Page 31 - Profile's Unit Trusts & Collective Investments - March 2025

P. 31

History of Collective Investment Schemes

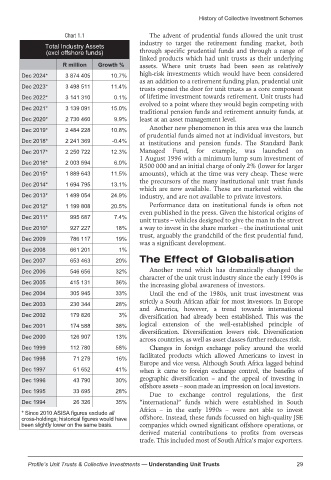

Chart 1.1 The advent of prudential funds allowed the unit trust

industry to target the retirement funding market, both

Total Industry Assets

(excl offshore funds) through specific prudential funds and through a range of

linked products which had unit trusts as their underlying

R million Growth % assets. Where unit trusts had been seen as relatively

Dec 2024* 3 874 405 10.7% high-risk investments which would have been considered

as an addition to a retirement funding plan, prudential unit

Dec 2023* 3 498 511 11.4%

trusts opened the door for unit trusts as a core component

Dec 2022* 3 141 310 0.1% of lifetime investment towards retirement. Unit trusts had

evolved to a point where they would begin competing with

Dec 2021* 3 139 091 15.0%

traditional pension funds and retirement annuity funds, at

Dec 2020* 2 730 460 9.9% leastatanassetmanagementlevel.

Another new phenomenon in this area was the launch

Dec 2019* 2 484 228 10.8%

of prudential funds aimed not at individual investors, but

Dec 2018* 2 241 369 -0.4%

at institutions and pension funds. The Standard Bank

Dec 2017* 2 250 722 12.3% Managed Fund, for example, was launched on

1 August 1996 with a minimum lump sum investment of

Dec 2016* 2 003 594 6.0%

R500 000 and an initial charge of only 2% (lower for larger

Dec 2015* 1 889 643 11.5% amounts), which at the time was very cheap. These were

the precursors of the many institutional unit trust funds

Dec 2014* 1 694 795 13.1%

which are now available. These are marketed within the

Dec 2013* 1 499 054 24.9% industry, and are not available to private investors.

Dec 2012* 1 199 808 20.5% Performance data on institutional funds is often not

even published in the press. Given the historical origins of

Dec 2011* 995 687 7.4%

unit trusts – vehicles designed to give the man in the street

Dec 2010* 927 227 18% a way to invest in the share market – the institutional unit

trust, arguably the grandchild of the first prudential fund,

Dec 2009 786 117 19%

was a significant development.

Dec 2008 661 201 1%

Dec 2007 653 463 20% The Effect of Globalisation

Dec 2006 546 656 32% Another trend which has dramatically changed the

character of the unit trust industry since the early 1990s is

Dec 2005 415 131 36%

the increasing global awareness of investors.

Dec 2004 305 945 33% Until the end of the 1980s, unit trust investment was

strictly a South African affair for most investors. In Europe

Dec 2003 230 344 28%

and America, however, a trend towards international

Dec 2002 179 826 3% diversification had already been established. This was the

Dec 2001 174 588 38% logical extension of the well-established principle of

diversification. Diversification lowers risk. Diversification

Dec 2000 126 907 13%

across countries, as well as asset classes further reduces risk.

Dec 1999 112 780 58% Changes in foreign exchange policy around the world

facilitated products which allowed Americans to invest in

Dec 1998 71 279 16%

Europe and vice versa. Although South Africa lagged behind

Dec 1997 61 652 41% when it came to foreign exchange control, the benefits of

geographic diversification – and the appeal of investing in

Dec 1996 43 790 30%

offshore assets – soon made an impression on local investors.

Dec 1995 33 695 28%

Due to exchange control regulations, the first

Dec 1994 26 326 35% “international” funds which were established in South

Africa – in the early 1990s – were not able to invest

* Since 2010 ASISA figures exclude all

cross-holdings; historical figures would have offshore. Instead, these funds focussed on high-quality JSE

been slightly lower on the same basis. companies which owned significant offshore operations, or

derived material contributions to profits from overseas

trade. This included most of South Africa’s major exporters.

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 29