Page 227 - Profile's Unit Trusts & Collective Investments - March 2025

P. 227

Statistics Domestic Unit Trusts Performance Figures

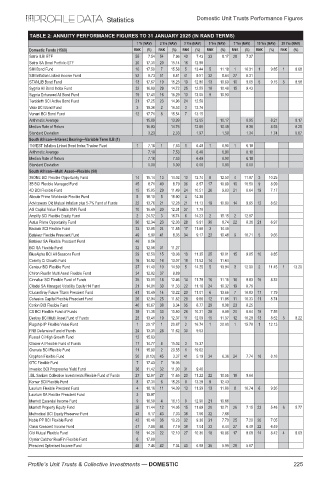

TABLE 2: ANNUITY PERFORMANCE FIGURES TO 31 JANUARY 2025 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1568) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Satrix ILBI ETF 55 7.54 54 7.96 43 7.43 33 8.17 28 7.37

Satrix SA Bond Portfolio ETF 20 17.31 20 15.14 16 12.90

SIM Bond Fund 16 17.50 7 15.58 5 13.44 5 11.18 1 10.31 1 9.85 1 8.68

SIM Inflation Linked Income Fund 52 9.73 51 9.81 41 9.51 32 8.64 27 8.31

STANLIB Bond Fund 13 17.67 19 15.23 19 12.80 13 10.69 10 9.65 5 9.15 5 8.58

Sygnia All Bond Index Fund 32 16.89 29 14.72 25 12.55 18 10.49 15 9.43

Sygnia Enhanced All Bond Fund 19 17.41 16 15.29 13 13.05 9 10.93

Terebinth SCI Active Bond Fund 21 17.25 23 14.96 24 12.58

Visio BCI Bond Fund 3 19.38 2 16.53 3 13.74

Vunani BCI Bond Fund 12 17.71 8 15.54 7 13.15

Arithmetic Average 15.89 13.99 12.05 10.17 8.95 8.21 8.17

Median Rate of Return 16.93 14.76 12.60 10.48 9.36 8.93 8.25

Standard Deviation 3.23 2.33 1.97 1.59 1.34 1.74 0.67

South African—Interest Bearing—Variable Term ILB (1)

1NVEST Inflation Linked Bond Index Tracker Fund 1 7.18 1 7.53 1 6.48 1 6.90 1 6.18

Arithmetic Average 7.18 7.53 6.48 6.90 6.18

Median Rate of Return 7.18 7.53 6.48 6.90 6.18

Standard Deviation 0.00 0.00 0.00 0.00 0.00

South African—Multi Asset—Flexible (50)

36ONE BCI Flexible Opportunity Fund 14 15.14 13 14.02 10 12.74 8 12.50 4 11.97 3 10.25

3B BCI Flexible Managed Fund 45 8.71 40 8.79 36 8.57 17 10.89 10 10.50 9 8.99

4D BCI Flexible Fund 15 15.05 29 11.49 24 10.51 26 9.83 21 8.64 19 7.17

Aboutir Prime Worldwide Flexible Fund 5 18.10 5 15.90 4 14.38

Adviceworx Old Mutual Inflation plus 5-7% Fund of Funds 22 13.76 21 12.28 21 11.13 19 10.80 14 9.95 12 8.62

AG Capital Value Flexible SNN Fund 10 16.49 20 12.31 37 7.70

Amplify SCI Flexible Equity Fund 2 24.52 3 16.74 6 14.23 2 15.15 2 12.97

Autus Prime Opportunity Fund 30 12.34 23 12.03 28 9.91 30 8.74 22 8.36 21 6.97

Baobab SCI Flexible Fund 33 12.05 24 11.85 17 11.60 3 14.48

Bateleur Flexible Prescient Fund 49 5.80 41 8.35 34 9.17 23 10.48 9 10.71 5 9.65

Bateleur SA Flexible Prescient Fund 46 8.56

BCI SA Flexible Fund 32 12.06 31 11.27

BlueAlpha BCI All Seasons Fund 29 12.50 15 13.08 19 11.35 25 10.01 15 9.85 10 8.85

Celerity Ci Growth Fund 16 14.92 16 13.07 18 11.52 14 11.64

Centaur BCI Flexible Fund 37 11.40 10 14.69 5 14.25 5 13.94 3 12.90 2 11.45 1 13.20

Chiron Realfin Multi Asset Flexible Fund 34 12.02 37 9.89

Cinnabar SCI Flexible Fund of Funds 25 13.01 18 12.46 14 11.79 16 11.16 16 9.83 15 8.32

Citadel SA Managed Volatility Equity H4 Fund 21 14.01 30 11.33 22 11.10 24 10.32 19 8.76

ClucasGray Future Titans Prescient Fund 41 10.49 14 13.22 23 11.01 6 13.66 7 10.83 17 7.79

Cohesive Capital Flexible Prescient Fund 26 12.94 25 11.82 29 9.86 12 11.96 11 10.33 11 8.74

Corion BCI Flexible Fund 40 10.67 38 9.34 35 8.77 29 8.98 23 8.25

CS BCI Flexible Fund of Funds 39 11.35 33 10.80 26 10.31 28 9.08 20 8.64 18 7.55

Destiny BCI Multi Asset Fund of Funds 23 13.41 19 12.37 11 12.09 15 11.37 12 10.28 13 8.52 5 8.22

Flagship IP Flexible Value Fund 1 29.17 1 20.87 2 16.74 1 20.00 1 15.78 1 12.13

FNB Defensive Fund of Funds 24 13.31 28 11.62 30 9.53

Fussell Ci High Growth Fund 12 15.63

Glacier AI Flexible Fund of Funds 17 14.77 8 15.02 3 15.37

Granate BCI Flexible Fund 11 15.80 2 20.55 1 19.62

Gryphon Flexible Fund 50 (0.13) 45 3.37 41 5.19 34 6.36 24 7.74 16 8.16

GTC Flexible Fund 7 17.43 7 15.05

Investec BCI Progressive Yield Fund 36 11.42 32 11.00 31 9.40

JBL Sanlam Collective Investments Flexible Fund of Funds 27 12.87 27 11.65 20 11.22 22 10.55 18 9.64

Korner BCI Flexible Fund 8 17.31 6 15.26 8 13.29 9 12.43

Laurium Flexible Prescient Fund 4 18.16 11 14.09 13 11.99 13 11.86 8 10.74 6 9.35

Laurium SA Flexible Prescient Fund 3 18.97

Marriott Essential Income Fund 9 16.59 4 16.13 9 12.90 21 10.68

Marriott Property Equity Fund 35 11.44 12 14.05 15 11.69 20 10.71 26 7.15 23 5.48 6 5.77

Methodical BCI Equity Preserver Fund 43 9.17 43 7.33 38 7.56 32 7.68

Noble PP BCI Flexible Fund 42 10.46 36 10.23 32 9.36 31 7.73 25 7.20 20 7.05

Oasis Crescent Income Fund 47 7.88 44 7.19 39 7.04 33 6.44 27 6.48 22 6.49

Old Mutual Flexible Fund 18 14.26 22 12.10 27 10.30 18 10.86 17 9.68 14 8.42 4 9.63

Oyster Catcher RealFin Flexible Fund 6 17.89

Prescient Optimised Income Fund 48 7.46 42 7.34 40 6.98 35 5.99 28 5.67

Profile’s Unit Trusts & Collective Investments — DOMESTIC 225