Page 224 - Profile's Unit Trusts & Collective Investments - March 2025

P. 224

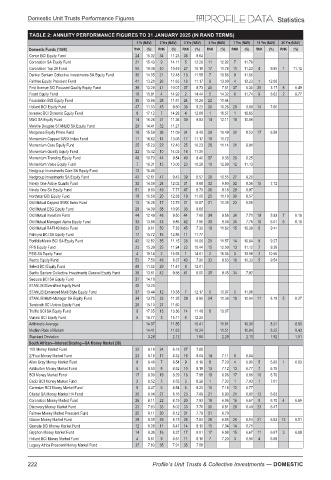

Domestic Unit Trusts Performance Figures Statistics

TABLE 2: ANNUITY PERFORMANCE FIGURES TO 31 JANUARY 2025 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1568) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Corion BCI Equity Fund 24 15.32 34 11.23 38 8.64

Coronation SA Equity Fund 21 15.43 9 14.11 5 12.26 11 12.92 7 11.78

Coronation Top 20 Fund 50 10.48 40 10.49 27 10.18 17 11.78 11 11.23 4 9.85 1 11.12

Denker Sanlam Collective Investments SA Equity Fund 30 14.35 21 12.48 13 11.58 7 13.66 9 11.66

Fairtree Equity Prescient Fund 41 13.20 26 11.63 18 11.17 9 13.00 4 13.23 1 12.06

First Avenue SCI Focused Quality Equity Fund 39 13.28 41 10.07 37 8.73 40 7.51 37 5.30 20 3.17 8 5.49

Foord Equity Fund 16 15.81 4 14.92 2 14.44 5 14.32 8 11.74 9 8.62 2 9.77

Foundation BCI Equity Fund 35 13.66 28 11.51 24 10.24 22 11.44

Hollard BCI Equity Fund 47 11.03 45 9.80 36 9.23 30 10.26 28 9.08 14 7.60

Investec BCI Dynamic Equity Fund 8 17.12 7 14.28 4 12.88 1 18.57 1 16.65

M&G SA Equity Fund 14 16.24 31 11.36 30 9.93 14 12.11 18 10.06

Melville Douglas STANLIB SA Equity Fund 28 14.41 32 11.27

Mergence Equity Prime Fund 18 15.59 36 11.09 34 9.45 29 10.49 31 8.53 17 6.58

Momentum Capped SWIX Index Fund 11 16.62 14 13.06 17 11.17 18 11.72

Momentum Core Equity Fund 25 15.23 22 12.40 25 10.23 26 11.14 21 9.91

Momentum Quality Equity Fund 22 15.42 10 14.03 16 11.35

Momentum Trending Equity Fund 49 10.70 44 9.84 40 8.46 37 9.35 26 9.25

Momentum Value Equity Fund 7 18.31 15 13.00 23 10.28 10 12.99 12 11.13

Nedgroup Investments Core SA Equity Fund 12 16.46

Nedgroup Investments SA Equity Fund 43 12.61 47 9.43 39 8.57 28 10.55 27 9.20

Ninety One Active Quants Fund 32 14.08 24 12.02 31 9.88 32 9.80 32 8.38 15 7.12

Ninety One SA Equity Fund 51 9.90 49 7.77 47 6.79 38 9.18 29 8.97

Northstar BCI Equity Fund 19 15.58 20 12.58 19 11.06 25 11.19 30 8.57

Old Mutual Capped SWIX Index Fund 13 16.26 17 12.75 21 10.87 21 11.45 23 9.55

Old Mutual ESG Equity Fund 29 14.39 38 10.95 33 9.66

Old Mutual Investors Fund 44 12.49 46 9.50 44 7.69 34 9.56 36 7.71 19 5.93 7 8.18

Old Mutual Managed Alpha Equity Fund 33 13.98 43 9.86 42 7.96 39 9.08 35 7.76 18 6.01 6 8.18

Old Mutual RAFI 40 Index Fund 52 9.61 50 7.33 45 7.30 19 11.62 15 10.38 6 9.41

Palmyra BCI SA Equity Fund 17 15.72 16 12.86 11 11.77

PortfolioMetrix BCI SA Equity Fund 42 12.82 35 11.15 28 10.06 20 11.57 14 10.84 8 9.27

PPS Equity Fund 23 15.39 25 11.94 22 10.44 15 12.00 13 11.12 7 9.38

PSG SA Equity Fund 4 19.14 2 15.93 1 14.61 2 18.35 3 13.98 2 10.55

Rezco Equity Fund 53 7.58 48 8.37 43 7.90 33 9.63 16 10.33 5 9.54

Select BCI Equity Fund 48 11.02 29 11.47 8 12.01

Sentio Sanlam Collective Investments General Equity Fund 36 13.61 42 9.88 41 8.00 35 9.45 34 7.92

Sequoia BCI SA Equity Fund 31 14.18

STANLIB Diversified Equity Fund 40 13.20

STANLIB Enhanced Multi Style Equity Fund 37 13.44 12 13.38 7 12.17 6 13.97 5 11.98

STANLIB Multi-Manager SA Equity Fund 34 13.75 33 11.25 29 9.99 24 11.38 19 10.04 11 8.18 5 8.27

Terebinth SCI Active Equity Fund 26 15.10 27 11.60

Truffle SCI SA Equity Fund 9 17.05 13 13.36 14 11.48 8 13.07

Vunani BCI Equity Fund 6 18.77 3 15.11 6 12.24

Arithmetic Average 14.37 11.85 10.41 11.81 10.31 8.21 8.60

Median Rate of Return 14.41 11.63 10.24 11.51 10.04 8.25 8.43

Standard Deviation 3.28 2.12 1.86 2.29 2.11 1.92 1.51

South African—Interest Bearing—SA Money Market (38)

10X Money Market Fund 22 8.18 24 8.18 27 7.85

27Four Money Market Fund 23 8.16 17 8.32 16 8.04 14 7.11 8 6.84

Allan Gray Money Market Fund 8 8.48 7 8.54 9 8.19 8 7.20 4 6.90 5 6.89 1 6.83

Ashburton Money Market Fund 6 8.50 8 8.52 10 8.18 13 7.12 13 6.77 7 6.75

BCI Money Market Fund 17 8.30 19 8.29 18 7.98 19 6.96 17 6.66 10 6.70

Cadiz BCI Money Market Fund 3 8.52 5 8.55 3 8.26 1 7.33 1 7.03 1 7.01

Cartesian BCI Money Market Fund 9 8.47 6 8.54 6 8.20 10 7.18 12 6.77

Citadel SA Money Market H4 Fund 30 8.04 27 8.16 23 7.89 21 6.90 21 6.60 13 6.63

Coronation Money Market Fund 26 8.11 22 8.19 20 7.93 18 6.96 16 6.67 9 6.70 4 6.69

Discovery Money Market Fund 33 7.93 33 8.02 33 7.76 30 6.81 28 6.48 23 6.47

Fairtree Money Market Prescient Fund 25 8.11 30 8.12 31 7.79 31 6.79

Glacier Money Market Fund 29 8.05 29 8.15 28 7.84 28 6.85 26 6.54 21 6.53 12 6.51

Granate BCI Money Market Fund 12 8.38 11 8.47 14 8.10 15 7.04 14 6.71

Gryphon Money Market Fund 14 8.36 16 8.37 17 8.01 17 6.98 15 6.67 11 6.67 3 6.69

Hollard BCI Money Market Fund 4 8.51 9 8.51 11 8.16 7 7.20 3 6.90 4 6.89

Legacy Africa Prescient Money Market Fund 37 7.83 35 7.91 35 7.58

222 Profile’s Unit Trusts & Collective Investments — DOMESTIC