Page 298 - Profile's Unit Trusts & Collective Investments - March 2025

P. 298

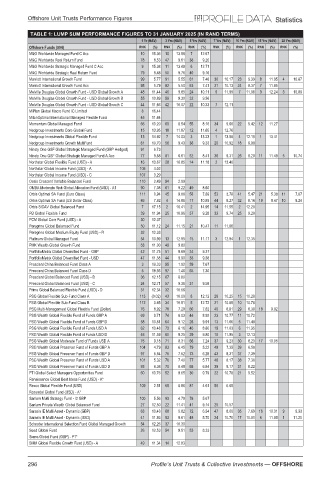

Offshore Unit Trusts Performance Figures Statistics

TABLE 1: LUMP SUM PERFORMANCE FIGURES TO 31 JANUARY 2025 (IN RAND TERMS)

1 Yr (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 15 Yrs (NAV) 20 Yrs (NAV)

Offshore Funds (594) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

M&G Worldwide Managed Fund C Acc 10 15.36 10 13.56 7 12.67

M&G Worldwide Real Return Fund 78 8.53 47 9.81 38 9.20

M&G Worldwide Strategic Managed Fund C Acc 9 15.38 11 13.49 6 12.71

M&G Worldwide Strategic Real Return Fund 79 8.48 50 9.76 40 9.16

Marriott International Growth Fund 99 5.77 91 5.55 61 7.48 30 10.17 23 9.39 8 11.95 4 10.87

Marriott International Growth Fund Acc 98 5.79 92 5.50 63 7.41 31 10.13 24 9.37 7 11.95

Melville Douglas Global Growth Fund - USD Global Growth A 48 11.44 46 9.85 24 10.11 9 11.99 7 11.08 3 12.24 3 10.89

Melville Douglas Global Growth Fund - USD Global Growth B 55 10.89 59 9.30 32 9.56

Melville Douglas Global Growth Fund - USD Global Growth C 44 11.66 42 10.07 22 10.33 7 12.11

MiPlan Global Macro Fund IC Limited 8 16.44

MitonOptimal International Managed Flexible Fund 45 11.64

Momentum Global Managed Fund 66 10.20 69 8.54 55 8.16 34 9.66 22 9.42 12 11.27

Nedgroup Investments Core Global Fund 15 13.95 18 11.87 12 11.65 4 12.76

Nedgroup Investments Global Flexible Fund 13 14.92 7 14.03 3 13.23 1 13.58 4 12.10 1 13.41

Nedgroup Investments Growth MultiFund 61 10.70 56 9.43 36 9.33 20 10.92 18 9.99

Ninety One GSF Global Strategic Managed Fund (GBP Hedged) 91 6.73

Ninety One GSF Global Strategic Managed Fund A Acc 77 8.88 81 6.61 52 8.41 36 9.31 26 9.20 11 11.49 5 10.74

Northstar Global Flexible Fund (USD) - A 16 13.67 28 10.85 14 11.18 2 13.40

Northstar Global Income Fund (USD) - A 106 4.02

Northstar Global Income Fund (USD) - C 107 3.29

Oasis Crescent Variable Balanced Fund 110 2.49 94 2.89

OMBA Moderate Risk Global Allocation Fund (USD) - A1 90 7.38 61 9.22 49 8.60

Orbis Optimal SA Fund (Euro Class) 111 0.94 45 9.88 58 7.89 53 3.78 41 5.47 21 5.38 11 7.07

Orbis Optimal SA Fund (US Dollar Class) 86 7.82 4 14.86 17 10.89 44 8.27 32 8.16 19 8.47 10 9.24

Orbis SICAV Global Balanced Fund 7 17.15 2 16.41 2 14.95 14 11.55 2 12.20

PB Global Flexible Fund 39 11.94 25 10.96 37 9.28 33 9.74 25 9.20

PCM Global Core Fund (USD) - A 30 12.37

Peregrine Global Balanced Fund 50 11.12 24 11.15 21 10.47 11 11.86

Peregrine Global Medium Equity Fund (USD) - R 32 12.33

Platinum Global Managed Fund 54 10.99 13 12.85 15 11.17 3 12.94 1 12.35

PMK Wealth Global Growth Fund 53 11.00 49 9.80

PortfolioMetrix Global Diversified Fund - GBP 42 11.75 51 9.69 34 9.37

PortfolioMetrix Global Diversified Fund - USD 47 11.58 44 9.90 33 9.38

Prescient China Balanced Fund Class A 3 19.33 95 1.82 59 7.67

Prescient China Balanced Fund Class D 5 18.93 97 1.46 65 7.30

Prescient Global Balanced Fund (USD) - B 36 12.15 67 8.80

Prescient Global Balanced Fund (USD) - C 24 12.71 57 9.36 31 9.58

Prime Global Balanced Flexible Fund (USD) - D 31 12.34 32 10.66

PSG Global Flexible Sub-Fund Class A 113 (0.02) 43 10.00 8 12.12 28 10.25 15 10.28

PSG Global Flexible Sub-Fund Class B 112 0.45 34 10.51 5 12.72 21 10.85 10 10.78

PSG Multi-Management Global Flexible Fund (Dollar) 76 8.92 78 7.28 60 7.62 40 8.81 29 8.30 18 9.92

PSG Wealth Global Flexible Fund of Funds GBP A 69 9.71 74 8.03 44 8.92 23 10.77 11 10.72

PSG Wealth Global Flexible Fund of Funds GBP D 58 10.81 64 9.12 26 9.91 13 11.66 5 11.48

PSG Wealth Global Flexible Fund of Funds USD A 62 10.48 73 8.16 45 8.80 19 11.03 6 11.35

PSG Wealth Global Flexible Fund of Funds USD D 46 11.59 60 9.25 29 9.80 10 11.95 3 12.13

PSG Wealth Global Moderate Fund of Funds USD A 75 9.18 71 8.31 66 7.24 37 9.23 30 8.23 17 10.05

PSG Wealth Global Preserver Fund of Funds GBP A 104 4.79 83 6.45 79 5.22 49 7.35 39 6.50

PSG Wealth Global Preserver Fund of Funds GBP D 97 5.84 75 7.52 73 6.28 43 8.31 37 7.39

PSG Wealth Global Preserver Fund of Funds USD A 101 5.32 76 7.40 77 5.77 46 8.17 38 7.30

PSG Wealth Global Preserver Fund of Funds USD D 93 6.38 70 8.48 68 6.84 38 9.17 31 8.22

PTI Global Select Managers Opportunities Fund 60 10.76 52 9.65 30 9.79 22 10.78 21 9.52

Renaissance Global Best Ideas Fund (USD) - A*

Rezco Global Flexible Fund (USD) 109 2.51 65 8.86 81 4.61 50 6.65

Rozendal Global Fund (USD) - A*

Sanlam Multi Strategy Fund - I2 GBP 100 5.56 93 4.79 78 5.67

Sanlam Private Wealth Global Balanced Fund 27 12.50 22 11.41 41 9.14 25 10.57

Sarasin IE Multi Asset - Dynamic (GBP) 63 10.43 88 5.82 72 6.34 47 8.05 35 7.69 16 10.31 9 9.33

Sarasin IE Multi Asset - Dynamic (USD) 41 11.93 53 9.61 48 8.70 24 10.70 17 10.01 6 11.98 1 11.20

Schroder International Selection Fund Global Managed Growth 34 12.26 37 10.30

Seed Global Fund 26 12.53 54 9.51 53 8.33

Sierra Global Fund (GBP) - P1*

SMM Global Flexible Growth Fund (USD) - A 49 11.34 14 12.83

296 Profile’s Unit Trusts & Collective Investments — OFFSHORE