Page 218 - Profile's Unit Trusts & Collective Investments - March 2025

P. 218

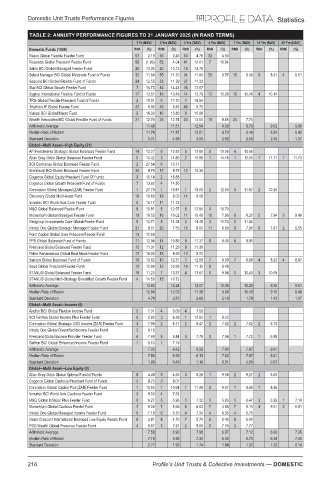

Domestic Unit Trusts Performance Figures Statistics

TABLE 2: ANNUITY PERFORMANCE FIGURES TO 31 JANUARY 2025 (IN RAND TERMS)

1 Yr (NAV) 2 Yrs (NAV) 3 Yrs (NAV) 5 Yrs (NAV) 7 Yrs (NAV) 10 Yrs (NAV) 20 Yrs (NAV)

Domestic Funds (1568) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%) RNK (%)

Rezco Global Flexible Feeder Fund 57 2.19 55 2.46 53 4.76 33 4.50

Rozendal Global Prescient Feeder Fund 59 (1.93) 53 4.04 41 10.61 7 10.94

Salvo BCI Global Managed Feeder Fund 20 13.30 20 13.15 16 13.76

Select Manager BCI Global Moderate Fund of Funds 32 11.64 35 11.20 34 11.84 20 9.57 15 9.48 9 8.61 4 9.01

Sequoia BCI Global Flexible Fund of Funds 24 12.55 33 11.39 37 11.33

Star BCI Global Growth Feeder Fund 7 16.73 14 14.43 26 12.67

Sygnia International Flexible Fund of Funds 17 13.51 18 13.49 14 13.79 13 10.26 10 10.46 4 10.14

TRG Global Flexible Prescient Fund of Funds 2 19.01 6 17.70 7 16.55

Triathlon IP Global Feeder Fund 47 8.96 49 8.46 46 9.79

Vunani BCI Global Macro Fund 9 16.33 10 15.80 9 15.98

Wealth Associates BCI Global Flexible Fund of Funds 21 12.74 23 12.74 23 13.00 15 9.85 24 7.74

Arithmetic Average 11.46 11.51 12.54 9.69 9.79 9.02 9.88

Median Rate of Return 11.74 11.87 12.51 9.70 9.48 8.54 9.42

Standard Deviation 5.01 4.68 3.55 2.82 2.55 2.36 1.07

Global—Multi Asset—High Equity (21)

AF Investments Strategic Global Balanced Feeder Fund 14 12.27 9 12.52 5 12.89 5 10.26 4 10.45

Allan Gray-Orbis Global Balanced Feeder Fund 5 14.42 3 14.80 2 15.98 1 14.78 1 13.51 1 11.71 1 11.73

BCI Contrarius Global Balanced Feeder Fund 2 27.54 6 13.71

Brenthurst BCI Global Balanced Feeder Fund 20 9.79 17 9.75 12 10.36

Cogence Global Equity Prescient Fund Of Funds 3 15.14 2 16.88

Cogence Global Growth Prescient Fund of Funds 7 13.92 4 14.50

Coronation Global Managed [ZAR] Feeder Fund 1 27.78 1 19.81 1 18.06 2 12.50 3 11.67 2 10.25

Discovery Global Multi-Asset Fund 18 10.80 19 8.03 14 8.08

Investec BCI World Axis Core Feeder Fund 6 14.17 11 11.73

M&G Global Balanced Feeder Fund 8 13.81 8 12.57 6 12.84 4 10.70

Momentum Global Managed Feeder Fund 19 10.55 16 10.02 11 10.49 10 7.96 8 8.21 5 7.94 3 9.40

Nedgroup Investments Core Global Feeder Fund 9 13.71 5 14.24 3 14.48 3 11.73 2 11.86

Ninety One Global Strategic Managed Feeder Fund 21 9.01 20 7.55 15 8.00 11 6.80 9 7.91 6 7.87 2 9.55

Point Capital Global Core Prescient Feeder Fund 13 12.59

PPS Global Balanced Fund of Funds 11 12.94 14 10.80 9 11.37 9 8.40 6 8.91

Prescient Global Balanced Feeder Fund 15 11.31 12 11.29 8 11.38

Prime Renaissance Global Best Ideas Feeder Fund 17 10.90 18 9.29 13 9.74

Sanlam Global Balanced Fund of Funds 10 13.62 10 12.31 7 12.58 7 9.09 7 8.89 4 8.23 4 8.97

Seed Global Prescient Feeder Fund 12 12.88 13 10.98 10 11.12 8 8.48

STANLIB Global Balanced Feeder Fund 16 11.23 7 13.37 4 13.67 6 9.94 5 10.43 3 10.08

STANLIB Global Multi-Strategy Diversified Growth Feeder Fund 4 14.58 15 10.73

Arithmetic Average 13.95 12.24 12.07 10.06 10.20 9.35 9.91

Median Rate of Return 12.94 12.02 11.38 9.94 10.43 9.16 9.48

Standard Deviation 4.74 2.87 2.66 2.19 1.78 1.43 1.07

Global—Multi Asset—Income (6)

Anchor BCI Global Flexible Income Fund 5 7.01 4 6.09 4 7.59

BCI Fairtree Global Income Plus Feeder Fund 6 2.80 3 6.26 1 10.52 1 8.23

Coronation Global Strategic USD Income [ZAR] Feeder Fund 3 7.98 2 6.71 2 8.47 2 7.62 2 7.62 2 6.73

Ninety One Global Diversified Income Feeder Fund 2 8.16

Prescient Global Income Provider Feeder Fund 4 7.69 5 5.84 3 7.79 3 7.54 1 7.72 1 6.88

Saffron BCI Global Enhanced Income Feeder Fund 1 8.63 1 7.19

Arithmetic Average 7.05 6.42 8.59 7.80 7.67 6.81

Median Rate of Return 7.84 6.26 8.13 7.62 7.67 6.81

Standard Deviation 1.96 0.48 1.16 0.31 0.05 0.07

Global—Multi Asset—Low Equity (9)

Allan Gray-Orbis Global Optimal Fund of Funds 8 4.48 9 4.65 3 8.28 1 9.58 2 8.27 2 6.63

Cogence Global Cautious Prescient Fund of Funds 2 9.23 2 9.01

Coronation Global Capital Plus [ZAR] Feeder Fund 1 13.50 1 10.64 1 11.48 2 9.57 1 9.46 1 8.45

Investec BCI World Axis Cautious Feeder Fund 3 9.00 4 7.83

M&G Global Inflation Plus Feeder Fund 6 6.27 5 5.96 5 7.32 5 5.83 5 6.47 3 6.29 1 7.18

Momentum Global Cautious Feeder Fund 7 6.08 7 5.66 6 6.63 7 4.54 7 5.11 4 5.01 2 6.91

Ninety One Global Managed Income Feeder Fund 5 7.18 6 5.70 4 7.34 4 6.35 4 6.75

Oasis Crescent International Balanced Low Equity Feeder Fund 9 3.81 8 4.70 7 5.74 6 5.45 6 6.01

PSG Wealth Global Preserver Feeder Fund 4 8.67 3 7.91 2 9.06 3 7.50 3 7.77

Arithmetic Average 7.58 6.90 7.98 6.97 7.12 6.60 7.05

Median Rate of Return 7.18 5.96 7.34 6.35 6.75 6.46 7.05

Standard Deviation 2.77 1.95 1.74 1.84 1.37 1.23 0.14

216 Profile’s Unit Trusts & Collective Investments — DOMESTIC