Page 299 - Profile's Unit Trusts & Collective Investments - March 2025

P. 299

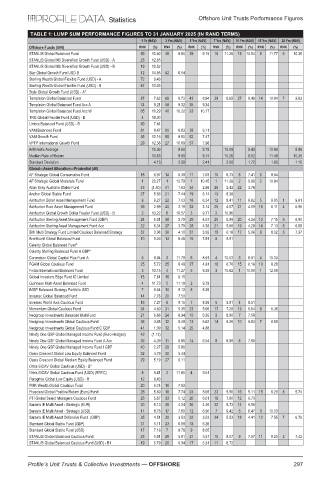

Statistics Offshore Unit Trusts Performance Figures

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JANUARY 2025 (IN RAND TERMS)

1 Yr (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 15 Yrs (NAV) 20 Yrs (NAV)

Offshore Funds (594) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

STANLIB Global Balanced Fund 59 10.80 48 9.80 39 9.19 16 11.28 13 10.54 9 11.77 6 10.35

STANLIB Global MS Diversified Growth Fund (USD) - A 23 12.85

STANLIB Global MS Diversified Growth Fund (USD) - B 19 13.52

Star Global Growth Fund USD B 12 14.95 82 6.54

Sterling Wealth Global Flexible Fund (USD) - A 72 9.43

Sterling Wealth Global Flexible Fund (USD) - B 67 10.03

Stylo Global Growth Fund (USD) - A*

Templeton Global Balanced Fund 87 7.62 68 8.73 43 8.94 39 8.85 27 8.40 14 10.84 7 9.83

Templeton Global Balanced Fund Acc A 74 9.21 58 9.32 35 9.34

Templeton Global Balanced Fund Acc W 65 10.29 40 10.22 23 10.17

TRG Global Flexible Fund (USD) - B 4 19.30

Umbra Balanced Fund (USD) - B 89 7.44

VAM Balanced Fund 81 8.47 80 6.83 76 6.11

VAM Growth Fund 35 12.16 55 9.50 62 7.47

VPFP International Growth Fund 29 12.38 27 10.89 57 7.98

Arithmetic Average 10.36 9.60 9.19 10.09 9.43 10.94 9.99

Median Rate of Return 10.83 9.80 9.14 10.26 9.52 11.49 10.35

Standard Deviation 4.13 2.99 2.41 2.00 1.72 1.80 1.16

Global—Asset Allocation—Prudential (46)

AF Strategic Global Conservative Fund 18 6.97 14 8.38 11 7.03 10 8.73 8 7.41 6 8.84

AF Strategic Global Moderate Fund 1 20.27 1 12.79 1 10.45 1 11.28 2 9.66 2 10.94

Allan Gray Australia Stable Fund 43 (4.50) 41 1.63 34 2.86 26 2.42 22 3.76

Anchor Global Stable Fund 27 5.66 21 7.44 19 6.14 13 8.38

Ashburton Dollar Asset Management Fund 9 9.27 22 7.03 16 6.34 12 8.41 11 6.82 5 9.05 1 9.01

Ashburton Euro Asset Management Fund 39 2.99 40 2.19 33 3.14 25 4.07 21 4.09 16 6.11 4 6.96

Ashburton Global Growth Dollar Feeder Fund (USD) - B 2 13.22 6 10.57 3 9.77 2 10.96

Ashburton Sterling Asset Management Fund (GBP) 24 5.91 38 3.79 29 4.57 20 5.89 20 4.24 13 7.15 5 6.90

Ashburton Sterling Asset Management Fund Acc 22 6.34 37 3.79 28 4.58 21 5.88 19 4.29 14 7.13 6 6.89

BMI Multi Strategy Fund Limited Cautious Balanced Strategy 37 3.98 36 4.10 31 3.92 19 6.18 17 5.06 9 8.32 3 7.37

Brenthurst Global Balanced Fund 10 9.03 13 8.46 10 7.91 6 9.51

Celerity Global Balanced Fund*

Celerity Sterling Balanced Fund A GBP*

Coronation Global Capital Plus Fund A 6 9.94 3 11.79 6 8.91 4 10.53 3 8.81 4 10.30

FGAM Global Cautious Fund 25 5.72 25 6.49 27 4.81 18 6.76 15 6.18 10 8.28

Fintax International Balanced Fund 3 13.15 4 11.27 5 9.39 3 10.62 1 10.00 1 12.09

Global Investors Edge Fund IC Limited 13 7.81 15 8.15

Guinness Multi-Asset Balanced Fund 4 11.73 5 11.19 2 9.79

iMGP Balanced Strategy Portfolio USD 7 9.54 10 9.13 8 8.39

Investec Global Balanced Fund 14 7.76 20 7.50

Investec World Axis Cautious Fund 16 7.27 9 9.15 7 8.39 5 9.91 4 8.51

Momentum Global Cautious Fund 34 4.60 31 5.35 23 5.06 17 7.28 13 6.64 8 8.36

Nedgroup Investments Balanced MultiFund 21 6.66 24 6.94 15 6.35 9 8.80 7 7.58

Nedgroup Investments Global Cautious Fund 38 3.45 12 8.49 13 6.62 14 8.26 10 6.83 7 8.58

Nedgroup Investments Global Cautious Fund C GBP 41 1.09 32 5.14 25 4.88

Ninety One GSF Global Managed Income Fund (Euro Hedged) 42 (1.12)

Ninety One GSF Global Managed Income Fund A Acc 36 4.39 11 8.86 14 6.54 8 8.90 6 7.68

Ninety One GSF Global Managed Income Fund I GBP 40 2.27 29 5.86

Oasis Crescent Global Low Equity Balanced Fund 32 4.79 30 5.44

Oasis Crescent Global Medium Equity Balanced Fund 29 5.19 27 6.11

Orbis SICAV Global Cautious (USD) - B*

Orbis SICAV Global Cautious Fund (USD) (RRFC) 8 9.41 2 11.85 4 9.51

Peregrine Global Low Equity (USD) - R 12 8.43

PMK Wealth Global Cautious Fund 20 6.74 16 7.93

Prescient Global Positive Return (Euro) Fund 28 5.60 18 7.74 24 5.05 23 5.56 16 5.11 15 6.29 8 5.74

PTI Global Select Managers Cautious Fund 26 5.67 33 5.12 20 6.01 16 7.80 12 6.73

Sarasin IE Multi Asset - Strategic (EUR) 30 5.13 35 4.24 30 4.36 22 5.73 14 6.50

Sarasin IE Multi Asset - Strategic (USD) 11 8.78 17 7.80 12 6.90 7 9.42 5 8.47 3 10.33

Sarasin IE Multi Asset Defensive Fund (GBP) 35 4.51 39 3.53 32 3.53 24 5.53 18 4.41 12 7.55 7 6.79

Standard Global Stable Fund (GBP) 31 5.11 23 6.99 18 6.26

Standard Global Stable Fund (USD) 17 7.18 7 9.78 9 8.05

STANLIB Global Balanced Cautious Fund 23 5.91 28 5.91 21 5.57 15 8.07 9 7.07 11 8.25 2 7.42

STANLIB Global Balanced Cautious Fund (USD) - B1 19 6.79 26 6.34 17 6.31 11 8.72

Profile’s Unit Trusts & Collective Investments — OFFSHORE 297