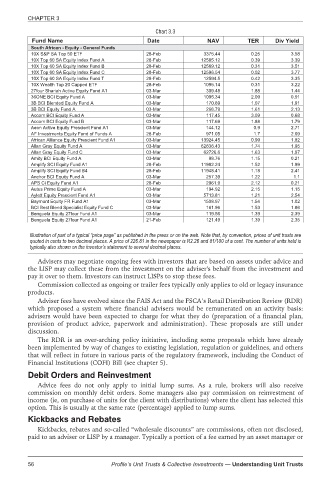

Chart 3.3

Fund Name Date NAV TER Div Yield

South African - Equity - General Funds

10X S&P SA Top 50 ETF 28-Feb 3375.44 0.25 3.58

10X Top 60 SA Equity Index Fund A 28-Feb 12585.12 0.39 3.39

10X Top 60 SA Equity Index Fund B 28-Feb 12589.12 0.31 3.51

10X Top 60 SA Equity Index Fund C 28-Feb 12596.54 0.02 3.77

10X Top 60 SA Equity Index Fund T 28-Feb 12594.5 0.42 3.35

10X Wealth Top 20 Capped ETF 28-Feb 1095.14 0.31 3.22

27four Shariah Active Equity Fund A1 03-Mar 309.48 1.88 1.44

36ONE BCI Equity Fund A 03-Mar 1095.34 2.09 0.91

3B BCI Blended Equity Fund A 03-Mar 170.89 1.07 1.91

3B BCI Equity Fund A 03-Mar 268.79 1.61 2.13

Accorn BCI Equity Fund A 03-Mar 117.45 3.09 0.68

Accorn BCI Equity Fund B 03-Mar 117.69 1.88 1.79

Aeon Active Equity Prescient Fund A1 03-Mar 144.12 0.9 2.71

AF Investments Equity Fund of Funds A 28-Feb 971.05 1.7 2.09

African Alliance Equity Prescient Fund A1 03-Mar 13924.45 0.99 1.82

Allan Gray Equity Fund A 03-Mar 62636.43 1.74 1.95

Allan Gray Equity Fund C 03-Mar 62726.6 1.63 1.97

Amity BCI Equity Fund A 03-Mar 98.76 1.15 0.21

Amplify SCI Equity Fund A1 28-Feb 11982.24 1.52 1.99

Amplify SCI Equity Fund B4 28-Feb 11948.41 1.18 2.41

Anchor BCI Equity Fund A 03-Mar 257.39 1.22 1.1

APS Ci Equity Fund A1 28-Feb 2961.9 2.12 0.21

Autus Prime Equity Fund A 03-Mar 194.92 2.15 1.15

Aylett Equity Prescient Fund A1 03-Mar 5713.81 1.21 2.54

Baymont Equity FR Fund A1 03-Mar 1508.97 1.54 1.02

BCI Best Blend Specialist Equity Fund C 03-Mar 161.96 1.53 1.86

Benguela Equity 27four Fund A1 03-Mar 119.56 1.39 2.39

Benguela Equity 27four Fund A1 21-Feb 121.49 1.39 2.35

Illustration of part of a typical “price page” as published in the press or on the web. Note that, by convention, prices of unit trusts are

quoted in cents to two decimal places. A price of 226.81 in the newspaper is R2.26 and 81/100 of a cent. The number of units held is

typically also shown on the investor’s statement to several decimal places.

Advisers may negotiate ongoing fees with investors that are based on assets under advice and

the LISP may collect these from the investment on the adviser's behalf from the investment and

pay it over to them. Investors can instruct LISPs to stop these fees.

Commission collected as ongoing or trailer fees typically only applies to old or legacy insurance

products.

Adviser fees have evolved since the FAIS Act and the FSCA’s Retail Distribution Review (RDR)

which proposed a system where financial advisers would be remunerated on an activity basis:

advisers would have been expected to charge for what they do (preparation of a financial plan,

provision of product advice, paperwork and administration). These proposals are still under

discussion.

The RDR is an over-arching policy initiative, including some proposals which have already

been implemented by way of changes to existing legislation, regulation or guidelines, and others

that will reflect in future in various parts of the regulatory framework, including the Conduct of

Financial Institutions (COFI) Bill (see chapter 5).

Debit Orders and Reinvestment

Advice fees do not only apply to initial lump sums. As a rule, brokers will also receive

commission on monthly debit orders. Some managers also pay commission on reinvestment of

income (ie, on purchase of units for the client with distributions) where the client has selected this

option. This is usually at the same rate (percentage) applied to lump sums.

Kickbacks and Rebates

Kickbacks, rebates and so-called “wholesale discounts” are commissions, often not disclosed,

paid to an adviser or LISP by a manager. Typically a portion of a fee earned by an asset manager or

56 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts