Page 66 - Profiles's Unit Trusts & Collective Investments - September 2024

P. 66

CHAPTER 3

Fund Fees and Platform Fees

As mentioned earlier, the fees covered thus far have been described from the point of view of a

single fund and relate to purchases made directly from the fund managers (either online or with

the help of a financial advisor).

In practise, many investors buy into unit trusts via LISPs or investment platforms (sometimes

referred to as unit trust supermarkets). Advantages of investing via a platform include access to a

much wider range of funds (compared to one management company) and ease of switching from

one fund manager to another. A potential disadvantage is the temptation to switch from one fund

manager to another when performance is below par.

Investing through a platform often changes the way fees are applied somewhat. The main

implications are:

Underlying fund fees may be less

An additional layer of costs will be imposed by the LISP

As we will cover later in this chapter, funds often have multiple unit classes with different fee

structures. The unit classes made available to bulk buyers, like LISPs, typically have lower fees

(and lower TERs) than retail classes. This means that the investment performance of a fund

bought through a LISP, if platform fees are ignored, will be slightly better than the performance of

the same fund’s retail class. However, the net performance of an investment via a platform may be

less attractive after paying the LISP fees.

It’s important to note that performance tables (including rates of return) published by stats

providers like ProfileData do not factor in platform fees. Generally the fund performance figures

available on LISP websites are also, ironically, shown before the impact of LISP costs (ie, returns to

the LISP client are lower than shown).

Similarly, the fee information shown for underlying funds on a platform website (such as TERs

and TICs) pertains to each fund and does not include the LISP fees that will be levied over and

above the fund fees. The costs reported by a platform under the EAC model should, however,

capture both the underlying fund costs and the costs of the platform itself.

As we saw earlier, the annual fees of a fund manager are deducted from the portfolio, which

means the NAV unit price is net of manager fees. But a LISP’s ongoing fees are deducted from the

client’s LISP account. To cover their fees, LISPs will sell units of funds in the client’s portfolio if

there is no cash in the client’s account.

Initial Charges versus Trailer Fees

LISPs (fund platforms) and fund managers who sell directly to the public may offer the investor

a choice of paying either an upfront fee or an ongoing fee (sometimes called a trailer fee) in respect

of commissions payable to financial advisors.

Which is better for the investor?

There are several things to consider in answering this question. Firstly, trailer fees are nearly

always lower than initial charges. For example, the maximum allowable initial fee (broker

commission) is usually 3.45% (including VAT) and the maximum allowable trailer fee might be

1%. Secondly, the initial fee is an immediate deduction against capital and the investor first has to

recoup this loss before achieving any positive performance. Because trailer fees are typically

collected monthly in arrears, they have

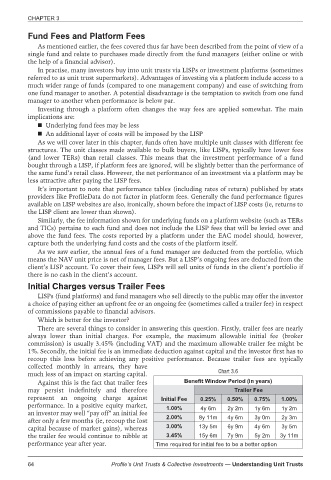

much less of an impact on starting capital. Chart 3.6

Against this is the fact that trailer fees Benefit Window Period (in years)

may persist indefinitely and therefore Trailer Fee

represent an ongoing charge against Initial Fee 0.25% 0.50% 0.75% 1.00%

performance. In a positive equity market, 1.00% 4y 6m 2y 2m 1y 6m 1y 2m

an investor may well “pay off” an initial fee

after only a few months (ie, recoup the lost 2.00% 8y 11m 4y 6m 3y 0m 2y 3m

capital because of market gains), whereas 3.00% 13y 5m 6y 9m 4y 6m 3y 5m

the trailer fee would continue to nibble at 3.45% 15y 6m 7y 9m 5y 2m 3y 11m

performance year after year. Time required for initial fee to be a better option

64 Profile’s Unit Trusts & Collective Investments — Understanding Unit Trusts