Page 101 - Profile's Unit Trusts & Collective Investments - March 2025

P. 101

Legislation and Guidelines

5. Investment organisations should ensure disclosures are meaningful, timeous and accessible to

ensure stakeholders can make informed assessments of progress towards positive outcomes.

The code requires that institutional investors fully and publicly disclose at least once a year to

what extent the code has been applied. Reasons must be given if any of the principles of the code

have not been followed.

Although CRISA is a voluntary code it has become the standard for investment activities in

South Africa. The full code is available on the CRISA website (www.crisa2.co.za)

Treating Customers Fairly (TCF)

One of the responsibilities of the FSCA is to protect consumers of financial products offered by

regulated entities. As part of this objective, the FSCA released a Treating Customers Fairly discussion

paper in May 2010 based on the TCF initiative of the UK Financial Services Authority (FSA) started

in 2001. In November 2011 ASISA published a TCF Best Practices Guideline for its members.

The TCF principles aim to ensure that customers enjoy good service, straightforward

communication, informed advice and appropriate products from providers of financial services and

their agents. The TCF principles represent the best way to build a relationship of trust with clients

and to achieve a sustainable long-term business model. A key feature of TCF is a top-down

approach which tasks business leaders and senior managers with creating a culture of good service

rather than a delegated ‘tick box’ compliance approach.

TCF goes beyond customer satisfaction. The fact that customers are satisfied does not

necessarily mean they have been treated fairly – satisfaction might be due to ignorance, distorted

expectations, or even misleading information given by the service provider.

In applying TCF, companies should seek to achieve six key outcomes, which are encapsulated in

the mindset: doing things right and doing the right thing. The key objectives can be summarised as follows:

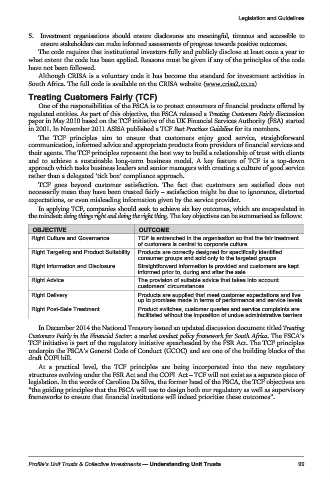

OBJECTIVE OUTCOME

Right Culture and Governance TCF is entrenched in the organisation so that the fair treatment

of customers is central to corporate culture

Right Targeting and Product Suitability Products are correctly designed for specifically identified

consumer groups and sold only to the targeted groups

Right Information and Disclosure Straightforward information is provided and customers are kept

informed prior to, during and after the sale

Right Advice The provision of suitable advice that takes into account

customers’ circumstances

Right Delivery Products are supplied that meet customer expectations and live

up to promises made in terms of performance and service levels

Right Post-Sale Treatment Product switches, customer queries and service complaints are

facilitated without the imposition of undue administrative barriers

In December 2014 the National Treasury issued an updated discussion document titled Treating

Customers Fairly in the Financial Sector: a market conduct policy framework for South Africa. The FSCA’s

TCF initiative is part of the regulatory initiative spearheaded by the FSR Act. The TCF principles

underpin the FSCA’s General Code of Conduct (GCOC) and are one of the building blocks of the

draft COFI bill.

At a practical level, the TCF principles are being incorporated into the new regulatory

structures evolving under the FSR Act and the COFI Act – TCF will not exist as a separate piece of

legislation. In the words of Caroline Da Silva, the former head of the FSCA, the TCF objectives are

“the guiding principles that the FSCA will use to design both our regulatory as well as supervisory

frameworks to ensure that financial institutions will indeed prioritise these outcomes”.

Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts 99